The Australian dollar rallied on Thursday on the release of data showing better-than-expected retail spending. The Australian Bureau of Statistics said month-on-month retail turnover rose 1.2 percent in November, triple the estimates of economists and the biggest jump in 5 years. The growth was attributed to a surge in electrical goods sales spurred by the iPhone X release. The Australian Dollar has been benefiting from a series of positive economic data releases, and while the RBA seems in no rush to hike rates, the markets are pricing in a 70% chance of one during the year.

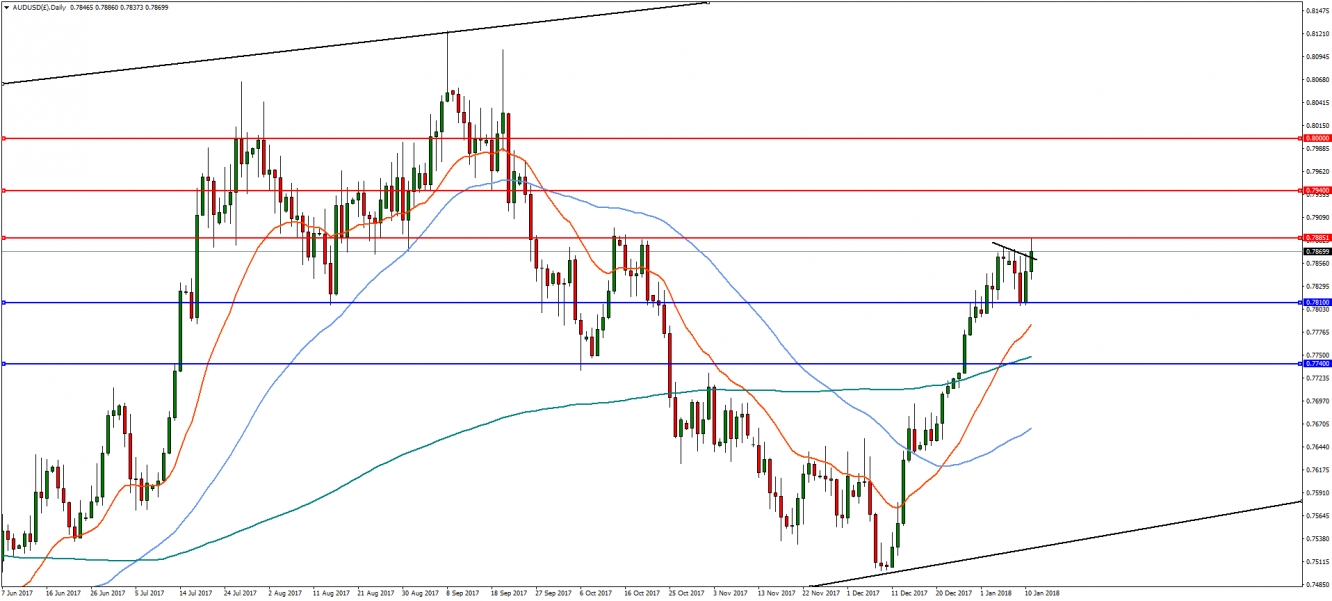

On a daily timeframe, this pair found support at 0.7810 and appears to be breaking higher, but is stalled at the 61.8% Fibonacci and horizontal resistance near 0.7885. Should the bullish momentum persist, a push through this level would target 0.7940 followed by 0.8000. However, reversal would find support again at 0.7810, and a breakdown could lead to a test of 0774.

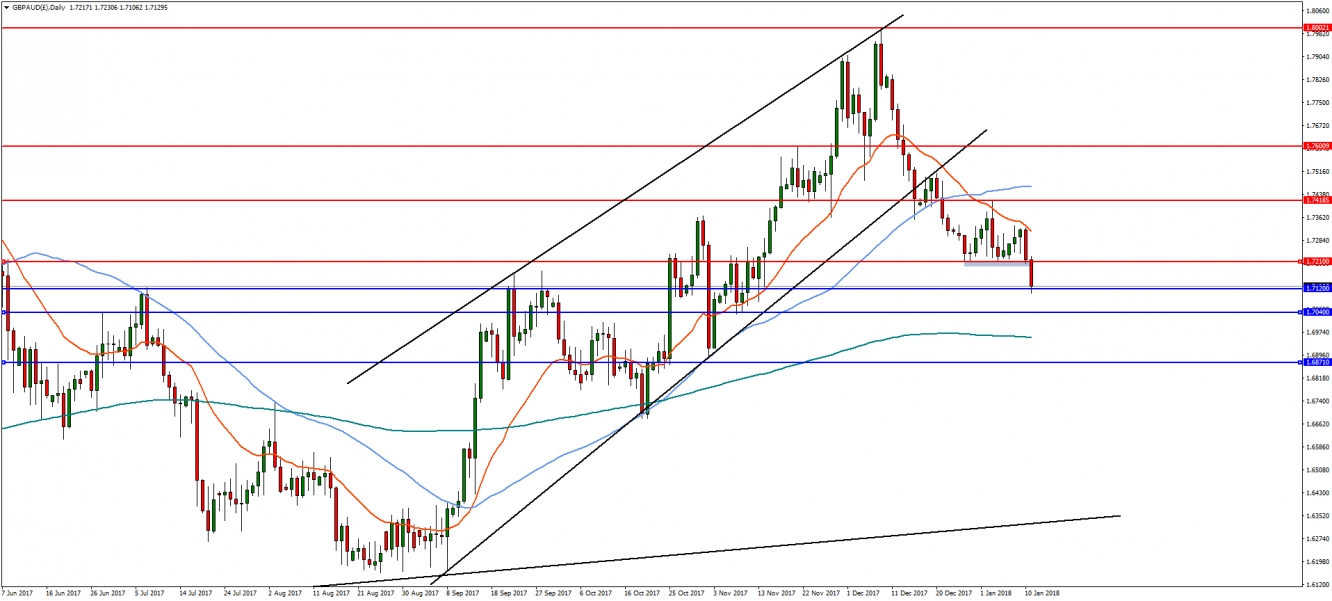

The strength of the Australian Dollar and the recently seen weakness of the British Pound have combined to give this cross a bearish outlook. Having broken a trading channel, GBP/AUD found strong support at 1.7210, but this level is now broken and has become resistance. The pair is now testing the 0.7120 resistance, which if broken would see a push lower to 1.7040, followed by the 61.8% retracement at 1.68710. On the flip side, a reversal above 1.7210 would negate the outlook and target 1.74185.