The Australian dollar fell to its lowest levels against the U.S. dollar since August 2010 on Thursday, on the heels of disappointing employment data.

The Australian Bureau of Statistics late Wednesday reported that the number of people employed unexpectedly fell by 22,600 in December, missing expectations of a rise of 7.5K. The prior months figure was revised lower to 15.4K. The Australian unemployment rate remained at 5.8 percent, in line with analyst expectations.

The weak labor market data fueled speculation that the RBA could cut interest rates again this year to stimulate the economy. RBA Governor Glenn Stevens has been vocal about his open attitude towards intervening to weaken the Australian dollar, the strength of which has challenged manufacturers, making their exports more expensive. The RBA benchmark interest rate is currently at 2.5 percent, a record low.

Last month the Australian dollar sold of sharply after the Australian Financial Review quoted Stevens saying that the RBA prefers a fall in the value Australian dollar over lower interest rates, as a means to stimulate the economy.

Stevens said, "To the extent that we get some more easing in financial conditions, at this point it's probably more preferable for that to be via a lower currency at the margin than lower interest rates."

Addressing the price level of the Australian dollar he stated, "I thought US 85¢ would be closer to the mark than US 95¢ ...but really, I don't think we can be that precise."

Speaking to the Australian Business Economists annual dinner in Sydney in November, Stevens said he was "open minded" on intervening to weaken the Australian dollar.

"Overall, in this episode so far, the Bank has not been convinced that large-scale intervention clearly passed the test of effectiveness versus cost. But that doesn't mean we will always eschew intervention."

He added, "Our position has long been, and remains that foreign exchange intervention can, judiciously used in the right circumstances, be effective and useful."

In the December RBA policy statement, Stevens reiterated his opinion that the exchange rate was “uncomfortably high."

Comments from the IMF in November also added pressure to the Australian currency. In a preliminary statement the IMF recommended accommodative monetary policy, stating "With growth currently on the soft side, the real exchange rate still overvalued and weighing on the non-mining sector, and inflation within the target range, monetary policy should remain accommodative."

At that time IMF deputy managing director Min Zhu added "The Australian dollar is overvalued by around 10 percent from a medium-term point of view."

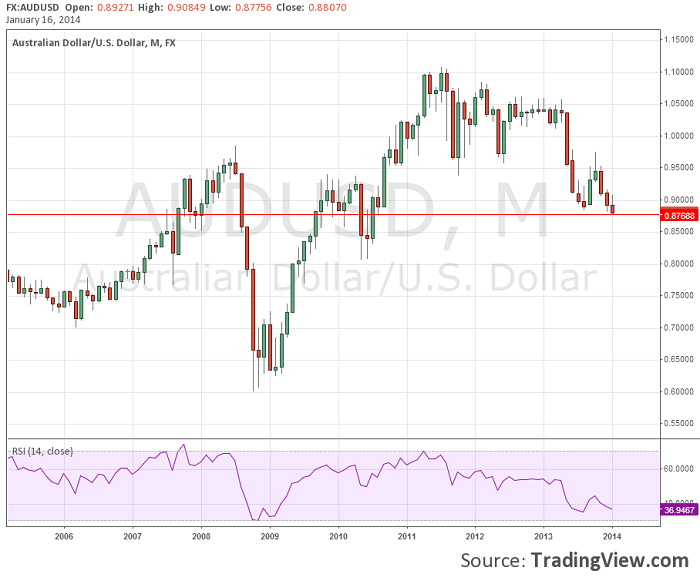

AUD/USD Monthly Chart

Looking at the monthly AUD/USD chart we can see that so far January marks its third consecutive month of losses. The Aussie found support today at around 0.8768, drawing nearer to the 0.85 level referenced by RBA Governor Stevens last month. AUD/USD Monthly Chart" title="AUD/USD Monthly Chart" width="700" height="581">

AUD/USD Monthly Chart" title="AUD/USD Monthly Chart" width="700" height="581">

Original Post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Australian Dollar Falls To Multi-Year Lows After Soft Employment Report

Published 01/16/2014, 10:59 AM

Australian Dollar Falls To Multi-Year Lows After Soft Employment Report

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.