The Australian dollar has started the week with considerable losses. Trading down at AUD/USD.

Will minutes shed light on RBA’s plans?

It’s a light calendar this week for Australian releases. One of the highlights is the Reserve Bank of Australia’s minutes of the September meeting, which will be released on Tuesday. At the meeting, the RBA hiked rates by 0.50% for a fourth straight time, bringing the cash rate to 2.35%. RBA Governor Lowe has made it quite clear that additional rate hikes are coming, and last week he told a parliamentary committee that the 2.35% rate “is still too low”. At the same time, Lowe has signalled that he plans to slow the pace of tightening. Lowe could decide to lower rates to 0.25% as soon as the October 6 meeting, but that is by no means certain, given that inflation rose to 6.1% in the second quarter, up from 5.1% in Q1. Inflation is the RBA’s number one priority, and Lowe may not want to ease up on rates until there are clear signs that inflation has peaked. The RBA is also concerned about inflation expectations, and there was good news last week as inflation expectations slowed to 5.4% in August, which was a third successive decline.

This week sees several major banks holding rate meetings, highlighted by the Federal Reserve meeting on September 21. The Fed has relied on a strong labour market to continue tightening at a steep pace as it grapples with high inflation. In August, inflation dipped for a second straight month, but the 8.3% reading was higher than the consensus. Inflation is proving to be more persistent than expected, which means that the Fed will have to remain more hawkish than the markets had anticipated. This sentiment has sent the US dollar higher. The markets have priced in a 0.75% hike at the upcoming meeting, with an outside chance of a massive 1.00% increase. With the Fed remaining in hawkish mode, the short-term outlook for the US dollar appears bright.

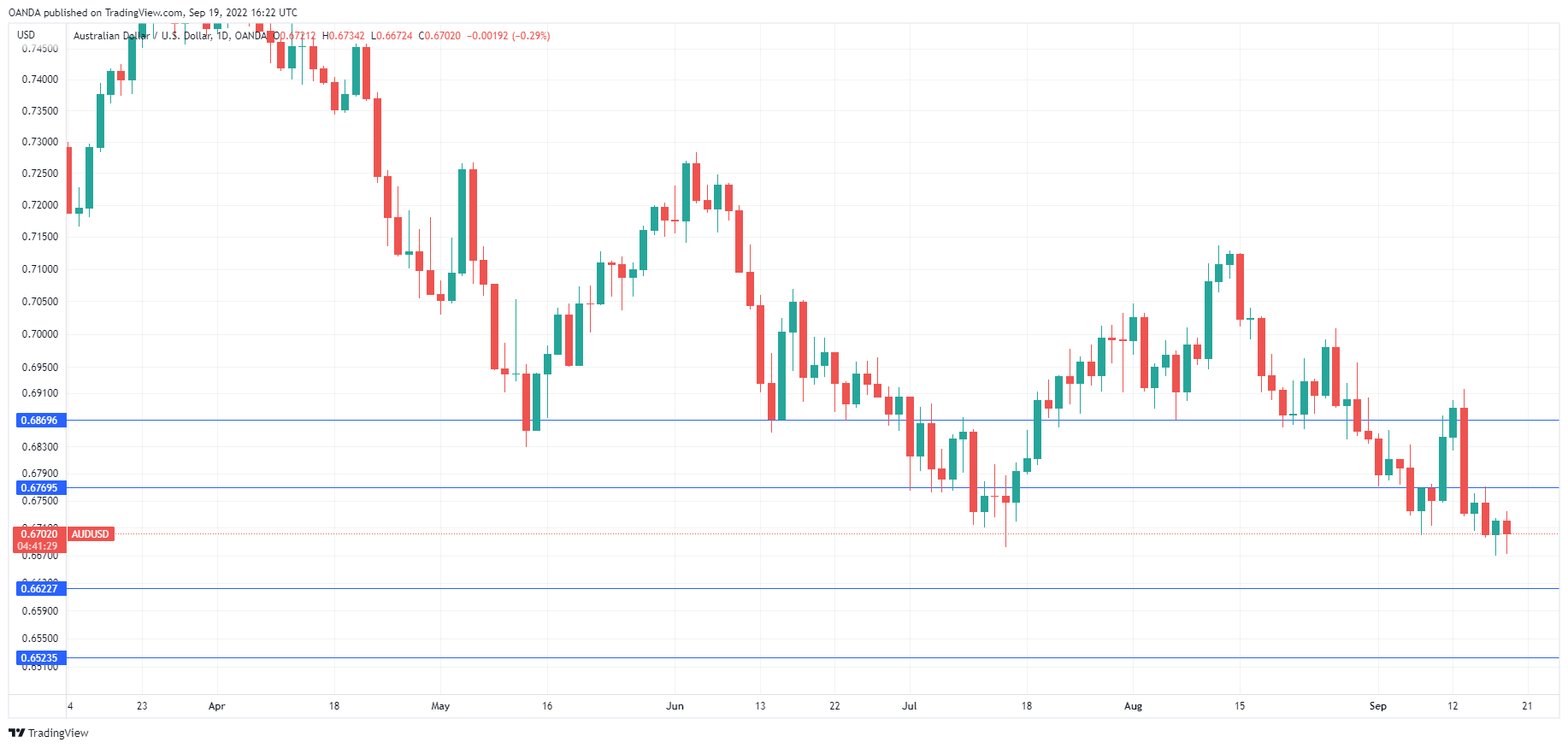

AUD/USD Technical

- AUD/USD has support at 0.6623 and 0.6523

- There is resistance at 0.6769 and 0.6869