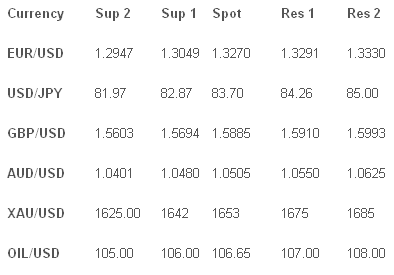

U.S. Dollar Trading (USD) the USD was mixed yesterday with the FED Chairman Bernanke avoiding making a splash with his speech yesterday disappointing the hawks by avoiding commenting on the timeline of US rates and instead stating the economic outlook remains challenging. US housing starts fell -1.1% in Feb but this was countered by building permits which grew 5.1%. Looking ahead, Fed Chief Bernanke speaks again. Also February Existing home sales forecast at 4.62mn vs. 4.57mn previously.

The Euro (EUR) the EUR/USD was strong ignoring the Chinese concerns that dominated the Asian session of trading. Support was seen at 1.3180 and we saw a move back to 1.3250 and the EUR/JPY kicked on above Y110. EUR/AUD was the big mover up above 1.2500 and rocketing to 1.2600. The Sterling (GBP) the GBP/USD remains stable and supported but was unable to break above the 1.5900 and the EUR/GBP grinded higher above 0.8350. The GBP/AUD break above the major 1.5000 level saw a sharp move to 1.5150 and has heaps of space to move higher. Looking ahead, UK MPC minutes from March meeting forecast at 9-0 hold.

The Japanese Yen (JPY) the USD/JPY was trapped by the USD weakness post Bernanke speech and the Yen weakness as crosses rally. The EUR/JPY rally past Y110 has seen the pair extend gains to Y111 and we have significant upside on most crosses given historical levels and last year’s selling. Australian Dollar (AUD) the AUD/USD has been played as the Chinese currency in recent months so when the China slowdown news from BHP hit the wires the European and the US traders sold the AUD aggressively across the board for one of the heaviest one day losses for the commodity currency this year. The story is taking grip on the market and could be a theme for the coming weeks. Looking ahead, Q4 GDP forecast at 0.6% vs. 0.8% previously.

Oil & Gold (XAU) Gold is continued to trade sideways near $1650 waiting for the next inspiration. Oil dropped hard down $2 a barrel to $106 on China slowing concerns and Saudi reserve production capacity comments.

Pairs to watch

EUR/AUD the unwind to continue from recent all time lows?

GBP/USD the MPC minutes to allow break above 1.5900?

TECHNICAL COMMENTARY

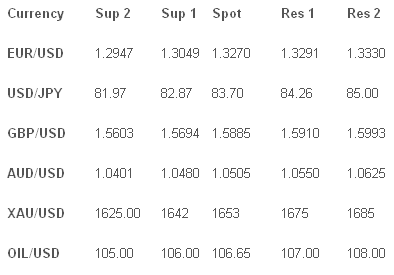

The Euro (EUR) the EUR/USD was strong ignoring the Chinese concerns that dominated the Asian session of trading. Support was seen at 1.3180 and we saw a move back to 1.3250 and the EUR/JPY kicked on above Y110. EUR/AUD was the big mover up above 1.2500 and rocketing to 1.2600. The Sterling (GBP) the GBP/USD remains stable and supported but was unable to break above the 1.5900 and the EUR/GBP grinded higher above 0.8350. The GBP/AUD break above the major 1.5000 level saw a sharp move to 1.5150 and has heaps of space to move higher. Looking ahead, UK MPC minutes from March meeting forecast at 9-0 hold.

The Japanese Yen (JPY) the USD/JPY was trapped by the USD weakness post Bernanke speech and the Yen weakness as crosses rally. The EUR/JPY rally past Y110 has seen the pair extend gains to Y111 and we have significant upside on most crosses given historical levels and last year’s selling. Australian Dollar (AUD) the AUD/USD has been played as the Chinese currency in recent months so when the China slowdown news from BHP hit the wires the European and the US traders sold the AUD aggressively across the board for one of the heaviest one day losses for the commodity currency this year. The story is taking grip on the market and could be a theme for the coming weeks. Looking ahead, Q4 GDP forecast at 0.6% vs. 0.8% previously.

Oil & Gold (XAU) Gold is continued to trade sideways near $1650 waiting for the next inspiration. Oil dropped hard down $2 a barrel to $106 on China slowing concerns and Saudi reserve production capacity comments.

Pairs to watch

EUR/AUD the unwind to continue from recent all time lows?

GBP/USD the MPC minutes to allow break above 1.5900?

TECHNICAL COMMENTARY