Those that view the message of the market on daily basis are likely confused by trading noise. While trading noise contributes to the long-term trends, it does not define them. Human behavior tries to explain trading noise as a meaningful trend. This confuses the majority which, in turn, contributes to their role as bagholders of trend transitions.

Guggenheim CurrencyShares Australian Dollar (NYSE:FXA)

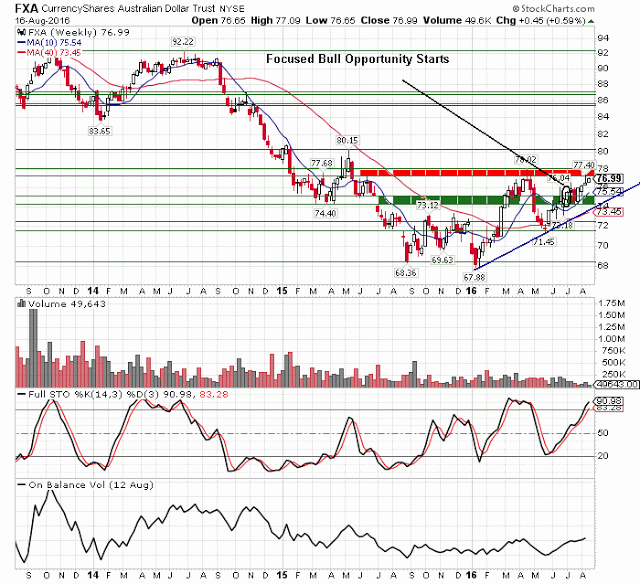

The Aussie's focused bull opportunity has produced a 16% annualized return for the bulls since the first week of July. Disciplined bulls that booked partial profits and reduced risk during the intra week high at resistance (red zone) are letting their profits run.

A weekly close above resistance from 77.37 to 78.02 (red zone) maintains the up impulse, while a close below the July 2015 gap from 74.32 to 75.17 pauses it and favors a retest of the May low.

On Balance Volume, a crude measure of trend energy, displayed higher lows relative to price from August 2015 to January 2016. This positive divergence, an indication of short-term accumulation, favors the bulls.