The Australian dollar rebounded on Friday, following receding US/Iran tensions and an upbeat retail sales report. The Aussie has a positive correlation with ‘risk assets’ and is typically underpinned as risk appetite rises.

On Friday, the Australian Bureau of Statistics reported that retail sales increased by 0.9% in November, beating expectations and marking the largest rise since November of 2017. Black Friday sales were credited with giving a major lift to retailers. The strong spending in November may indicate weaker December sales, however.

Gold, crude oil and bitcoin soared on the news of the killing of Iranian general Qassem Soleimani and the retaliation by Iran. Meanwhile, the risk proxy Australian dollar sold off sharply on the news.

Money flowed out of safe havens into riskier assets as President Trump de-escalated the crisis on Wednesday. During his televised address to the nation, he stated: “Iran appears to be standing down, which is a good thing for all parties concerned and a very good thing for the world.”

In December President Trump announced that the Phase 1 trade deal with China would be signed on January 15th. In an interview on Thursday, Trump said the agreement could be signed “shortly thereafter.” Speaking with the ABC TV affiliate in Toledo, Ohio he stated: "We're going to be signing on January 15th - I think it will be January 15th, but shortly thereafter, but I think January 15th - a big deal with China." China is Australia’s largest trading partner, and positive news relating to the US/China trade war supports the Australian dollar.

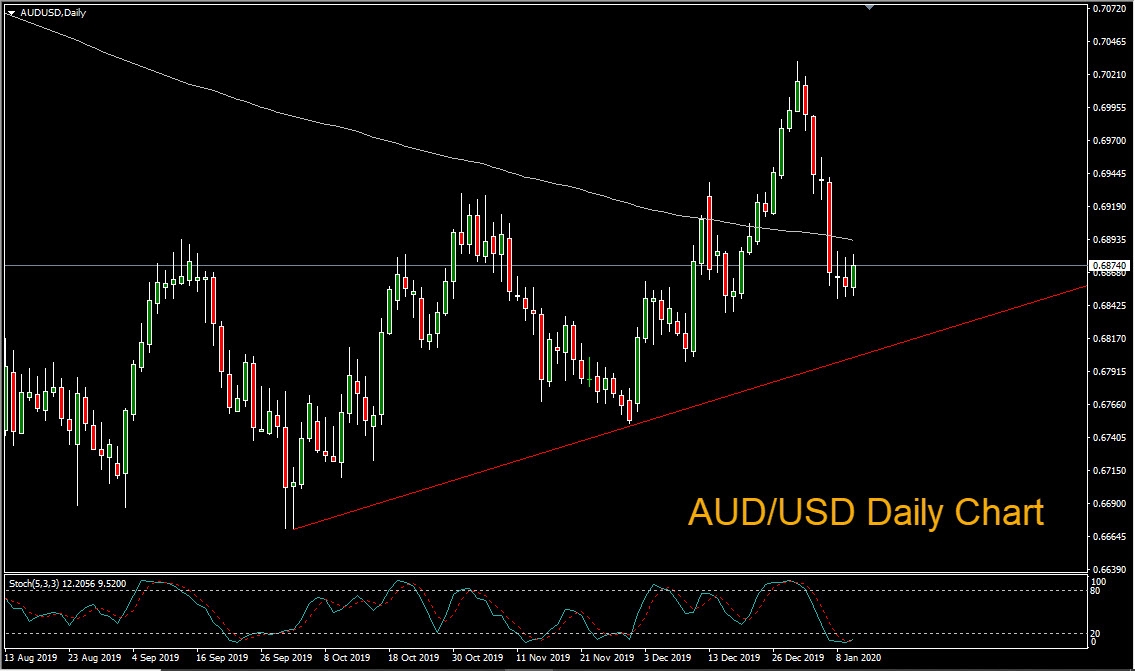

Looking at the AUD/USD daily chart we can see that the upward move on Friday comes after 6 bruising sessions. Brightening US/China trade relations and de-escalation of the Middle East crisis could continue to support the Australian dollar. However, geopolitical tensions could easily flare up again, sending risk assets lower.