It has been a while since I took note of the impact of economic numbers on the Australian dollar (NYSE:FXA). For most of this year, I have instead been a lot more focused on what the Australian dollar, combined with the Japanese yen (NYSE:FXY), might be saying about risk attitudes in financial markets. Today, I finally took note of economic drivers.

The Australian Bureau of Statistics (ABS) delivered another strong jobs report for the Australian economy:

The trend unemployment rate fell from 5.2 per cent to 5.1 per cent in the month of October 2018…Today’s fall in trend unemployment to 5.1 per cent marks the lowest unemployment rate since early 2012. This month is the 25th consecutive monthly increase in employed full-time persons with an average increase of 20,300 employed per month…

The Australian dollar jumped in response. The 5-minute chart below of AUD/JPY shows the immediate pop. The daily chart shows the likely bullishness of this move. So far, it looks like AUD/JPY confirmed a new 200DMA breakout. The currency pair could be off to the races if it surpasses the highs from last week.

Most of the pop in AUD/JPY occurred in the first 5 minutes after the jobs numbers were released. It took over three hours for momentum to start picking up again.

AUD/JPY broke out above its 200DMA last week and retested it this week. The jobs numbers helped confirm a successful test.

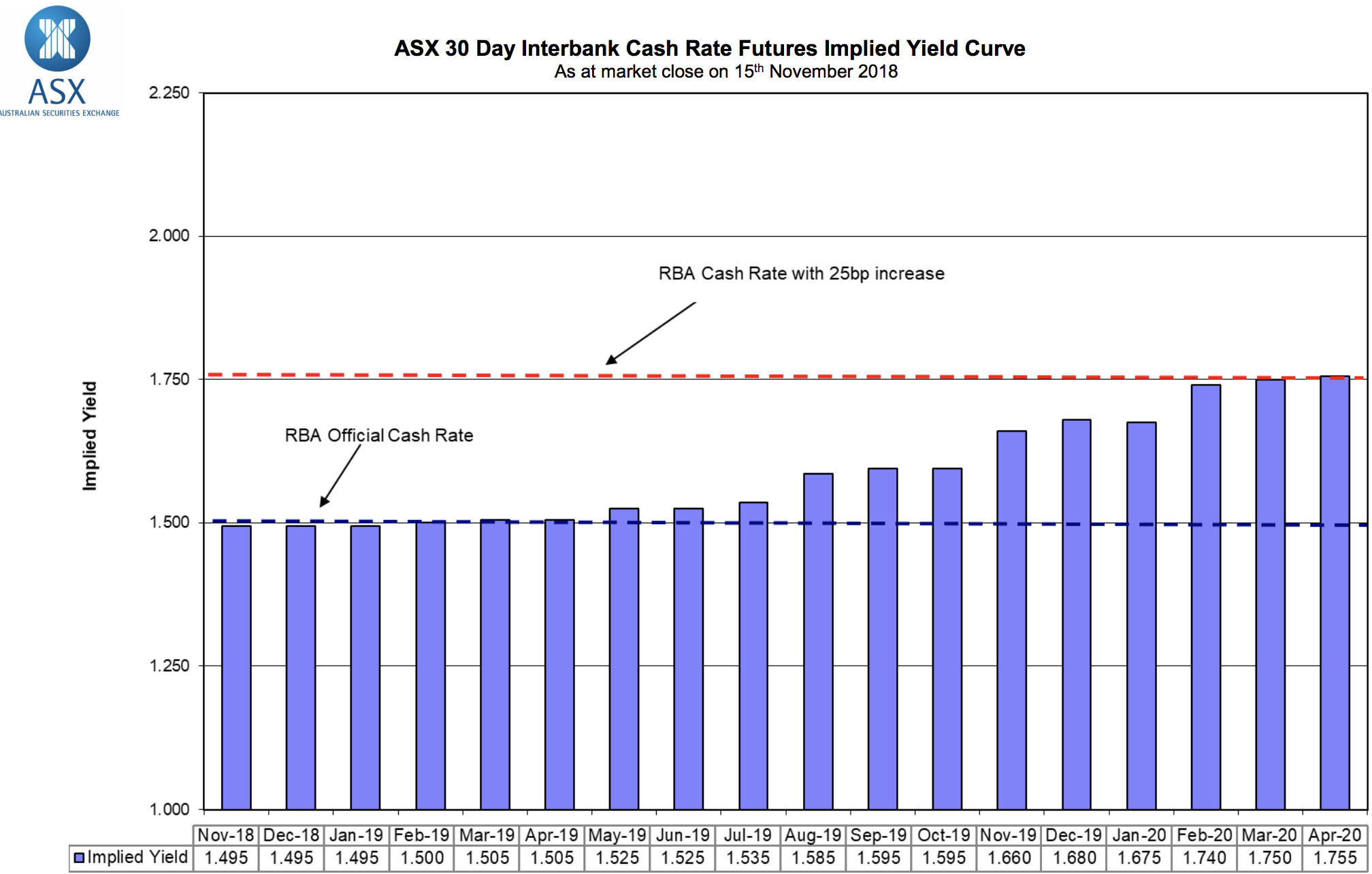

Interestingly, the odds for the next rate hike are far out into the future. So if these economic numbers are harbingers of a strong or strengthening economy, the potential for a rate “surprise” must be increasing. In other words, I need to maintain a bullish bias on the Australian dollar as the odds seem to favor a more hawkish statement from the Reserve Bank of Australia (RBA) in the near future. I can only imagine how much the Australian dollar could soar whenever trade tensions between the U.S. and China ease.

The market is not expecting a full 25bps rate hike until February, 2020.

For now, RBA interest rates remain at historic lows.

Be careful out there!

Full disclosure: long AUD/JPY, short AUD/USD