The Australian CPI for the December quarter is due to be released at 00:30 GMT 28 January with a consensus expectation of 1.8% YOY.

The CPI announcement is an important one for AUD, as the CPI is a key input into the Reserve Bank of Australia’s interest rate deliberations. If the result comes in below consensus (as it has in nine out of the last 16 quarters), speculation of further official interest rate cutswill be reinforced which will exert further downward pressure in time on the AUD.

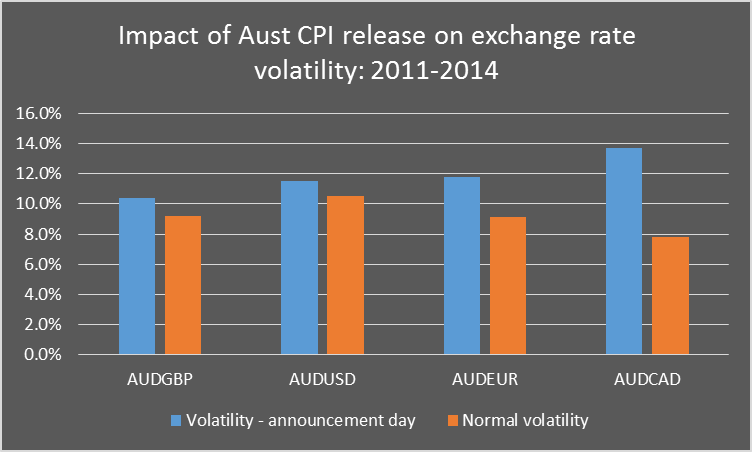

On the day, higher volatility is likely –

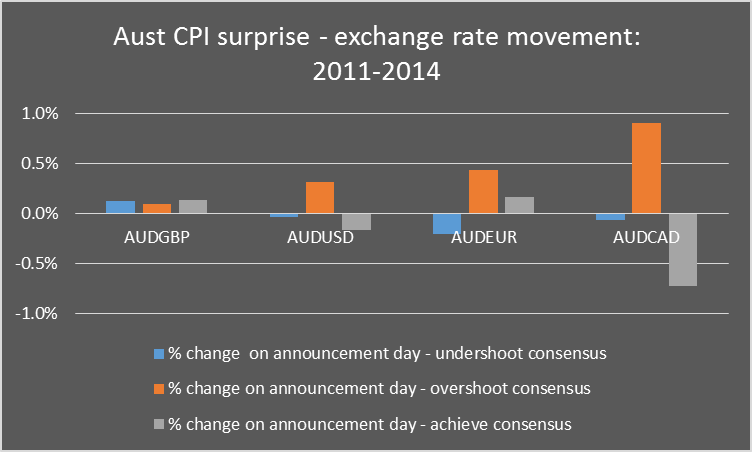

… but the direction is variable between pairs unless the result surprises on the upside –

A statistical analysis of the last 16 quarters actual vs consensus suggests a slight bias to a result below consensus tomorrow.

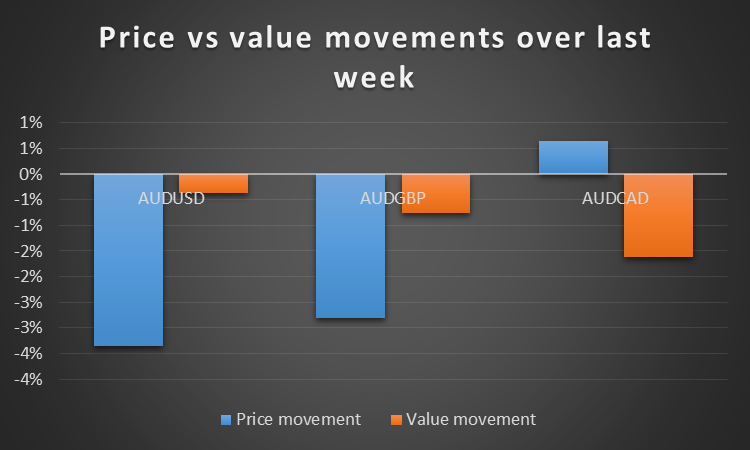

Value considerations

In the last week AUD/USD dropped below 0.80 for the first time since July 2009 with a 3.3% fall over the week. However, for AUD/USD and AUD/GBP, the price drop considerably exceeded the drop in fair value –

The unexpected cut in the Canadian official interest rate explains the movements in AUD/CAD.

The above results normally would suggest taking short term long positions in AUD/USD and AUD/GBP and a short term short position in AUD/CAD. This strategy would also mitigate the event risk of the CPI announcement.

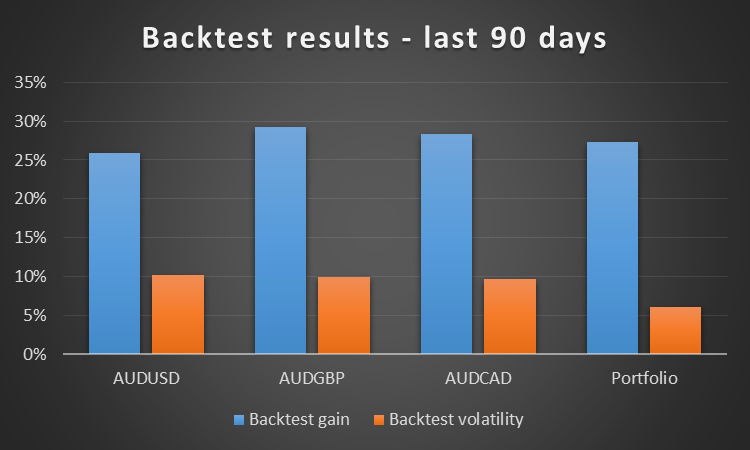

Our backtesting over the most recent 90 days (see graph below) suggests that trading the price/value movement divergences in this way would have been profitable. Also, taking positions following the indicator in all three (equally weighted) would have given a significantly better return/volatility outcome than trading any of the pairs individually. (The highest return/volatility ratio for any of the three pairs individually was 2.95 – for AUD/CAD – when it was 4.54 for an equally weighted portfolio of the three).