Australia is a substantial global economy and one that is incredibly lucky given its immense commodity reserves. Over the last decade, this has contributed to massive growth in the economy leading to the so called title ‘the lucky country’. Over the last 12 months, there have been some worries regarding the state of the economy and its exposure to global events – one in particular seems to be the most serious of them all.

China plays a major role in the Australian economy as it currently contributes 26.2% of all Australian exports, which roughly equals 78.7 billion dollars. When compared to the second largest trading partner –Japan, China is considerably larger as Japan only comes in at 16.6% or 49.8 billion in exports.

The Australian economy, as many know, has been at the forefront of a natural resources boom as its vast mineral deposits help feed the expansion of China. The only problem is that any slowdown in China leads to a hangover in Australia when it comes to the state of the economy. As in the last few years, most sectors have been struggling and it has been the mining sector propping up the economy.

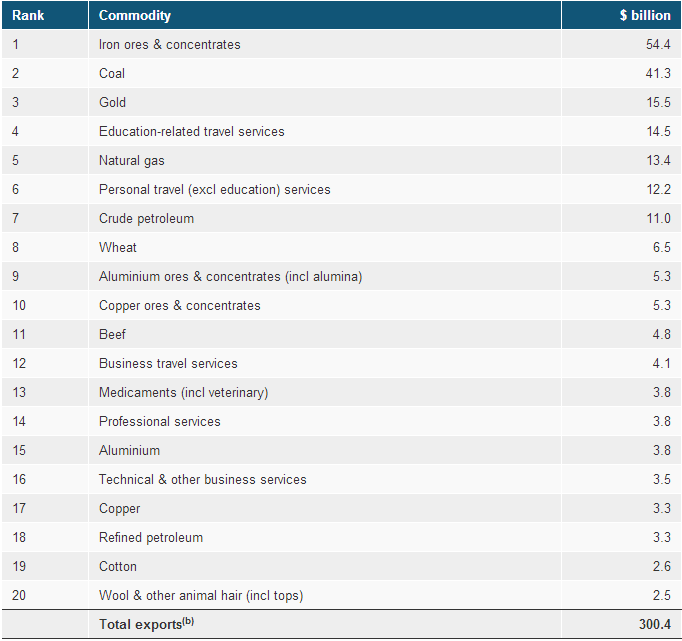

Mining only becomes a problem when you look at the current major exports for the Australian economy.

Source: Australian Department of Foreign Affairs and Trade

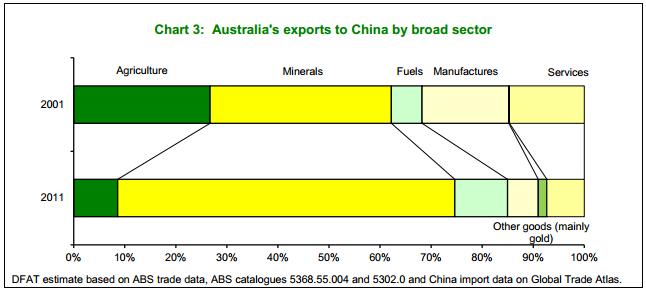

The extent of the mining sector in Australia quickly becomes clear, especially when you take into account the numbers, with all mining exports (excluding gas and oils, as these can be easily traded globally) making up 42.9% of exports ($128.9 billion). Furthermore, over the last 10 years, mineral exports to China have grown at an average rate of 36.8% p.a., an impressive growth rate for an export sector. Mineral exports to China account for 66.0% of exports to China in 2011.

Source: Australian Department of Foreign Affairs and Trade

So the Chinese economy quickly becomes a worry for the economy of Australia and the impact of a slowdown is magnified by the fact that so much of the Australian export economy is invested in supplying China.

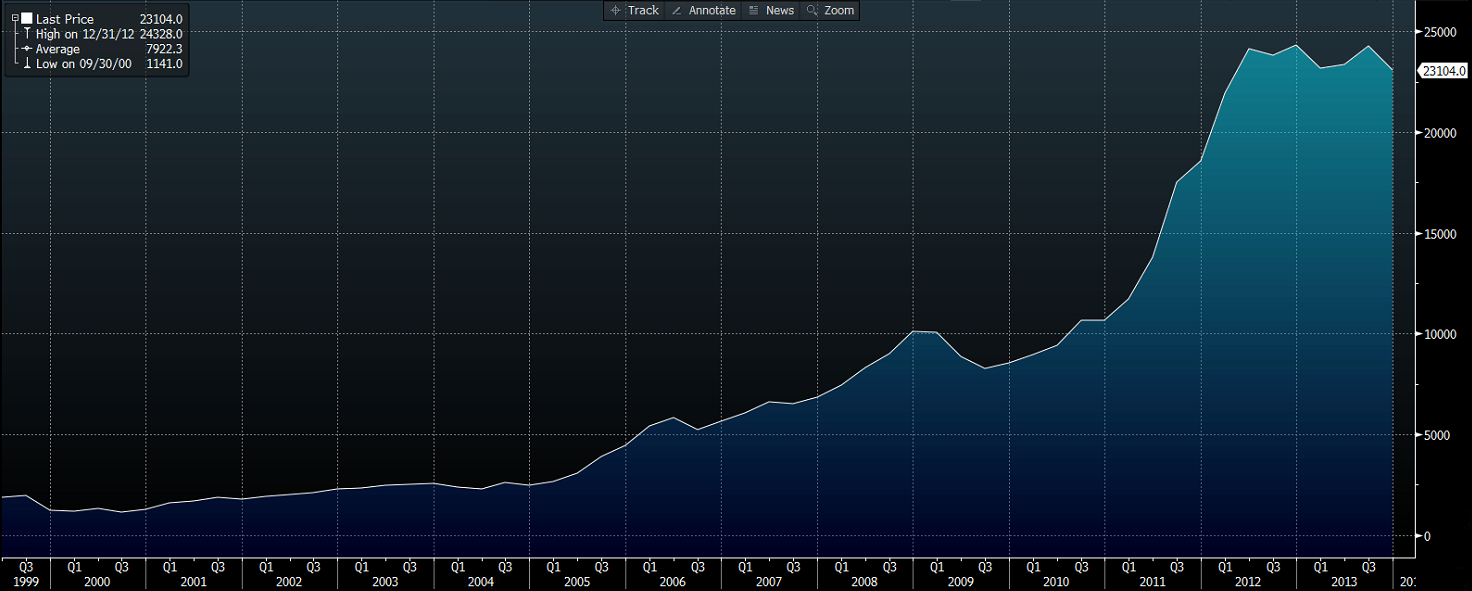

China’s economy has grown significantly over the last two decades, as it went from communism to a more market/capitalistic structure after the ‘great leap forward’ under Deng Xiaoping. This growth in the double digits had a massive impact on the global economy and significantly, Australia. However, growth prospects have started to diminish slightly as the Chinese economy starts to come full circle. Party officials are now saying that growth between 7-8% is more sustainable in the long run, compared to past growth rates which have been immense and have caused economic headaches.

Source: Bloomberg (China real GDP 20 yr)

The 90’s and early 2000’s saw not only massive growth but global markets embrace China as the world’s fastest industrialisation took place under the great leap forward. With double digit growth and a thirst for natural resources, Australia opened up its mining sector in an effort to stimulate the economy and it reaped the rewards in doing so.

The opening up of the mining sector led to massive investment in the domestic economy; commonly referred to as Capex (Capital Expenditure). This in turn helped boost Australias GDP and drive wage growth, especially in the mining sector. Capex levels have now peaked and the effects on the Australian economy could be severe over the next few years, as firms look to freeze wage growth and shrink work forces slowly via attrition.

Source: Bloomberg (Australian capital expenditure on the mining sector)

What plays the largest impact on all of this is the recent manufacturing PMI data from China, with statistics released yesterday painting two very different pictures for the manufacturing sector in China. The official data released from the PBOC shows very light expansion, while the data from HSBC shows that the manufacturing sector is starting to slow and in actual fact, it’s starting to contract slightly (anything under 50 is contraction). I’m more inclined to believe the data from the HSBC survey as Chinese data in the past as been known to be ‘trumped up’ in order to keep officials happy and to make sure no trouble comes from Beijing.

Source: Bloomberg (HSBC Manufacturing Index [blue], Chinese Manufacturing Index [yellow])

China today is a slowing economy and has a few problems at home – especially when it comes to the credit markets. Many people will be aware of the shadow banking system.The dodgy lending practices which have led to bubbles in China could also lead to long term damage to the economy.

Overall, the long term impact on Australia’s economy is not likely to be felt immediately but slowly instead as Capex slows and China’s growth starts to slow further – including its manufacturing PMI data. While many people reading this may look for a silver lining in all of this, the reality is quite clear. Australia’s economic situation hinges heavily on China’s and that is a real concern in the short term. While China might have economic problems which would affect the global community, the effects would be much more severe on the Australian economy.