Australia 200 for Tuesday, June 3, 2014

Over the last week the Australian 200 Index moved back and forth between the two key levels of 5500 and 5550. Over the last couple of months the Australia 200 Index has formed an amazing attraction to the key 5500 level as it spent a considerable amount of time trading around it. A couple of weeks ago, the index fell away heavily back down to support around 5400 before returning to the key 5500 level just as quickly, as if gravity had pulled it back. Throughout the last few weeks it has been placing ongoing pressure on the resistance level at 5500 and a few weeks ago it was finally able to move through to a three week high before easing back again to this key level.

Several weeks ago it slowly but surely eased away from its multi-year high achieved near 5560 however the following week it fell reasonably sharply and started looking towards the 5400 level which is near where it currently sits. In doing so it returned to back under the key 5500 level which has provided some reasonable resistance over the last few months.

For the bulk of the last few months, the Australia 200 Index has traded roughly between 5300 and 5500 therefore its return to back under 5500 was not surprising. The index has done well over the last couple of months to move steadily higher from support around 5300 up to beyond 5500, forming higher peaks and higher troughs along the way. The support level at 5300 may also be called upon should the index fall lower and will also likely play a role in providing some buffer from any decline. Since February, most of the trading activity has occured between 5400 and 5500 therefore the former level may also be called upon to prop up prices. The index has done very well over the last couple of years moving from below 4000 to its present trading levels around 5500.

A measure of Australian manufacturing activity improved in May although firms continued to complain of challenging conditions in the business sector. The Australian Industry Group’s performance of manufacturing index (PMI) rose 4.4 points to 49.2, just below the 50 level that is supposed to mark the threshold between contraction and expansion. The survey has been persistently weaker than official measures of manufacturing, implying the sector has been deep in recession for almost all of the past five years. The may result marked the seventh consecutive month of contraction. The federal budget had dampened confidence levels and delayed or lowered business commitment to new expenditure, the report said. There was also pressure from the renewed strength in the Australian dollar, which had seen import competition intensify. “The manufacturing sector continues to be buffeted by weak household demand, a lack of business confidence and fierce competition in both domestic and export markets, heightened by the renewed strength in the Australian dollar,” Ai Group chief executive Innes Willox said.

Australia 200 June 3 at 00:10 GMT 5535 H: 5535 L: 5535

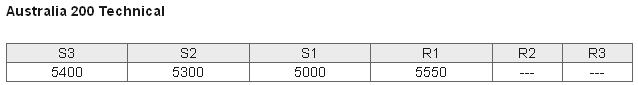

During the hours of the Asian trading session on Tuesday, the Australia 200 Index will be looking to see it it can finally break through the short term resistance level around 5550 after finding support at 5500 again. For most of this year the Australia 200 Index has moved well from the lower support level at 5000 up to the multi-year highs above 5500 in the last month or so.

Further levels in both directions:

• Below: 5400, 5300 and 5000.

• Above: 5550.

Economic Releases

- 01:30 AU Current Account (Q1)

- 01:30 AU Net Exports of GDP (Q1)

- 01:30 AU Retail trade (Apr)

- 04:30 AU RBA – Overnight Rate (Jun)

- 06:00 UK Nationwide House Prices (May)

- 08:30 UK CIPS / Markit Construction PMI (May)

- 09:00 EU Flash HICP (May)

- 09:00 EU Unemployment (Apr)

- 14:00 US Factory Orders (Apr)

- 14:00 US IBD Consumer Optimism (Jun)

- US Vehicle Sales (May)