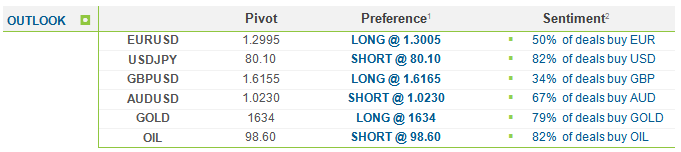

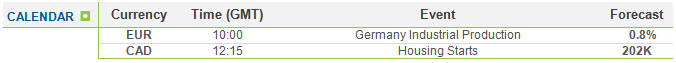

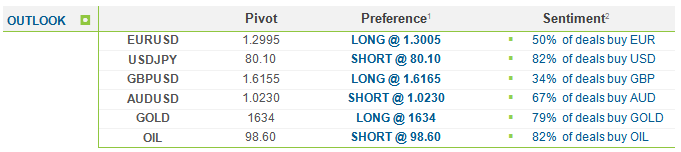

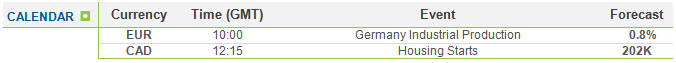

The euro (EUR) rose to 1.3065 rebounding from a three-month low at 1.2954 against the US dollar. The single currency tumbled following the elections in Greece and France as investors are concerned about the countries’ ability to apply the austerity measures necessary to tackle the eurozone debt crisis. Political uncertainty in Greece continues to weigh on the euro as a first attempt to form a new Greek government failed while investors fear about the country’s ability to avoid bankruptcy and stay in the euro. Shares recovered on Tuesday and sentiment in the market appears improved on hopes about a plan to bolster its troubled banks. Focus turns to today’s Industrial Production figures from Germany.

The US dollar (USD) strengthened against a basket of currencies following the elections but throughout the day the dollar pared its gains as risk sentiment in the market improved. Versus the Japanese yen (JPY), the greenback edged higher to 80.07 from 79.64. On Friday, the pair slid as nonfarm payrolls showed poor figures increasing expectations about a third round of quantitative easing by the Federal Reserve.

The Australian dollar (AUD) edged higher versus the US dollar to 1.0219 from 1.0110 after an improvement in Australian economic data. Retail Sales surprised the markets after a 0.9% expansion while Building Permits rose higher than expected. But the aussie remains under pressure after an unexpected 50 bps cut in Australia’s interest rates followed by a dovish tone by the Reserve Bank of Australia. RBA revised its growth forecast lower and expectations for further interest rate cuts continue to weigh on the aussie. Today, the country’s trade balance was revealed and figures showed a third straight trade deficit in March as exports are not recovering as quickly as anticipated.

Oil rose to 98.16 dollars a barrel from 95.06. Gold (XAU) was little changed falling to 1632.31 dollars an ounce from 1642.42 and against the euro it fell to 1251.85 from 1255.38. Silver (XAG) dropped to 29.67 dollars an ounce from 30.36.

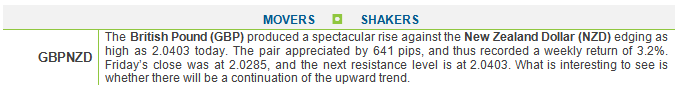

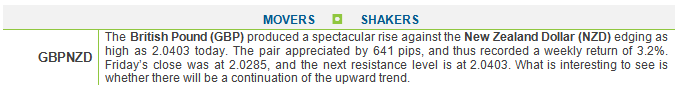

GBP/NZD" title="GBP/NZD" width="678" height="89" />

GBP/NZD" title="GBP/NZD" width="678" height="89" />

Disclaimer: Please note that forex trading (OTC trading) involves substantial risk of loss, and may not be suitable for everyone. The information provided is based on data generated by third party investment research providers. easy-forex® does not assume any liability as to the accuracy of such information. This information shall be used for reference only and it is not binding on easy-forex. This is not an advertisement or a recommendation by easy-forex in engaging / binding you in any forex transactions.

The US dollar (USD) strengthened against a basket of currencies following the elections but throughout the day the dollar pared its gains as risk sentiment in the market improved. Versus the Japanese yen (JPY), the greenback edged higher to 80.07 from 79.64. On Friday, the pair slid as nonfarm payrolls showed poor figures increasing expectations about a third round of quantitative easing by the Federal Reserve.

The Australian dollar (AUD) edged higher versus the US dollar to 1.0219 from 1.0110 after an improvement in Australian economic data. Retail Sales surprised the markets after a 0.9% expansion while Building Permits rose higher than expected. But the aussie remains under pressure after an unexpected 50 bps cut in Australia’s interest rates followed by a dovish tone by the Reserve Bank of Australia. RBA revised its growth forecast lower and expectations for further interest rate cuts continue to weigh on the aussie. Today, the country’s trade balance was revealed and figures showed a third straight trade deficit in March as exports are not recovering as quickly as anticipated.

Oil rose to 98.16 dollars a barrel from 95.06. Gold (XAU) was little changed falling to 1632.31 dollars an ounce from 1642.42 and against the euro it fell to 1251.85 from 1255.38. Silver (XAG) dropped to 29.67 dollars an ounce from 30.36.

GBP/NZD" title="GBP/NZD" width="678" height="89" />

GBP/NZD" title="GBP/NZD" width="678" height="89" />Disclaimer: Please note that forex trading (OTC trading) involves substantial risk of loss, and may not be suitable for everyone. The information provided is based on data generated by third party investment research providers. easy-forex® does not assume any liability as to the accuracy of such information. This information shall be used for reference only and it is not binding on easy-forex. This is not an advertisement or a recommendation by easy-forex in engaging / binding you in any forex transactions.