For the 24 hours to 23:00 GMT, the AUD weakened 0.79% against the USD to close at 0.7631.

Yesterday, the RBA Assistant Governor, Christopher Kent stated that the Australian dollar was still having elevated value and continued to hamper the nation’s economic growth.

LME copper prices declined 0.28% or $16.5/MT to $5783.5/MT. Aluminium prices declined 0.62% or $11.0/MT to $1749.5/MT.

In the Asian session, at GMT0400, the pair is trading at 0.7598, with the AUD trading 0.43% lower from yesterday’s close.

Data just released indicated that in China, Australia’s biggest trading partner, retail sales rose 10.7% YoY, lower than market expected advance of 11.7%. Additionally, the nation’s industrial production dropped to 6.8% on an annual basis in February, after registering a level of 7.9% in the preceding month.

Early morning data showed that Australian home loans slid 3.5% in January, higher than market expected decline of 2.0% and following a drop of 2.7% registered in the prior month. Meanwhile, investment lending in the nation fell 0.1% in January after registering a rise of 6.0% in December.

Overnight data indicated that Australia’s Westpac consumer confidence index dropped to a level of 99.5 in March, compared to a rise to a reading of 100.7 registered in the previous month.

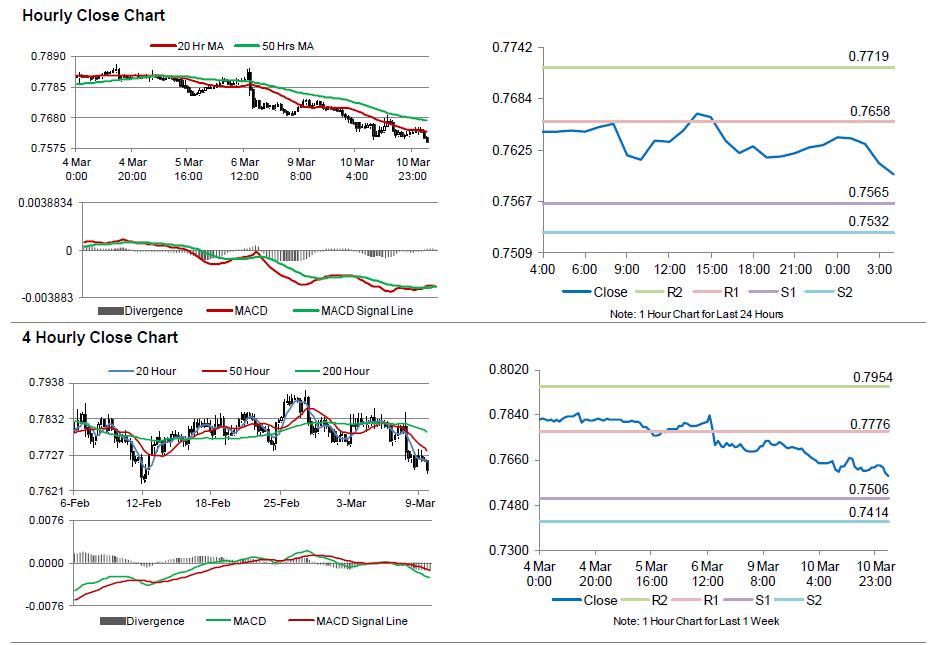

The pair is expected to find support at 0.7565, and a fall through could take it to the next support level of 0.7532. The pair is expected to find its first resistance at 0.7658, and a rise through could take it to the next resistance level of 0.7719.

Looking ahead, investors would closely monitor Australia’s consumer inflation expectation data, scheduled in the early hours tomorrow.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.