For the 24 hours to 23:00 GMT, the AUD declined 0.58% against the USD and closed at 0.7363.

LME Copper prices declined 1.2% or $74.0/MT to $6063.0/MT. Aluminium prices declined 0.6% or $13.0/MT to $2023.0/MT.

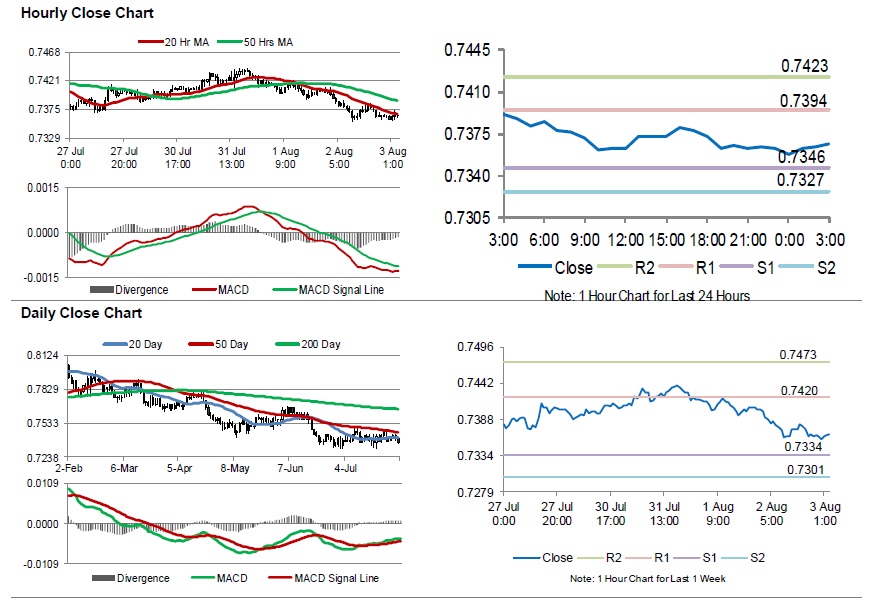

In the Asian session, at GMT0300, the pair is trading at 0.7366, with the AUD trading marginally higher against the USD from yesterday’s close.

Overnight data indicated that, Australia’s seasonally adjusted retail sales jumped 0.4% on a monthly basis in June, compared to a similar rise in the prior month. Markets had anticipated retail sales to climb 0.3%. Meanwhile, the nation’s AIG performance of services index eased to 53.6 in July, following a level of 63.0 in the previous month.

Elsewhere in China, Australia’s largest trading partner, the Caixin/Markit services PMI index dropped to a level of 52.8 in July, less than market expectations for a fall to a level of 53.5. The index had registered a reading of 53.9 in the prior month.

The pair is expected to find support at 0.7346, and a fall through could take it to the next support level of 0.7327. The pair is expected to find its first resistance at 0.7394, and a rise through could take it to the next resistance level of 0.7423.

Looking ahead, investors would keep an eye on the Reserve bank of Australia’s (RBA) monetary policy decision, due to be released next week.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.