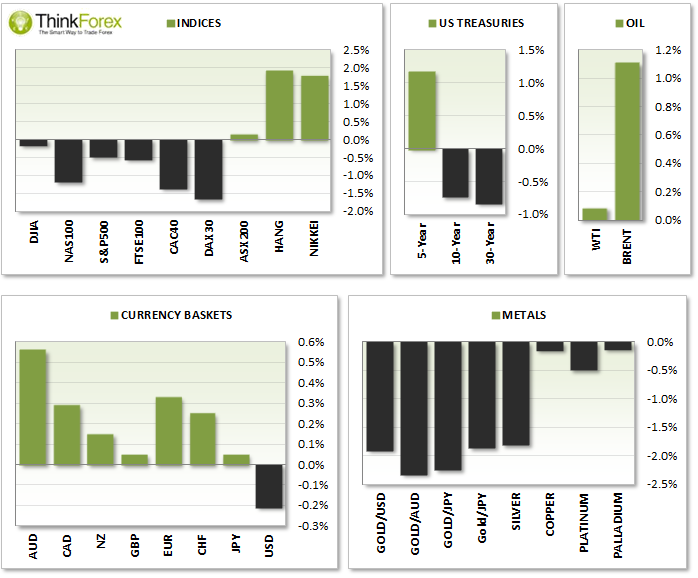

The main themes driving yesterday's session was the uncertainty with Crimea, the G7 summit (which excluded Russia) and the weak data from China released during the Asia session. With the data coming in so weak it has put stimulus back onto the cards which saw the Aussie trade to its highest level since the 2nd December and Gold drop another 2%.

FOREX:

AUD/USD broke to its highest level this year following talk of Chinese Stimulus after the disappointing PMI figures yesterday. Currently up 0.6% the 200 day sMA capped as resistance and could still be within a bearish wedge pattern.

EUR/USD traded to a 3-day high and tested 1.387 resistance.

USD/CAD produced a bullish hammer within the previous day's range and continues to trade above 1.115 support. Technically still bullish and I expect to see it trade to new highs

NZD/USD trades sideways for a 3rd consecutive session.

USD/JPY ranges between 102 support and 102.60. The daily timeframe remains directionless so intraday trading is preferred.

INDICES:

US Equities finished down for the day but regained strength near the lows;

FTSE100 decline has slowed and produced an Inverted Hammer at the 7-week lows;

COMMODITIES:

Gold shed another 2%, its biggest loss in 2 months and broke out of a bullish channel to suggest further downside. Since the $1392 high Gold has lost 6%;

Palladium traded to a 2.5yr high due to concerns of potential trade sanctions against Russia, a leading producer of Palladium.

Brent Oil holds above a multi-year trend line but caught beneath 107.70 resistance.

WTI Continues to trade below the $100 and trade sideways in a suspected correction.