It seems that every time that Capital markets start to feel optimistic this so-called US recovery disappoints. Yesterday’s disappointing US data (weekly claims, Philly Fed and housing starts) are renewing the debate whether tapering Fed bond buying in the second half of this year would be premature. An end to stimulus would probably see the Fed hiking the Fed Funds rate. A current concern is that with tapering the market seems to automatically link and end to QE with higher borrowing costs. In this scenario it would not necessarily mean the end of either the current risk rally or even US equities.

Bernanke and his fellow policy making cohorts will need to improve their communication skills and convince the market that “tapering” does not necessarily mean further tightening – it actually means less accommodation. The trick is to make the clear distinction between the expectations of an end to QE and the expectations of the first official rate hike. For the FI dealers this should steepen the US treasury curve. With several of the emerging currencies paring some of their steepest losses already printed this week would suggest that they expect the Fed to extend its stimulus practices. Obviously, the uneven US growth outlook will make it less likely that the US 10-year benchmark will be trading north of +2% anytime soon.

Speaking of the flight of pessimism to optimism, investors seem to be regaining their confidence on the Euro-zones peripheral debt, certainly aided by the reduction of tail risks and breakup risks – the pendulum of optimism has finally swung the Euro’s way. Now that yields have plummeted since last year, policy makers are beginning to sift their focus from putting “out fires” to dealing with the twin economic problems of “low growth and high unemployment” in Europe.

None of this is so dissimilar to what the Fed has prioritized. Investors are beginning to price in the possibility that policy makers will deliver and have been aided by a strong macro search for “yield.” Both pessimism and optimism is a feature of the economic landscape and the Euro-zone is currently riding the optimism wave. Easing from other European Central banks is compensating the lack of QE from the ECB.

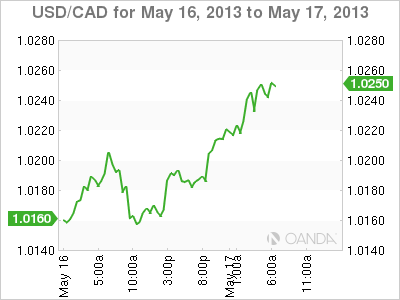

The foreign buying of Canadian securities to the tune of +CAD$1.19-billion’s worth in March versus the sale of -CAD$6.28- billion in the previous month has been helping the loonie in the North American dollar mix and this despite the onslaught of weaker US data. Even the Canadian investor has been selling some of their US equities, capping the “mighty” dollars rise, mostly on the back of the +10% Q1 increase in equity index prices. Does this market still have the legs to presell more US dollars in anticipation of further Canadian investor liquidation?

This morning’s Canada data could set the tone heading into the Canadian long weekend. Investors are forecasting a +0.7%, y/y CPI print, falling below the BOC’s +1-3% inflation control range for the first time in three-months. Even the core’s CPI is to ease slightly (+1.3%), but to remain above January’s low point (+1.0%, y/y). The loonies’ fate requires more fundamental data. Until then, expect investors to remain neutral, holding in a “wait and see” mode until the leadership transition at the helm of the BoC/BoE is finally put to bed in early June.

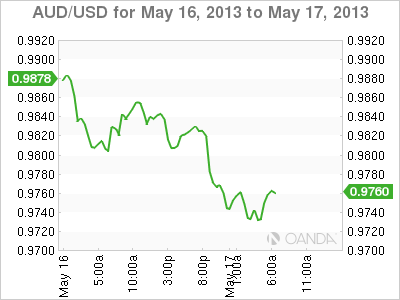

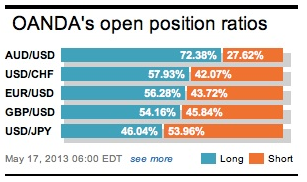

It’s commodity sister currency, the AUD, continues to ride the express elevator and is on a plummeting route to nowhere. The currency has continued its overnight slide to its lowest outright level in nearly 11-months. The Aussie has weakened sharply over the recent sessions, as the RBA’s decision to cut interest rates to a new record low continues to weigh on this antipodean currency. Disappointing data from the country’s largest trading partner, China, has only encouraged further selling of the commodity risk sensitive AUD. Many analysts have jumped on the negative bandwagon and slashed Aussies medium term targets. The AUD is expected to be trading at or near +0.97 within three-months, +0.96 in six-months and +0.90c in 12-months. The currency so far has weakened -6% in May and has its eyes on last years low of 0.9581 from June in 2012 as its medium term target.

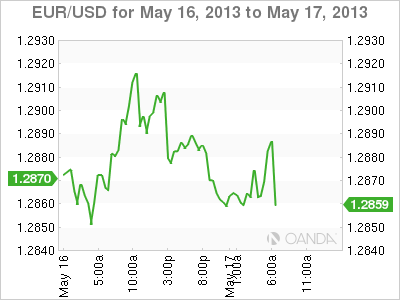

The 17-member single currency is looking set to take another crack at the downside. In the overnight sessions, this market has been trying to get short on any recovery attempts. The recent resistance levels are capped at 1.2930 and 1.2943 set earlier in the week. The overall daily momentum remains increasingly negative, justifiably highlighting the market bearish bias. The 76.4% retracement throws up 1.2859 – a print that has been broken but no official ‘close’ below thus far. Once through this level with momentum, it certainly opens up 1.2740. Until then, aggressive short remain cautious.

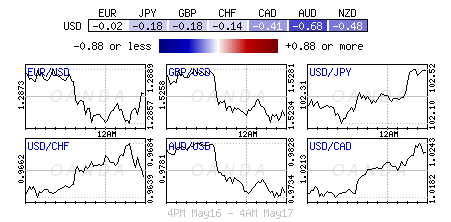

The softer-than-expected tone of this week’s US data overall is supportive of the view that recent USD strength is unlikely to prove persistent. As such, even though the markets expectation for today’s data is for a higher sentiment print, a small minority thinks risks are skewed to the downside – expecting USD to weaken against EUR, but remain supported against JPY and AUD.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Aussie Spanking Is Preferred Over A Timid Euro

Published 05/16/2013, 03:57 PM

Updated 07/09/2023, 06:31 AM

Aussie Spanking Is Preferred Over A Timid Euro

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.