AUD/USD has been moving in a downward direction all week, and this trend is continuing in Wednesday trading. The pair briefly dipped below the 0.89 line as the Australian dollar continues to struggle. In economic news, Australian Construction Work Done was a disappointment, posting a decline and falling well short of the estimate. Today’s major event is US Pending Home Sales.

Australian data has not looked sharp lately and the Construction Work Done release on Wednesday did not bring any relief. The important construction indicator, which is released every quarter, posted its fourth decline in the past five quarters. The reading for Q2 was a decline of 0.3%, well off the estimate of a 1.1% gain. Meanwhile, John Edwards, a board member of the RBA, said that the Australian dollar is still too strong. With the economy suffering from the effects of a mining boom slowdown, the RBA wants the currency to weaken in order to boost economic activity. The Aussie has shed about 11% of its value since May, and has the dubious title of the worst-performing currency in the G-10.

After some weak key releases, the US rebounded nicely on Tuesday, with excellent consumer confidence and manufacturing numbers. CB Consumer Confidence rose to 81.5 points in August, its highest level since January 2008. The estimate stood at 79.6. After some weak manufacturing data earlier in the week, Richmond Manufacturing Index sparkled, soaring from -1 to +14 points. This crushed the estimate of -7 points and was the indicator’s best showing since April 2012. If US data continues to look good, we could see the dollar post further gains against the shaky Australian dollar.

The US Federal Reserve has been tightlipped about when it might taper QE, but the recent Jackson Hole summit provided a glimpse of the divisions in the Fed as to when it might act. Fed chair Bernard Bernanke was a no-show at the summit, giving other policymakers an opportunity to express their views on QE. Dennis Lockhart, head of the Atlanta Fed, said that tapering could start in September, but only if US data justified such a move. There was a more hawkish statement from James Bullard, head of the St. Louis Fed. Bullard said that there was no need for the Fed to rush into QE tapering. The uncertainty over QE tapering has buoyed the US dollar, raised the yields on US treasury bonds and led nervous investors to pull billions of dollars out of emerging markets. With September just around the corner, we could see strong volatility in the markets as speculation over QE heats up. AUD/USD" width="400" height="300">

AUD/USD" width="400" height="300">

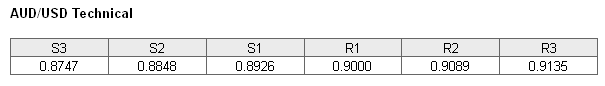

AUD/USD Technicals" title="AUDUSD Technical" width="605" height="86">

AUD/USD Technicals" title="AUDUSD Technical" width="605" height="86">- AUD/USD continues to lose ground in Wednesday trading. The pair dropped sharply in the Asian session, touching a low of 0.8904. I the European session, the pair dipped below the 0.89 line but recovered.

- AUD/USD is testing the 0.90 level on the upside. This is followed by stronger resistance at 0.9089.

- On the downside, the pair faces resistance at 0.8926. This is not a strong line, and could face pressure if the Aussie continues to sag. This is followed by support at 0.8848. This line has remained intact since January.

- Current range: 0.8926 to 0.9000

Further Levels

- Below: 0.8926, 0.8848, 0.8747 and 0.8578

- Above: 0.9000, 0.9089, 0.9135, 0.9221 and 0.9328

AUD/USD ratio continues to point to movement towards long positions. This is not currently reflected in the pair’s movement, as the Aussie has lost ground in Wednesday trading. The makeup of the ratio shows a solid majority of long positions, indicating that trader sentiment is strongly biased towards the Australian dollar reversing direction and posting gains against the US dollar.

The Aussie remains under pressure and is struggling to stay above the critical 0.90 line. With the US releasing key housing numbers later in the day, we could see some more activity from AUD/USD in the North American session.

AUD/USD Fundamentals

- 1:30 Australian Construction Work Done. Estimate 1.1%. Actual -0.3%.

- 14:00 US Pending Home Sales. Estimate 0.2%.

- 14:30 US Crude Oil Inventories. Estimate 0.5M.

*All release times are GMT

Original post