- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Aussie Shrugs as Business Confidence Falls, RBA Review Released

- Australian Business Confidence and Business Conditions fall

- RBA review calls for overhaul of central bank

- Governor Lowe says willing to continue

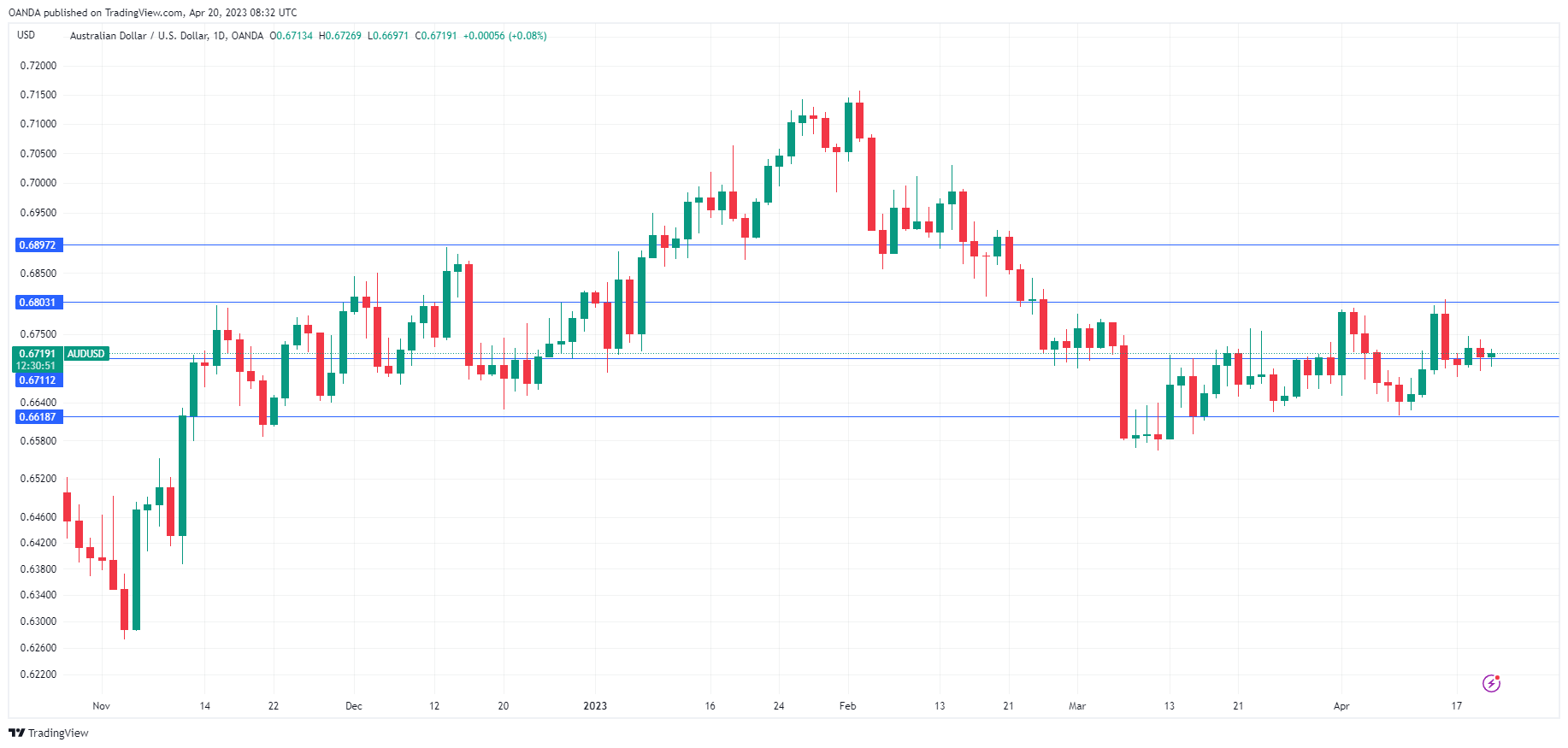

- There is resistance at 0.6803 and 0.6896

- AUD/USD is testing support at 0.6711. Next, there is support at 0.6018

AUD/USD is almost unchanged, trading at 0.6714

Australian Business confidence declines again

The NAB Business Confidence Index declined for a second straight quarter, falling by 4 pts. This missed the estimate of 2 and follows a Q4 2022 reading of -1. Business Conditions also dropped by 4 pts. The NAB found that businesses remain most concerned about wage growth and continue to report a shortage of workers. The good news was that supply chains have improved and there are expectations that inflation may have peaked.

RBA review calls for major overhaul of central bank

Australian Treasurer Chalmers released the findings of a review of the Reserve Bank of Australia today. The central bank last underwent major changes in the 1990s and the report had some 51 recommendations. The key suggestions include setting up a separate policy board, press conferences after each policy meeting and reducing board meetings from 11 to 8, in order to give households more time to react to rate decisions.

The changes are not expected to affect rate policy and the markets shrugged as the Australian dollar is drifting today. The report did not make any recommendations regarding the future of Governor Lowe, whose mandate expires in September. Lowe welcomed the report’s recommendations and said he would be happy to continue serving if ask to do so by the government.

Lowe has absorbed heavy criticism for the sharp rise in rate hikes after stating in 2020 that rising inflation was transient and the RBA would not raise rates for three years. This forecast was of course way off the mark and the RBA has raised rates some 350 basis points over the past year, which has weighed heavily on households as mortgage payments have soared.

AUD/USD Technical

Related Articles

The BOJ’s policy shift continues to strengthen the yen, keeping USD/JPY under pressure. Rising Japanese bond yields signal further tightening ahead, reinforcing the bearish...

U.S. economic growth fears mount as data disappoints, weighing on USD European data surprises fuel optimism, boosting EUR/USD Bond markets signal diverging growth outlooks for...

CHF/JPY Forex Strategy is Bearish: We are currently @ 166.78 in a range. If we can break slope support, we are looking for a continuation to the ATR target @ 165.97 area, with a...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.