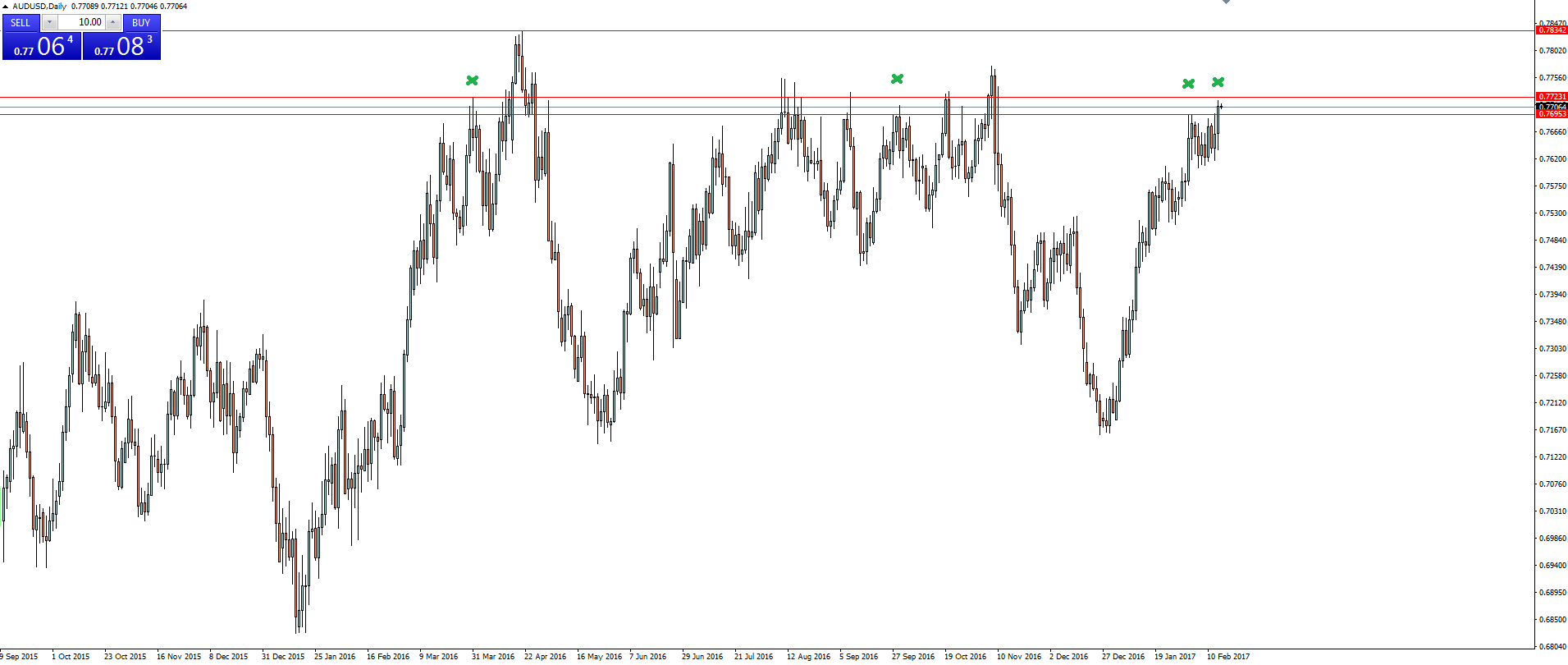

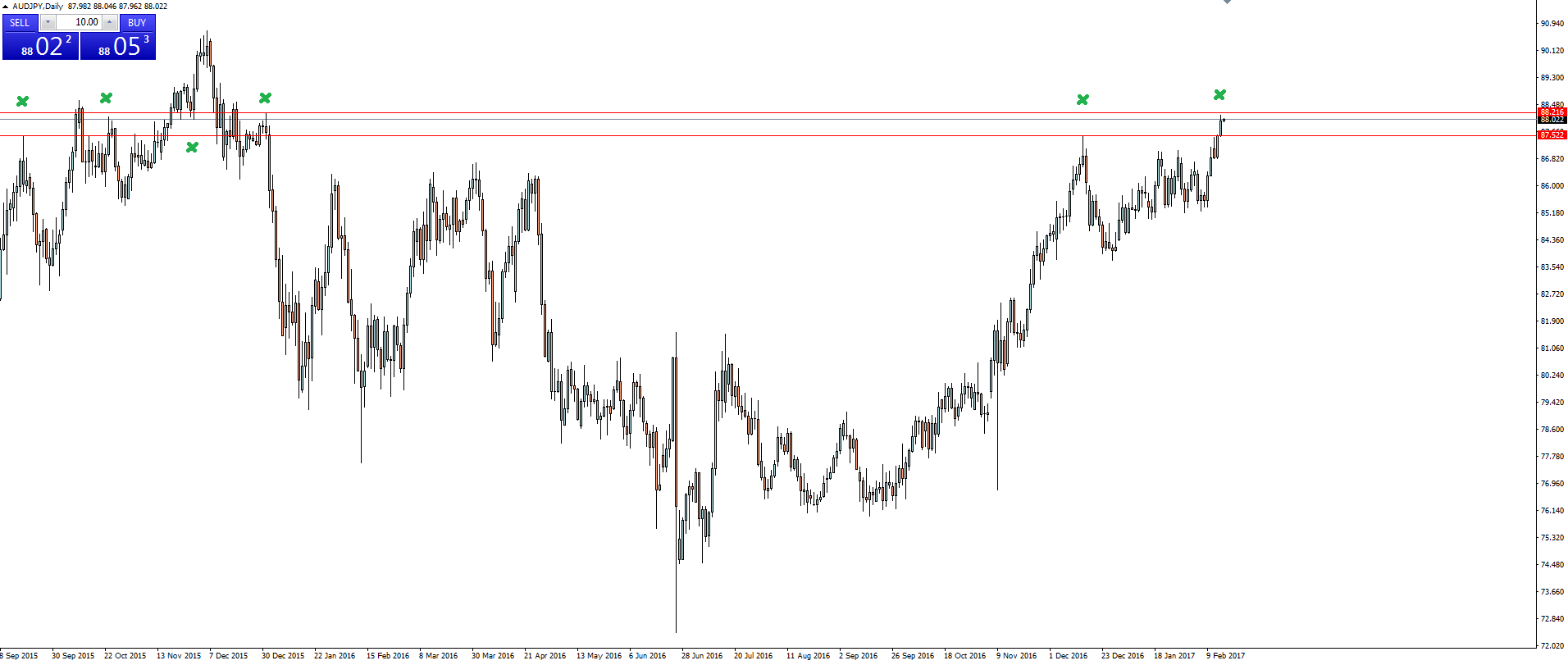

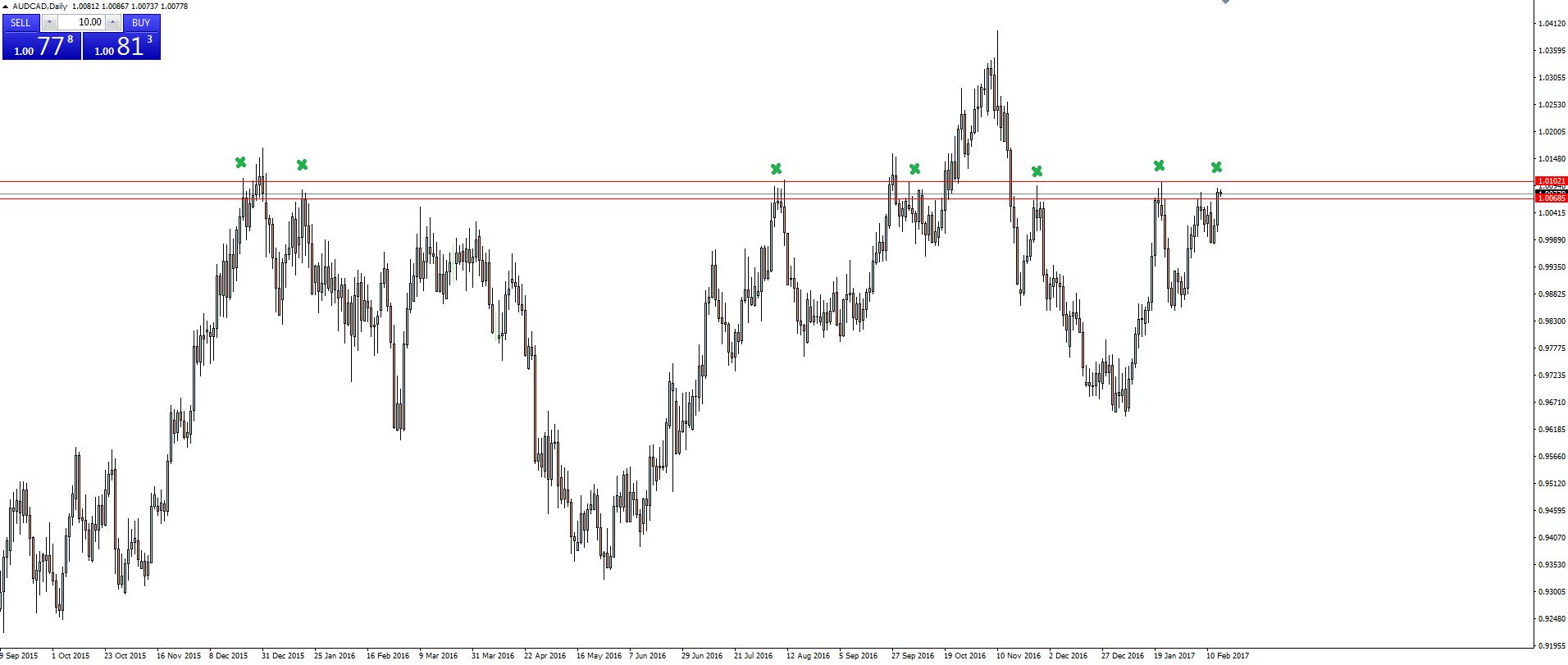

Taking a look at the daily charts across the AUD spectrum, we can see that almost all of the pairs are pushing into a clear daily resistance zone.

AUD/USD Daily:

AUD/JPY Daily:

AUD/CAD Daily:

If you’re an aggressive trader then you can sell as soon as price hits the zone, but for me there is no point jumping in front of a moving train and fighting momentum when you have no idea if it’s going to pull up or not.

From here the safest play is to wait and see if the higher time frame level holds, and then to sell any short term pull backs.

Just one final point that we can take onto the @VantageFX Twitter account, everyone has that one currency pair that they just can’t work the personality of and therefore don’t touch because they feel like every time they do, the trade goes against them. For me, this is anything Swissy (which you see I have casually avoided posting here!)

What’s yours?

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Australian forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, forex news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.