The Aussie can’t catch a bid and a key trend-line in AUD/USD is in play this morning. Meanwhile, sterling is trying to put up a fight after yesterday’s BoE inflation report.

The market is making a rather big deal out of strong Japanese growth data, but a look at the details suggests we need plenty more proof before we can call this the real deal. Nominal GDP growth was only +0.4 percent vs. the +0.9 percent headline as the GDP deflator came in at -1.2 percent YoY vs. only-0.7 percent in Q4. Nevertheless, the data will be peddled as a success for Abenomics, though the inconvenient truth is that this data was all from the anticipation phase of Abenomics, as the BoJ’s big move from early April is still only a few weeks old.

BoE Inflation Report

The release of yesterday’s Bank of England quarterly inflation report saw the BoE upgrading its language on the economy and moving forward the anticipated peak in inflation, which would look far better for sterling (with the huge assumption that the BoE can anticipate these variables accurately) than an environment of weaker growth and higher inflation. The release saw EURGBP diving back into the range well below 0.8500 and we may go on to test the 0.8400 support if the Euro remains on the defensive. If not, it’s a sign that GBP is weak indeed and if EURGBP heads back above 0.8500 – look out for a possible run to 0.8700+ there. I suspect that this will only cause a minor diversion in the GBPUSD sell-off, a diversion that may already be over with after yesterday’s attempt to rally beyond 1.5250 before the pair eased back lower again.

Aussie Melt-Down

The Aussie continues to just melt away almost across the board, posting new lows versus most of the rest of the major currencies this morning after yesterday saw gold slipping below 1400 dollars an ounce in yesterday’s trading. There was no specific catalyst to the selling, which is clearly about a reassessment of the global macro picture. There has been much talk about an end to the commodity super-cycle lately and of course, China’s economic transition and need to move away from commodity-intensive fixed asset investment as well as the possible blowup in some of the odd shadow financing schemes of recent years, which have included, for example, the use of huge copper inventories as collateral for loans.

AUD/USD

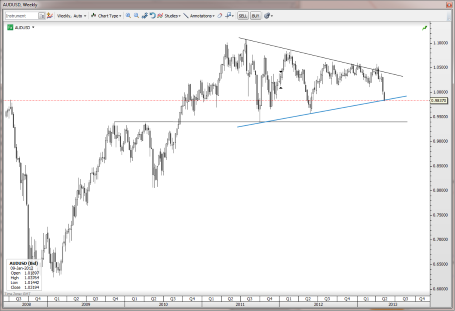

The big ascending trendline, or line of consolidation if you prefer, is in play this morning in AUD/USD. If this fails, we are possibly opening up for a run at the 0.9580 low of 2012 and even the major 0.9400 level from further back. The really big perspective is worth consideration here as AUD/USD has been in a very elevated range for a very long time and there are plenty of stale long positions that will be hurting worse and worse and liquidity may dry up as we head lower. AUD/USD" title="AUD/USD" width="455" height="311">

AUD/USD" title="AUD/USD" width="455" height="311">

Looking Ahead

For NOK crosses, watch for the Norway GDP report out this morning as we have a four-touch trend-line in play in EUR/NOK that could open up for a test of the 200-day moving average at 7.42 if the data proves supportive. I’m not a huge NOK fan further out, so any NOK strength could prove interesting for establishing USD/NOK long positions.

We’ve got a euro zone CPI data point out this morning which could help to underline the theme of deflationary risks in the euro zone. A bit before this and an hour later, two French debt auctions are on tap, though there have been virtually no signs of strain of late in EU debt markets at the periphery or the core, though there has been a general sell-off led by the USA on the anticipation that the Fed may be turning the QE battleship later this year.

On that note, remember that we had awful data out of the U.S. yesterday, with ugly industrial production and capacity utilization prints and a weak Empire manufacturing survey. The leading NAHB survey, however, suggested that the housing recovery is not flagging. Today we get the CPI data and the latest weekly jobless claims survey, with Apr Housing Starts and Building Permits up a bit later, as well as the Philly Fed survey. The weekly jobs survey will get lots of focus after the very strong readings of late and because it tends to lead the other jobs data.

Economic Data Highlights

- New Zealand Apr. Business NZ PMI out at 54.5 vs. 53.4 in Mar.

- Japan Q1 GDP out at +0.9% QoQ and +3.5% Annualized vs. +0.7%/+2.7% expected, respectively and vs. +1.0% Annualized in Q4.

- France Q1 Non-farm Payrolls out at -0.1% QoQ vs. -0.3% expected and -0.3% in Q4.

- Norway Q1 GDP (0800)

- Euro zone Apr. CPI (0900)

- Euro zone Mar. Trade Balance (0900)

- U.S. Fed’s Rosengren to Speak (1145)

- U.S. Apr. CPI (1230)

- U.S. Weekly Initial Jobless Claims (1230)

- U.S. Apr. Housing Starts and Building Permits (1230)

- U.S. Fed’s Fisher to Speak (1300)

- U.S. Weekly Bloomberg Consumer Comfort Survey (1345)

- U.S. May Philadelphia Fed Survey (1400)

- U.S. Fed’s Williams to Speak (1905)

- Japan Mar. Machine Orders (2350)

- New Zealand May ANZ Consumer Confidence (0100)