The dollar was lifted by strong consumer confidence data overnight, and remains firm in the Asian session. Meanwhile, the Aussie under-performed as the IMF lowered China's growth forecast. The fund cut China's 2013 GDP growth projection to 7.75%, down from 8.00%. 2014 growth is projected to grow at "about the same pace". IMF Deputy Managing Director Lipton said the lowered projection "comes essentially from looking at the global economy and the pace of growth in the global economy, and the demand that derives from that growth for Chinese exports". Meanwhile, he urged China to have "continued liberalization" and "reduced government involvement". He added that China needed "a decisive push to promote rebalancing" towards higher household incomes.

In the U.S., the better-than-expected domestic data sent 2 messages to the market. First, it assured that the U.S. economic recovery has remained on track. Second, encouraging economic data might give more confidence to the Fed to consider the reduction of QE measures. More growth data will be released alter this week, including the Q1 GDP revision and personal income and spending. But the more important data will be next week's ISMs and non-farm payroll.

The Canadian dollar also weakened against the dollar ahead of the BoC rate decision. The central bank is widely expected to keep rates unchanged at 1.00%. This meeting will be the last under governor Mark Carney, who will assumes the role of Governor of the Bank of England. Stephen Poloz will take up the post as BoC Governor next Monday. It's generally expected that BoC statement wouldn't deviate much from prior reports. There is also speculation that Carney will drop the not too meaningful tightening bias prior to his his departure, and will leave Poloz with a more neutral stance to start with.

On the data front, Japan retail sales dropped -0.1% yoy in April. Australia Westpac leading indicator rose 0.2% mom in March. German job data, CPI, Eurozone M3 and UK CBI reported sales will be featured.

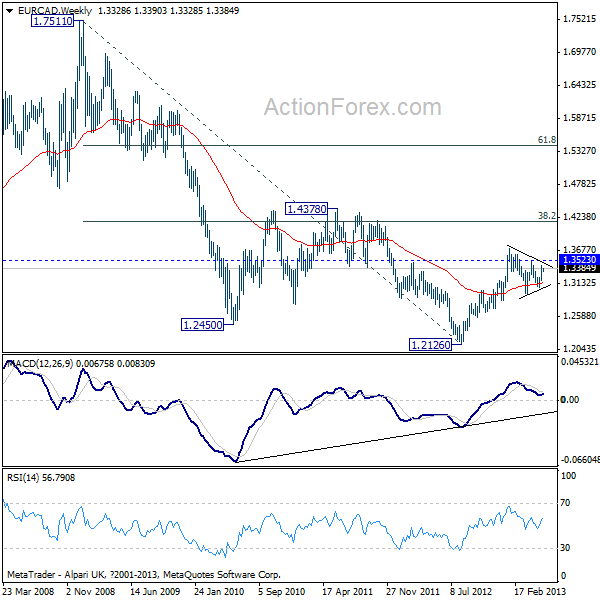

We talked about weakness in commodity currencies recently, mentioning the NZD/USD yesterday. Let's take a look at EUR/CAD today. The medium term rebound form 1.2126 halted after hitting 1.3708 earlier in January, and turned into sideway consolidations. The pattern looked like a triangle and the cross managed to hold depend 55 weeks EMA on various occasions. The development indicates that the rebound from 1.2126 isn't over yet. It could very well resume soon. The focus will stay on 1.3523 resistance, and a break there would strongly suggest that rise from 1.2126 is extending. In that case, the next medium term target will be a 38.2% retracement of 1.7511 to 1.2126 at 1.4183. EUR/CAD Weekly" title="EUR/CAD Weekly" width="600" height="600">

EUR/CAD Weekly" title="EUR/CAD Weekly" width="600" height="600">

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Aussie Lower As IMF Lowers China Forecast, BOC Watched

Published 05/29/2013, 05:06 AM

Updated 03/09/2019, 08:30 AM

Aussie Lower As IMF Lowers China Forecast, BOC Watched

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.