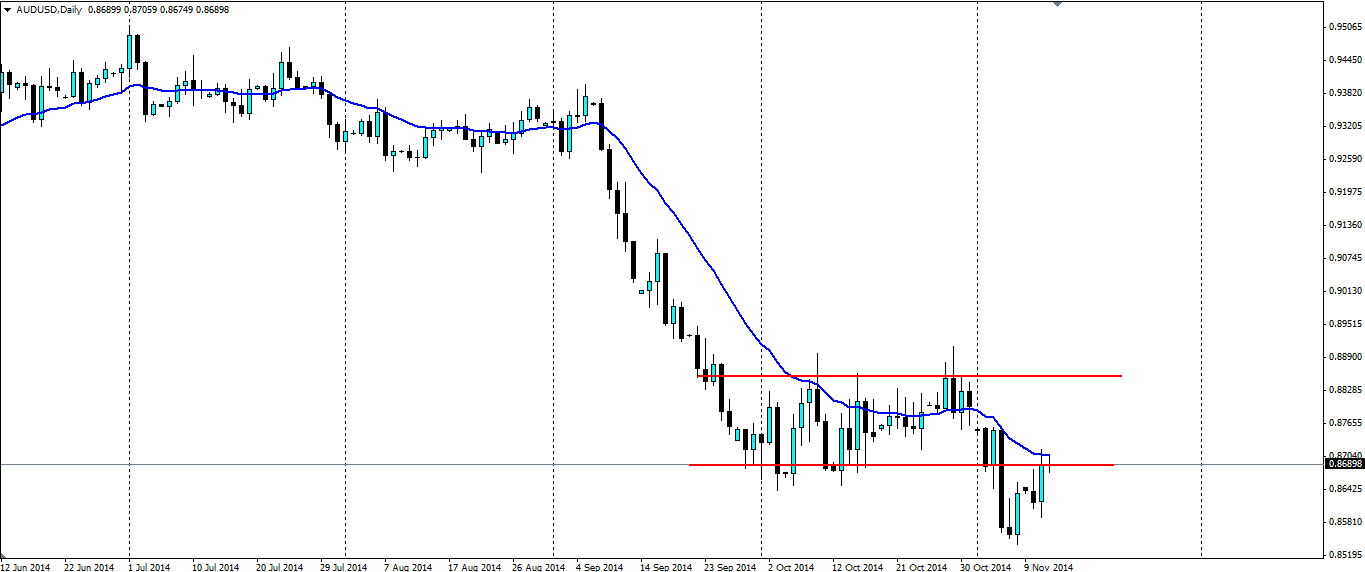

The AUD/USD has broken free of the ranging pattern it was stuck in for a month or so and now looks to use the previous support as resistance for a movement lower.

Source: Blackwell Trader

Fundamentally the US is in a strong position led by the labour market that continues to impress. US Unemployment has fallen to 5.8%, a level not seen since August 2008, and Nonfarm payrolls are giving consistent readings over 200k per month. Australia on the other hand saw the unemployment rate unexpectedly rise to 6.2% from 6.1% last week and the RBA is sitting firmly on the fence when it comes to interest rates. So it is no surprise to see the Aussie dollar break out of the range lower.

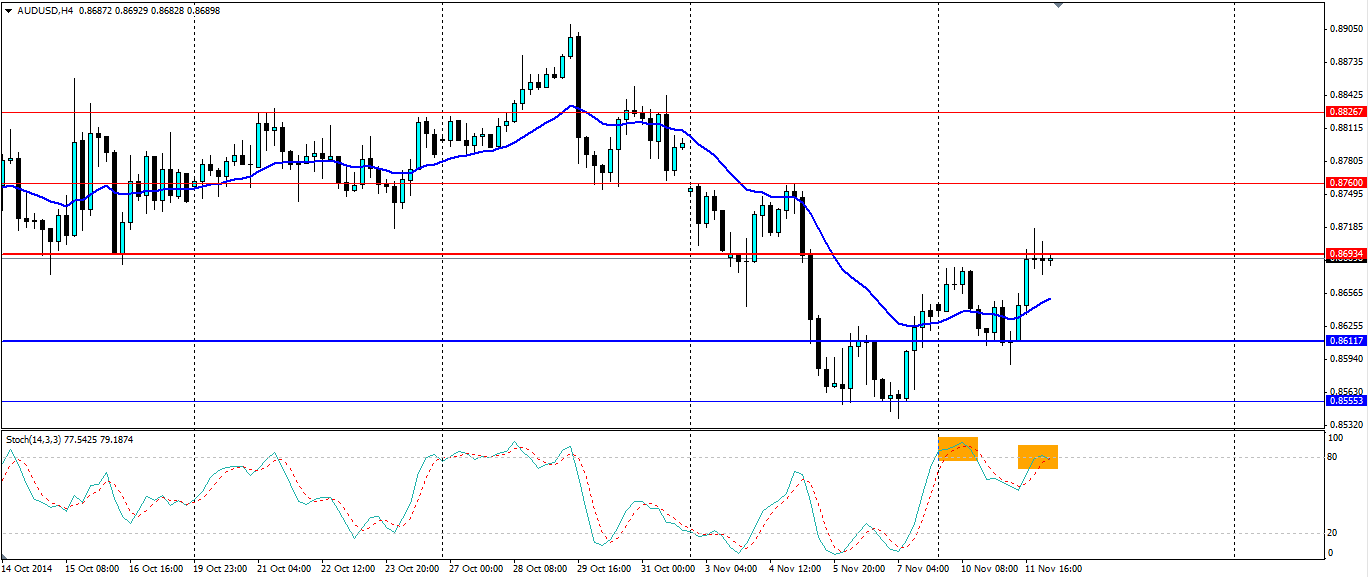

We have seen a sharp pull back towards the previous level of support that has reversed its role and now acts as resistance. Several doji candles with long upper wicks on the H4 chart below confirm that the resistance is holding and a potential reversal is on the cards.

Source: Blackwell Trader

If we look at the stochastic oscillator on the H4 chart we can see some clear divergence. The first highlighted high on the indicator is higher than the second high, despite the fact that the current high is higher on the price chart.

My only concern is the previous low is a higher low, potentially indicating that the bulls are back in with a sniff. For this reason I don’t see this trade as a long term one as the volatility will continue and could knock out stops before the low is breached. A short at the current level should target the recent low at 0.8611 with a potential eye on the bottom at 0.8555.

It would pay to keep an eye on the upcoming Chinese money supply and industrial production data due out tomorrow and the Aussie inflation expectations data due at the same time. From the US side keep an eye on US Unemployment claims, retail sales and consumer sentiment later this week.

A continuation of the trend on the AUD/USD pair may be forthcoming as the fundamentals point to this, however, the volatility will ensure the short opportunity that has presented itself is a short term trade.