Investing.com’s stocks of the week

The Australian dollar gained ground in early Tuesday trading, after the Reserve Bank of Australia left the official interest rate at the historic low of 0.75%. The Australian currency was also boosted by positive news emerging about the US/China trade war.

RBA Holds

The RBA left monetary policy unchanged, as expected, after the jobless rate dipped for the first time in seven months and inflation edged higher. RBA governor Philip Lowe stated:

“The low level of interest rates, recent tax cuts, ongoing spending on infrastructure, the upswing in housing prices in some markets and a brighter outlook for the resources sector should all support growth."

Dr. Lowe also cited the outlook for consumer spending as a concern:

"The main domestic uncertainty continues to be the outlook for consumption, with the sustained period of only modest increases in household disposable income continuing to weigh on consumer spending."

Trade Talks

Fresh signs of a brightening outlook for the US/China trade war have emerged, underpinning the US dollar and pressuring safe-haven currencies. The Financial Times reported on Monday that the US is considering dropping some tariffs on Chinese goods. On Tuesday, US Commerce Secretary Wilbur Ross stated that very good progress was being made towards completing a ‘phase one’ trade agreement with China. On a call with reporters, Ross stated:

“If we resolve phase one, that will calm people down a lot because they’ll see an end point is hopefully within sight...”

Technical Outlook

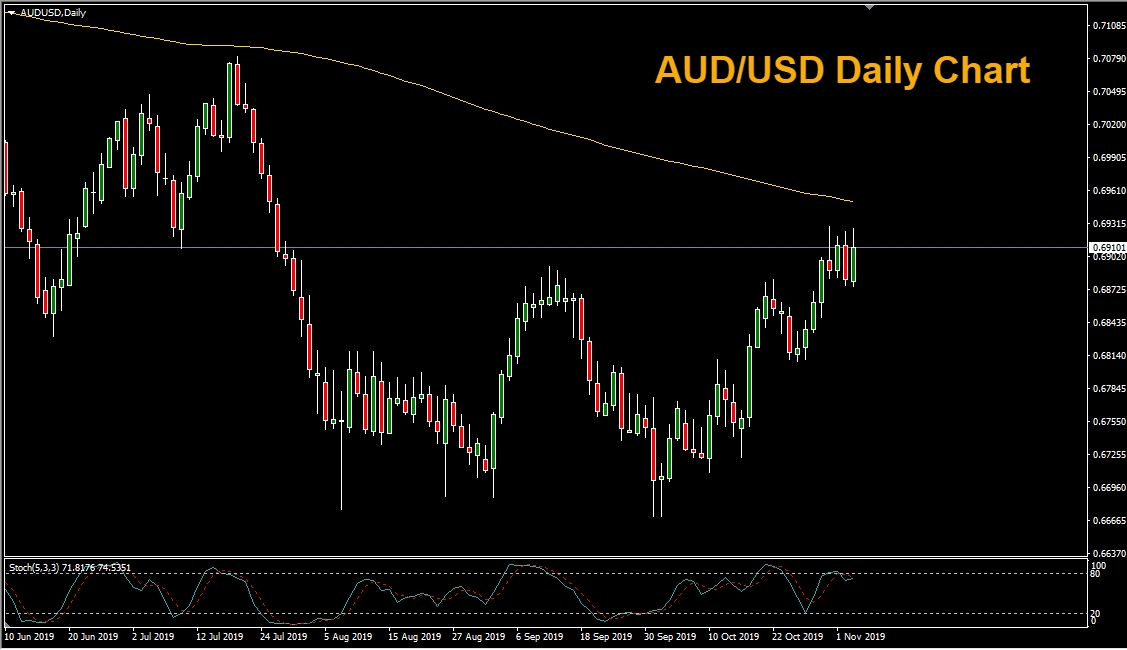

Looking at the AUD/USD daily chart, we can see that it neared its highest levels since late July. Resistance of the 200 period moving average currently lies overhead at 0.6950. Meanwhile, AUD/CHF and AUD/JPY soared to their highest levels since July, aided by the ‘risk on’ sentiment in the market.