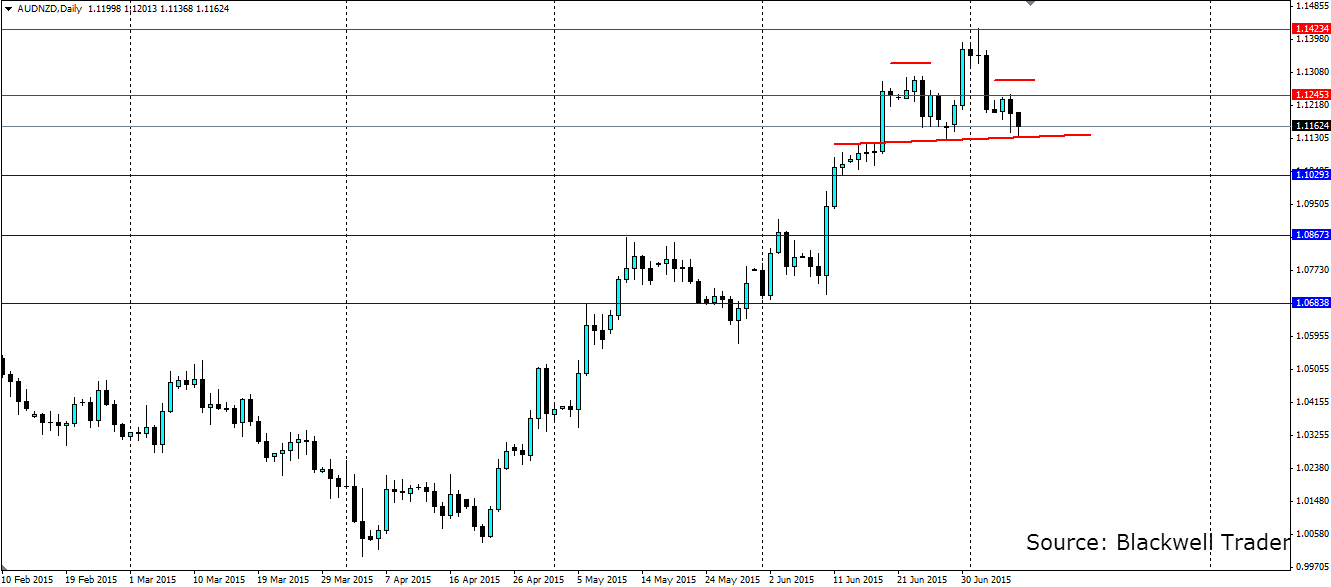

The AUDNZD has been following a strong bullish trend upwards as the kiwi falls out of favour, ahead of the upcoming interest rate decision on 22 July. However, a double top is forming that could signal an end to the upward trend.

The markets have decided pretty strongly that New Zealand is in for several more rate cuts this year, with the first scheduled for the 22nd July. Milk prices continue to deteriorate which is eroding NZ’s export earnings. This has led to the kiwi dollar depreciating against the Aussie in a strong trend that took the pair from close to parity, up as high as the 1.1400 mark.

The Aussie on the other hand is not faring much better. The rate cuts are not as priced in as the kiwi ones, hence the bullish sentiment, but there is certainly a possibility for more if the economy deteriorates further. The RBA has certainly not helped the Aussie by jawboning the currency lower at its most recent meeting, and predictions are for it to fall further.

The formation of a head and shoulders pattern is a sign that the market has priced in the rate cuts for the Kiwi dollar, and now it’s looking to price in any potential Aussie cuts. The neckline, currently around the 1.1131 mark is going to be a line in the sand that will determine if this structure plays out. The second ‘shoulder’ is lower than the first indicating that the momentum is shifting and the bears are gaining ground.

If we are to see a bearish trend form, watch for the support at the neckline to fail and for price to break through. We will likely see a pull-back to the neckline as traders take profits from the initial break, and if it holds as newly formed resistance, the bears will pile in and hammer the pair lower.

Watch for support to be found at 1.1029, 1.0867 and 1.0683 on the way down. If the neckline holds, watch for resistance at 1.1245 and the top of the structure at 1.1423.