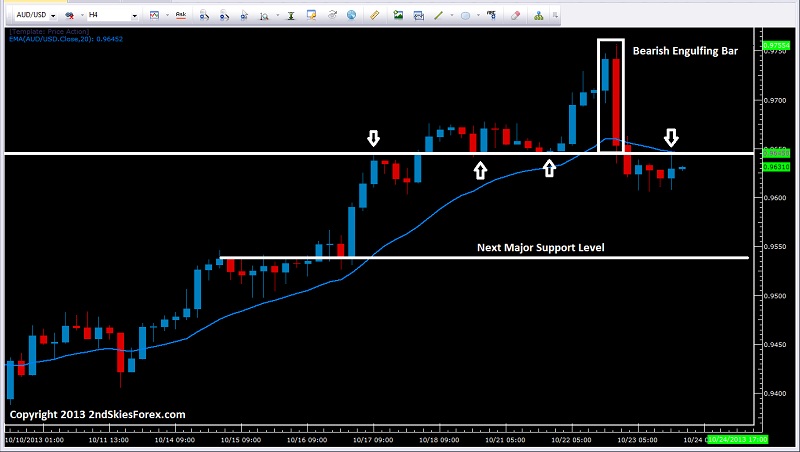

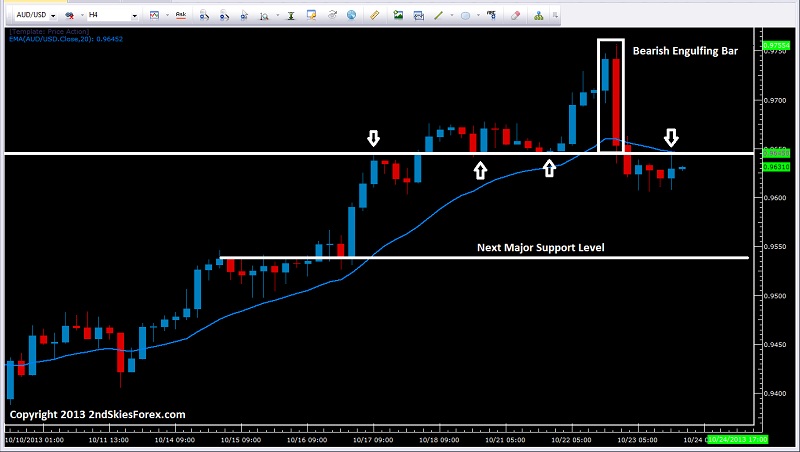

AUDUSD – First Round of Major Selling Since 9275

Climbing for 14 of the last 18 days, and 9 of the last 11, the Aussie sold off impulsively forming a bearish engulfing bar on the daily and 4hr charts. In doing so, it punctured below strong support at 9645 and has attempted to climb above it (failing thus far). I’m suspecting bulls long for this last 450 pip leg up have minimally taken some profit while sellers are gaining some confidence.

I’ll look for a corrective pullback towards the resistance zone between 9670 and 9703. If the rally fades in this zone, then I’ll look to get short, targeting 9615 and 9536. Although the medium/long term trends are up, this has dented the trend short term, so bulls should be on alert while bears may have a short term play here.

Original post

Climbing for 14 of the last 18 days, and 9 of the last 11, the Aussie sold off impulsively forming a bearish engulfing bar on the daily and 4hr charts. In doing so, it punctured below strong support at 9645 and has attempted to climb above it (failing thus far). I’m suspecting bulls long for this last 450 pip leg up have minimally taken some profit while sellers are gaining some confidence.

I’ll look for a corrective pullback towards the resistance zone between 9670 and 9703. If the rally fades in this zone, then I’ll look to get short, targeting 9615 and 9536. Although the medium/long term trends are up, this has dented the trend short term, so bulls should be on alert while bears may have a short term play here.

Original post