The Australian dollar continues to slide against the US currency, as the pair broke through the 0.98 line in Friday’s Asian session. The pair has fallen to the mid-97 range and shows no signs of finding its footing. The Aussie has had a miserable May, shedding a remarkable six cents since the start of the month. On Thursday, US releases were unimpressive, but the US dollar got a boost as a regional Federal Reserve Chairman said that the Fed could scale back its quantitative easing program as early as this summer. It’s a quiet end to the week, with the just three releases out of the US. The highlight is UoM Consumer Sentiment. There are no releases out of Australia on Friday.

The US released a string of releases on Thursday, but for the most part, the news was not encouraging. Core CPI posted a weak gain of 0.1%, missing the forecast of a 0.2% gain. Unemployment Claims had looked impressive in recent readings, but the key indicator slumped, as new claims jumped to 360 thousand, blowing past the estimate of 332 thousand. The Philly Fed Manufacturing Index dropped into negative territory, posting a reading of -5.2 points. The markets had expected a gain of 2.5 points. Housing Starts fell sharply, from 1.04 million to 0.85 million. This was well below the estimate of 0.98 million. There was some positive news, as Building Permits, which rose to 1.02 million, beating the estimate of 0.94 million. The disappointing numbers will again bring into question the health of the US economy, which has not been able to churn out continuous positive releases.

The beleaguered Aussie has been taking it on the chin from all corners. New Motor Vehicle Sales, an important consumer indicator, looked weak, and the budget release indicates that Australia will post a record deficit. The RBA has also contributed to the currency’s free-fall. The recent interest rate cut, which surprised the markets, pushed down on the Australian dollar. The central bank added more fuel to the fire when it stated in its Monetary Policy Statement that it expected “subdued” growth from the economy.

The US dollar has enjoyed some broad strength against the major currencies of late, in part due to speculation that the Federal Reserve might terminate its current round of quantitative easing, thanks to an improving employment picture in the US. On Thursday, John Williams, president of the Federal Reserve Bank of San Francisco, said that the Fed could begin reducing its quantitative easing program this summer and wind up bond buying late in 2013. As QE is dollar-negative, these remarks gave a boost to the US dollar. The markets will be all ears to what the Fed has to say, as comments about QE will likely have an impact on the currency markets.

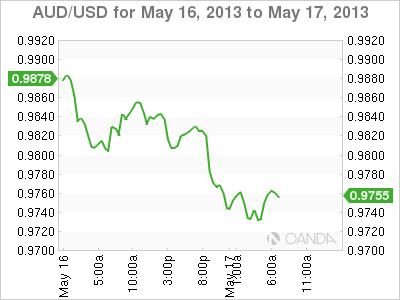

AUD/USD May 17 at 11:10 GMT

AUD/USD 97.56 H: 98.27 L: 97.28

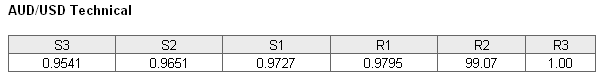

AUD/USD continues to fall, and is trading in the mid-0.97 range. The pair is receiving support at 0.9727. Given the sharp volatility we area experiencing, this line cannot be considered safe. The next support level is at 0.9651. On the upside, the pair is testing support at 0.9795. There is strong resistance at 99.07. This line has strengthened as the pair trades at lower levels.

- Current range: 0.9727 to 0.9795

- Below: 0.9727, 0.9651, 0.9541, 0.9405 and 93.28

- Above: 0.9795, 0.9907, 1.00 and 1.0080

AUD/USD ratio remains unchanged, continuing the trend we have seen all week. This is not reflected in the pair’s current movement, as AUD/USD continues to lose ground. With the strong activity we are seeing from the pair, we can expect the ratio to show some movement at any time.

The Australian dollar’s woes continue, as the currency continues to plunge lower and lower. We could see further activity from the pair during the day, as the US releases key consumer confidence data.

AUD/USD Fundamentals

- 13:55 US Preliminary UoM Consumer Sentiment. Estimate 77.9 points.

- 13:55 US Preliminary UoM Inflation Expectations.

- 14:00 US CB Leading Index. Estimate 0.3%.