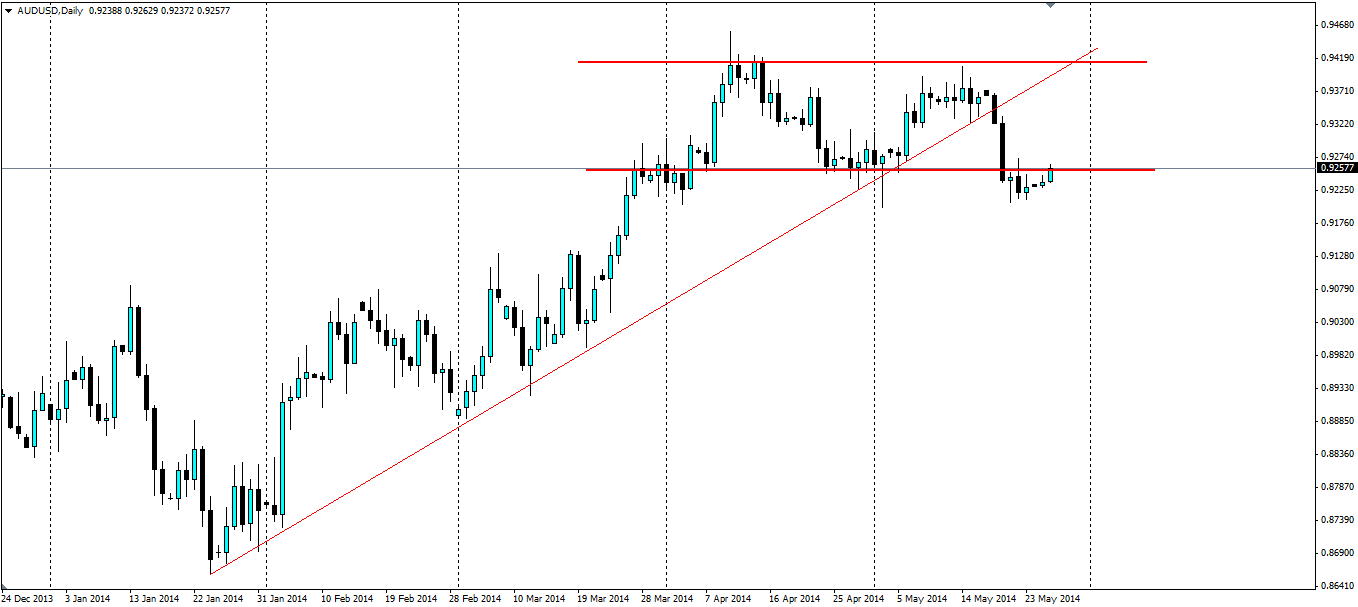

The keen eyed trader would have noticed that the Australian Dollar (AUD/USD) has formed a double top pattern and will also know how to take advantage of the upcoming bearish reversal.

The AUD/USD pair broke through the bullish trend line that was in play since mid-January when iron ore prices broke through the psychological US$100 mark and comments by the Reserve Bank of Australia (RBA) sent the price smashing through this line. The RBA released the minutes of its May 6th meeting when it held rates even at 2.5% and had the following to say: “The current accommodative stance of policy was likely to be appropriate for some time yet.” This signalled to the market that a rate rise is not likely to happen anytime soon.

Since then, the price has been testing the previous resistance/support line around the 0.9250 mark. If this resistance holds, then we will have ourselves a clear double top pattern which is a signal for a bearish reversal.

Source: Blackwell Trader

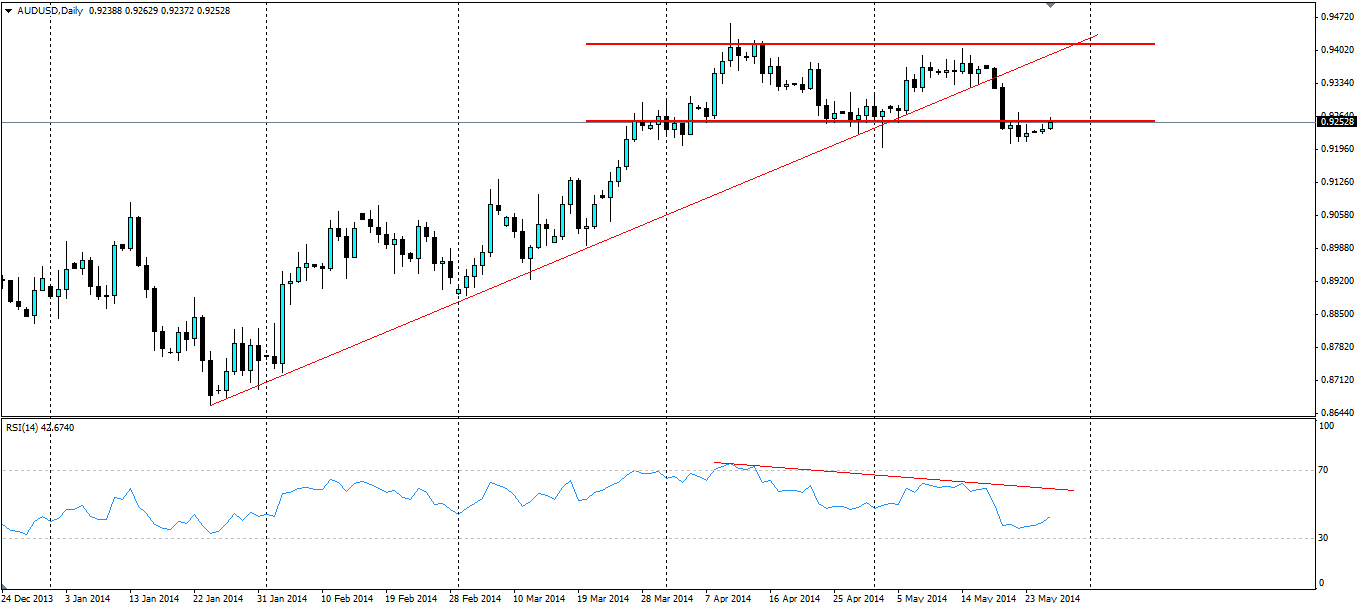

The RSI on the AUD/USD D1 chart has ticked back up as the price has tested the resistance at 0.9250 level, but is certainly on the bearish side of even. It has even formed a bearish trend of its own from the first peak of the double top pattern, indicating that momentum is turning bearish.

Source: Blackwell Trader

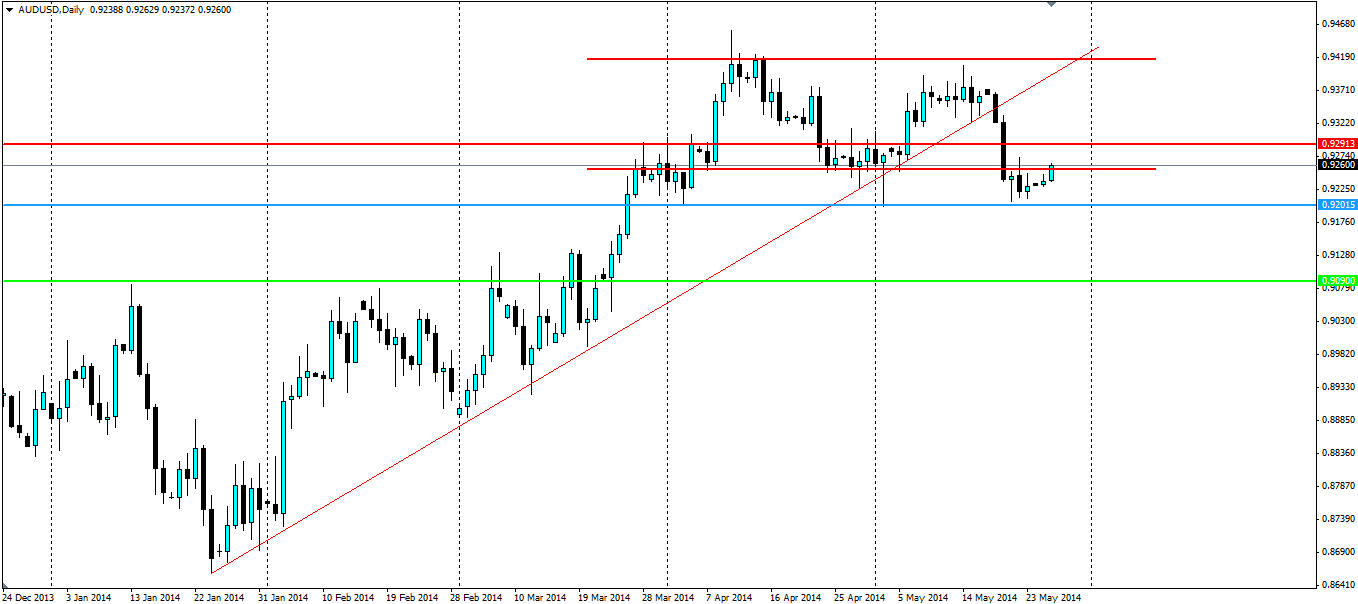

We can take all these bearish signals and build a trading strategy. The resistance at the current level should hold, therefore an entry can be placed to go short at the market price or even wait for a solid rejection off this level. A stop loss should be placed inside the channel just in case the resistance does not hold. Common wisdom suggests that our first price target should be the same distance away as the top of the double top channel. In this case, the channel is roughly 160 pips wide; therefore our first price target should be 160 pips below the bottom of the channel, or roughly in the 0.9090 region. This target should be actively managed according to individual traders risk requirements.

Source: Blackwell Trader

The Aussie Dollar (AUD/USD) has formed a double top pattern which is a clear bearish reversal of the current trend. The price should bounce off the current level of support and head down for a roughly 160 pip movement.