Australian dollar extends recent down trend and reaches new four year low against dollar after GDP disappointment. Q3 GDP grew 0.3% qoq versus expectation of 0.7% qoq and slowed from Q2's 0.5% qoq. Yoy growth was unchanged at 2.7%. Looking at the details, one aspect to note is that real net national disposable income contracted for the second quarter in succession, and shrank -0.3%, after -0.2% in Q2. Economists noted that weak income growth will continue to weigh on corporate profits and public income, which would then flow back into consumer spending and investments. Meanwhile, the weak data might bring the possibility of further rate cut back into RBA's considerations. The central bank left rates unchanged at 2.50% earlier this week.

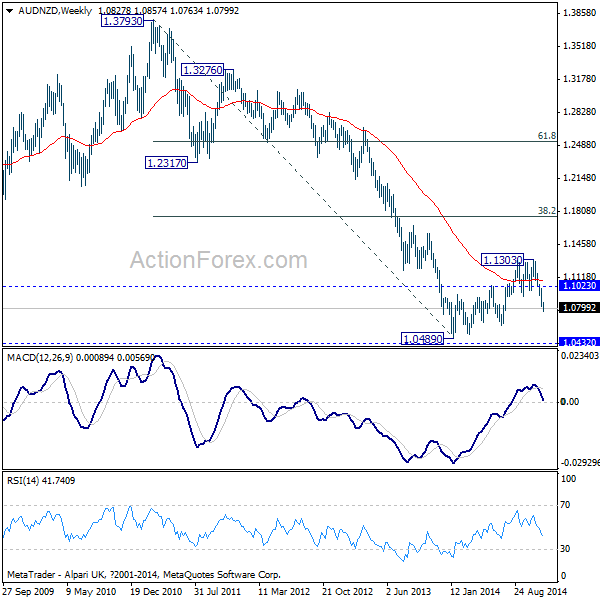

Aussie remains the weakest currency against other commodity currencies. As discussed AUD/NZD's recovery from 1.0489 should have completed at 1.1303 already. Later down trend from 1.3793 might be resuming. Fall from there extends to as low as 1.0763 so far this week. Near term outlook will stay bearish as long as 1.1023 minor resistance holds and deeper decline should be seen to 1.0489 support and further to 2005 low of 1.0432.

AUD/CAD also stays soft and is heading back to last week's low of 0.9566. We'd mentioned before that the rejection from 55 weeks EMA is taken as a sign of weakness. And, current decline from 1.0349 should extend to 0.9410 support next. Break there will likely resume the whole decline from 1.0784 to 0.9169 support and below. In any case, outlook will stay bearish as long as 0.9986 resistance holds.

Looking ahead, BoC rate decision is a major focus today. Recent developments in Canada's economy have been encouraging. Headline CPI accelerated to 2.4% in October from 2% in September. BOC's estimate of core CPI rose to 2.3% from the same period last year, compared with 2.1% in September. Canada's GDP rose 0.7% q/q in 3Q14. From a year ago, growth came in at an annualized pace of 2.8%, down from an annualized 3.6% in the second quarter. Nominal GDP rose by an annualized 4.7% in 3Q14, up from 3.9% in the prior quarter. The job market has been improving. Addition of 43.1K to the total number of payrolls, the unemployment rate fell to 6.5% in October, the lowest since November 2008. That being said, the BOC is likely to keep rates unchanged in December while acknowledging the pick-ups in the economy. On rising inflation, the BOC would suggest that higher inflation is a result of transitory effects and caution that lower oil prices would be negative for the economy.

Elsewhere, services data will be another main focus. UK will release services PMI and is expected to rise to 56.5 in November. Eurozone will release services PMI final and retail sales. US will release ISM non-manufacturing as well as non-farm productivity revision. Fed will also release Beige Book economic report.