I believe the risk vs potential reward of being long the Aussie dollar is skewed the right way at present.

The Currency markets have been particularly volatile since the JPY/USD broke par on Thursday at 1pm Chicago time.

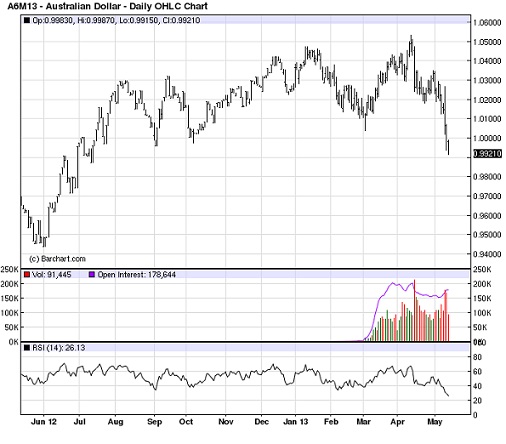

I would advocate for a Long future in the Aussie dollar (ADM13) at 99.20 based on technicals (it appears oversold) as well as my belief that the Energies/Metals are likely to be well supported via easy global monetary policy). The Royal Bank of Australia cut rates to 2.75% last week which is interpreted as a sign of spreading weakness from China.

I would recommend a STOP at 98.50 which is below the August 2011 lows (following the US Debt downgrade).

Risk (not including frictional costs) would be $700.

Target an exit at 101.00. In essence, 2.5 to 1 on risk. ($700 v. $1,800).

Option types could consider SELLING the WEEK 4 (May 24th expiration) 98.50 puts for 45 ticks. Collect $450 less frictional costs. Risk a "synthetic" long future at ~ 98.05. Trade around that position post expiration.

Shorter term look at the chart:

The last time the Aussie was 99.20 - the S&Ps were 300 points lower. Perhaps an unfair comparison, but if China comes off the rails (which I don't believe happens with their form of "controlled/massaged Capitalism") then everyone suffers.