In typical Australian fashion, the Aussie has continued to rally despite facing significant adversity. Just like the “little Aussie Battler”, the pair has fought higher to trade within a nice bullish channel, supporting its moves. However, the beer keg has just run dry, and the “little Aussie battler” is about to find himself in front of a closed pub, and with the prospect of heading home to face the wife.

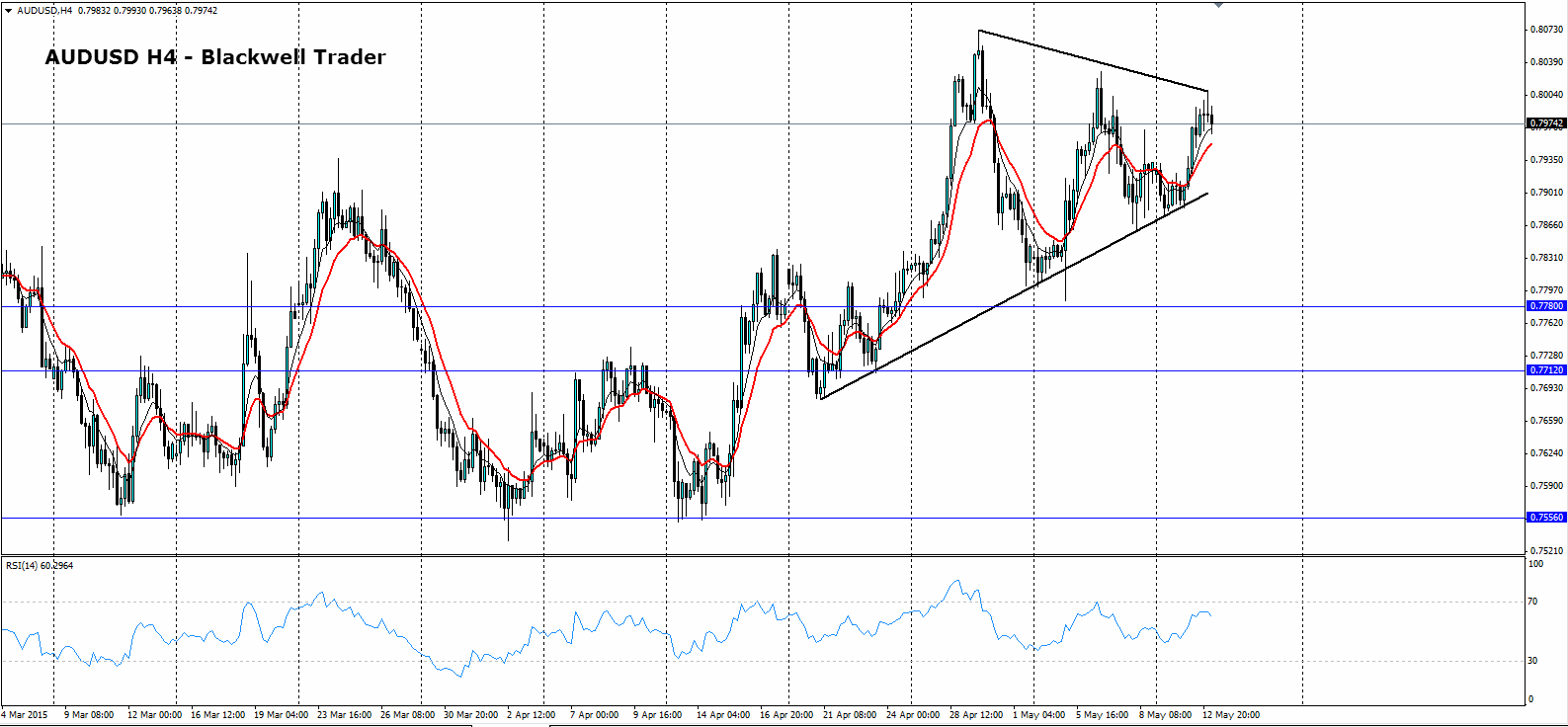

In recent days, the pair has rallied to the top of a newly formed wedge pattern, with its highs becoming lower, signalling that a short-term reversal might be on the cards. The H4 charts show a range of Doji candles at the top of the rally, lending some support to the reversal proposition. RSI is still within neutral territory but appears to be in the early stages of moving lower.

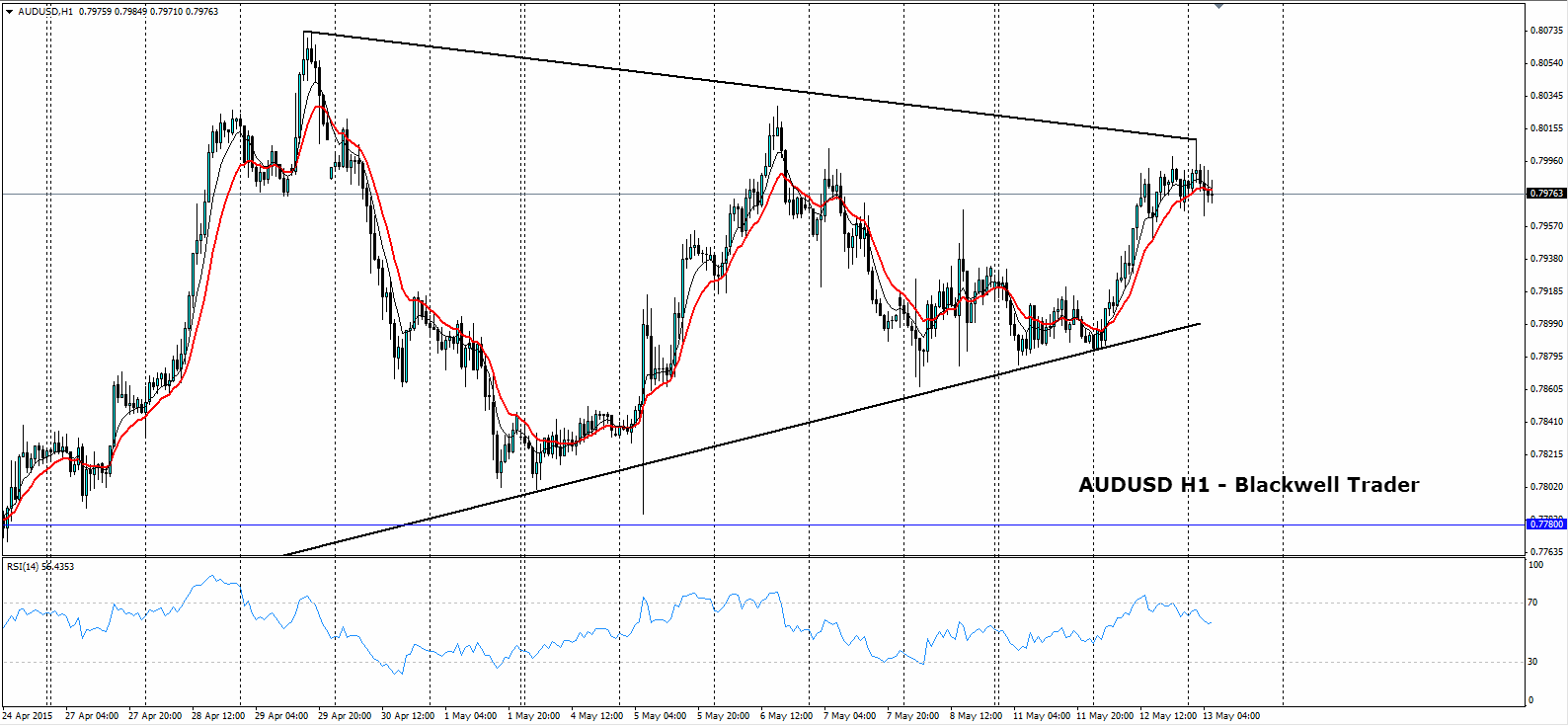

Looking at the hourly chart, it shows the 6SMA and 12SMA converging and seeking a cross, signalling that momentum is shifting from the current bullish run. A pin bar has also formed, touching the top of the wedge, providing further weight to a short bias. Over the coming days, price action is likely to consolidate as pressure builds for a definitive move

From a fundamental perspective, the Australian economy has suffered recently with both softening macroeconomic data along with a ballooning budget deficit. Subsequently, the RBA has sought a looser monetary policy, through rate cuts, in the hope of stimulating some spending. Australia has also felt the worldwide decline in commodity prices, and in particular, China’s cooling demand. However, the pair has been supported by the historically low world-wide interest rates, which have sought to create a differential that is supporting the currency pair.As long as this differential exists, the Aussie is likely to find support at lower levels regardless of the technical aspects.

Ultimately, wedge patterns can be difficult to predict, but in assessing the variables, I am of the view that a retracement on the short side is a very real prospect. The pair will need to break lower, beyond the support bullish trend-line to confirm a move back towards the key 0.7900 level. Any fall below this key support could see the pair tumble back towards the daily swing candle at 0.7785, and then, Bob’s your uncle!