The Australian Dollar has seen a roller coaster of volatility in the past few months as the pair whipsawed within a 350 pip range. However, despite the recent declines, the AUD finally looks to have discovered a bottom and is subsequently readying for a sharp retracement.

Since August, the venerable pair has traded between 0.6925 and 0.7383, with the smart money playing reversals from the range. Monday, yet again, saw the AUD/USD approach and reverse from the bottom of the channel and a definite retracement now appears to be in progress. Further supporting the rise was a buoyant Chinese trade balance which rose to 60.1B from the previous result of 54.1B.

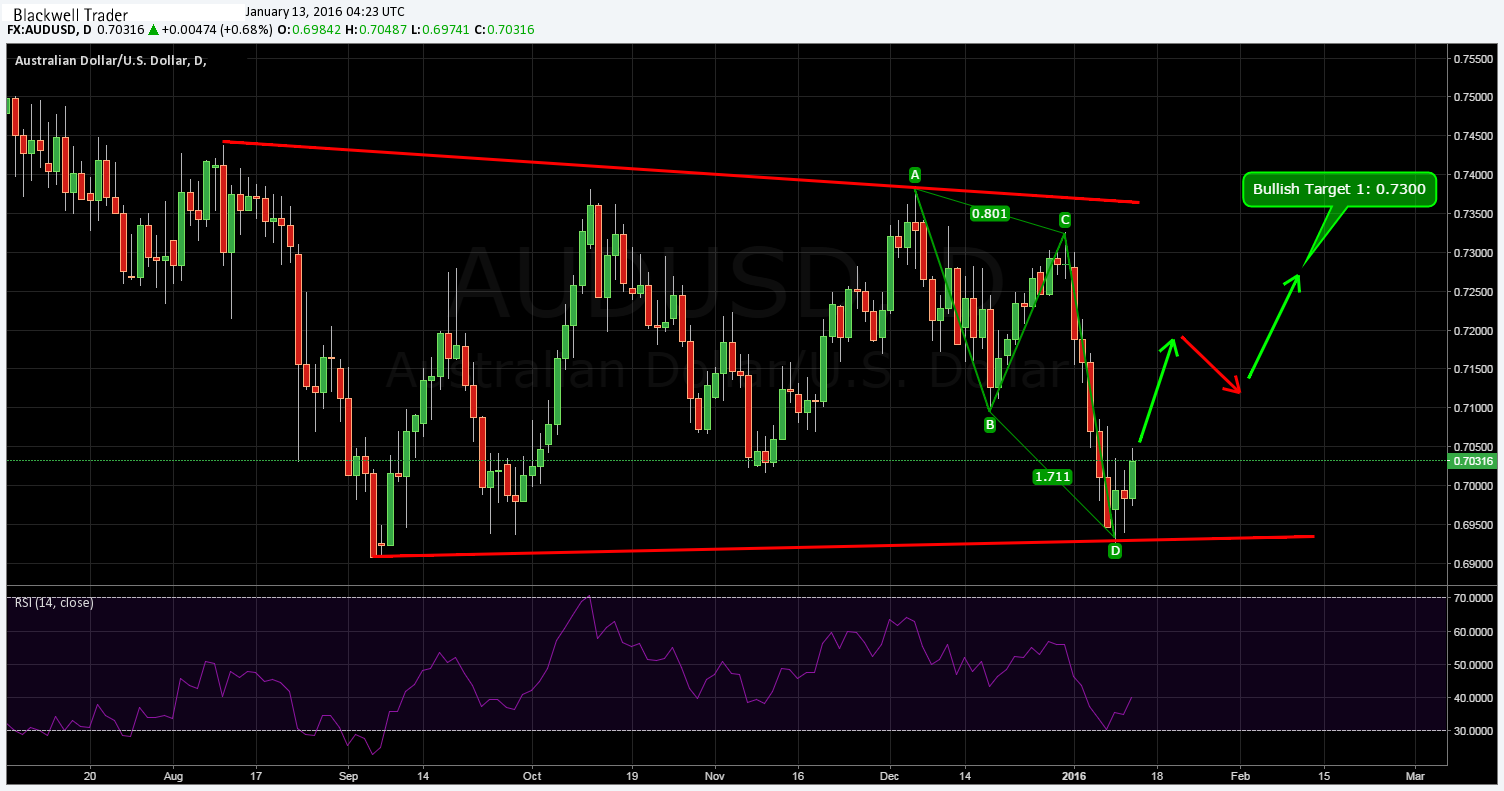

From a technical analysis viewpoint, the pair continues to be supported by a relatively strong channel that is constraining its price action within a wide range. Price action is currently depressed within the lower bounds of the channel whilst a retracement appears to be occurring. In fact, a strongly bullish signal has appeared on the daily chart as the AUD appears to have just completed an ABCD pattern.

In addition, an analysis of the RSI oscillator shows the key indicator having exited oversold territory as it ticks upwards in a signal of things to come. Stochastics adds to the argument for a long side move as the indicator is trending higher after also having exited reversal territory. Given the AUD’s location, relative to the bottom of the channel, the risk reward ratio for any long biased trade is advantageous.

However, some major fundamental news looms upon the near term horizon, as the Australian and US Unemployment Claims figures fall due this week. Subsequently, be weary of any surprises that those data points may contain.

Ultimately, to cement a move higher, the pair will need to surmount a minor support/resistance swing point at 0.7100 as well a strong swing candle at 0.7287. The pair’s intermediate target falls around the 0.7300 mark but any further moves above that level would require some significant fundamental or technical drivers.

Subsequently, enjoy the short term bullish romp but know that as the top of the channel nears that the bears will gather once again.