Talking Points:

- Aussie, NZ Dollars Rise as Markets Await Australian Budget Announcement

- British Pound May Not See Follow-Through on Industrial Production Data

- US Dollar Looks to Fed-Speak to Drive FOMC Interest Rate Hike Outlook

The Australian Dollar outperformed in overnight trade, rising as much as 0.6 percent on average against its leading counterparts. The move tracked an advance in Australia’s front-end bond yields, pointing to firming RBA monetary policy expectations as the catalyst for the advance. Bets on higher borrowing costs were likewise telegraphed in the equities space, where financial shares led Australia’s benchmark S&P/ASX 200 stock index upward even as most Asian bourses traded lower.

The upward shift in investors’ RBA outlook may reflect pre-positioning ahead of today’s announcement of the federal budget for the fiscal year ending June 2016. A survey of economists polled by Bloomberg projects a deficit of A$40 billion, an increase from a December estimate calling for a short-fall of A$31.2 billion. The budget may mark a departure from a focus on austerity previously championed by Prime Minister Tony Abbott. The markets may have interpreted a turn toward a growth-focused fiscal policy approach as reducing the future need for further easing on the monetary side of the equation.

The New Zealand Dollar likewise advanced, pacing its Aussie counterpart to score an 0.4 percent increase against the majors. Australia is the island nation’s largest trade partner and the prospect of a more accommodative government spending plan may have been seen as underpinning cross-border demand. That in turn could have positive spillover for New Zealand’s own economic growth and possibly limit scope for RBNZ interest rate cuts.

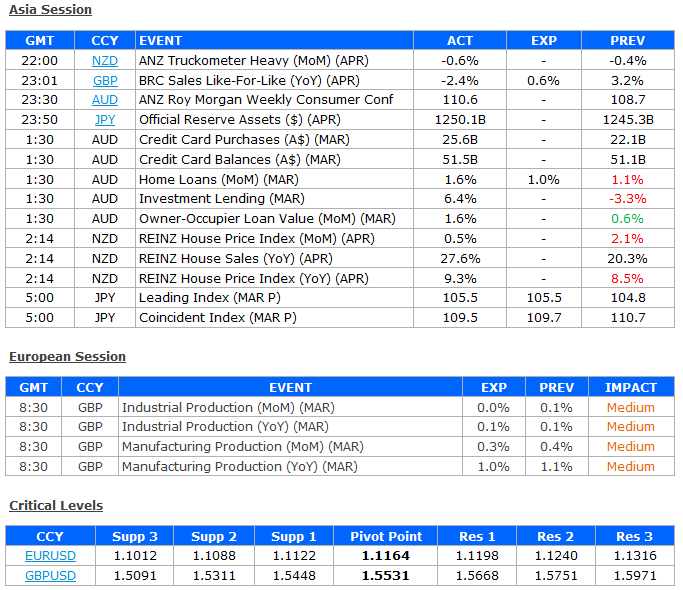

Looking ahead, UK Industrial Production figures lead the data docket in European trading hours. Output is expected post a 0.1 percent year-on-year increase in March, matching the 20-month low recorded in February. While a soft result may weigh against BOE rate hike speculation, follow-through from the British Pound seems unlikely as traders withhold directional commitment ahead of the release of the central bank’s quarterly Inflation Report on Wednesday.

Later in the day, Fed-speak will enter the spotlight as scheduled commentary from New York and San Francisco Fed Presidents Bill Dudley and John Williams (respectively) cross the wires. Both policymakers are currently members of the rate-setting FOMC committee and tend to lean on the dovish side of the spectrum. Rhetoric hinting the Federal Reserve may move relatively slower to issue its first post-QE interest rate hike is likely to weigh against the US Dollar (and vice versa).