- The post FOMC-rally for the USD brought on a dip in the AUD

- But it is still above most estimates of its fundamental value

- The Reserve Bank of Australia is talking down the AUD

The main take out from the Federal Open Markets Committee meeting yesterday was this again: Don’t fight the Fed. Rates are to stay low for a “considerable period” after the asset buying program ends next month. USD bulls read into the Summary of Economic Projections that when rates do rise, the increase will be at a sharper pace than had been priced in. This provoked an across the board USD rally, taking AUDUSD down to .8960.

The question now is: where to from here for Australia’s exchange rate? To answer this question is it important to point out that the “exchange rate” is more than just the AUDUSD. It is the trade-weighed index (TWI) of the AUD against all of Australia’s trading partners. In order of importance these partners are: • China 25% • Japan 13% • US 10%

• the European Union 9%

RBA view

The Reserve Bank of Australia continues to talk down the currency.

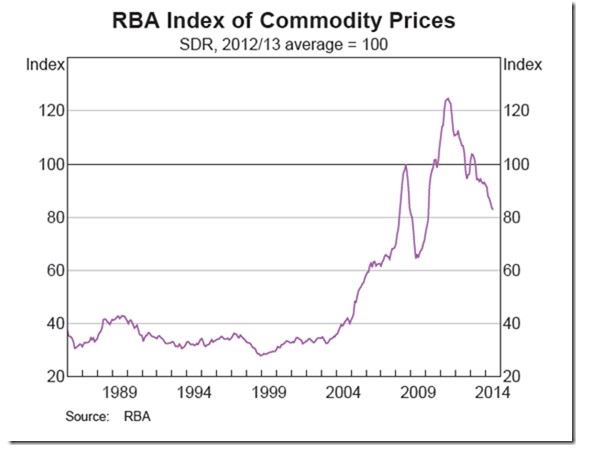

On Wednesday the RBA issued the minutes from its September 2 monetary policy meeting. This was the RBA's assessment of the currency: "The exchange rate remained above most estimates of its fundamental value, particularly given the decline in commodity prices and, overall, has offered less assistance to date than would normally be expected in achieving balanced growth in the economy".

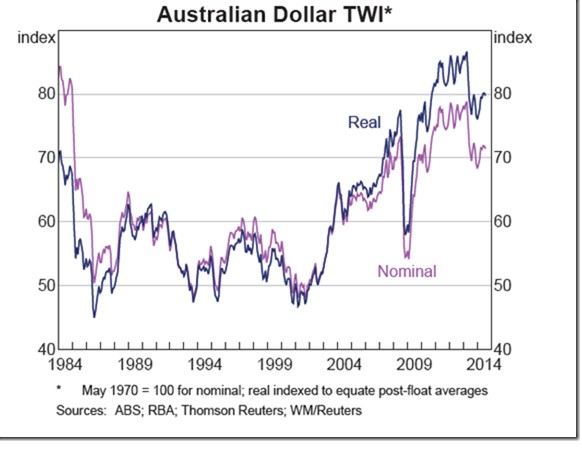

When the central bank describes its currency as being above its fundamental value, it is coming from a different perspective than short-term traders. Firstly it means the overvaluation is of a magnitude of 10% at least. Secondly, the fundamental value of the exchange rate is measured not by a single cross rate, but against those of Australia’s major trading partners. This is referred to as the nominal effective exchange rate, or the trade-weighted index.

Adjusting the nominal index for movements in inflation between Australia and the countries it trades with gives the most accurate measure of “fundamental value” of the AUD. It is called the real effective exchange rate or the real TWI. This is the measure the RBA monitors most closely.

Australia’s inflation rate has been running ahead of that of the major economies in recent years, so the real exchange rate has been pushing higher, as demonstrated in the Australian Dollar TWI chart.

Loss of competitiveness

Loss of competitiveness

The Australian economy is becoming uncompetitive.

A rising real exchange rate means Australia has been losing its competitiveness in the global market place. This is what concerns the RBA, because the failure of the currency to decline means it “has offered less assistance to date than would normally be expected in achieving balanced growth in the economy”. This assistance is crucial to transitioning the economy from an over-reliance on the mining sector to a broader based expansion.

The potential danger to the Australian economy is shrouded at the moment, because a decade of strong mining investment is now maturing into a surge in mineral exports. But prices are declining and the terms of trade are following them down.

A substantial decline in the exchange rate is required to ameliorate the effects of the winding down of the mining investment boom.

Since the TWI peaked in March 2013 it has declined by 12%. But commodity prices have fallen over 30% as shown in the RBA Index of Commodity Prices chart.

TWI and price disconnect

TWI and price disconnect

This disconnection between movements in the TWI and commodity prices was noted by the RBA.

On the surface, the Aussie dollar has been under pressure of late. Since July 1, when the AUDUSD hit USD .95, it has fallen about 6%, as has the AUDCNY (not surprisingly, because the Chinese currency tracks the US dollar). But the AUDJPY and AUDGBP have risen slightly and AUDEUR is little changed, the net effect being the overall decline in the TWI is not much more than 3%.

This means that the AUD is still above most estimates of its fundamental value, and “not just by a few cents”, as RBA governor Glenn Stevens has noted previously.

Other factors are conspiring against the Aussie. The interest rate differential has halved in the past two or three years, as shown in the Differential between Australian and US 10-year Government Bond Yields chart.

So the chances are there is substantial downside potential in Australia’s trade-weighted index. This won’t necessarily all come via the AUDUSD, but given the combined weighting of the US and China in the index, any significant adjustment to the exchange rate will have to involve the USD. However, the AUDJPY and the AUDEUR will also be worth keeping an eye on.