The Australian dollar has found a slight bit of support after posting a 6 year low recently. This has resulted in a consolidation that is likely to break lower and continue the bearish trend.

The minutes from the most recent Reserve Bank of Australia Monetary Policy meeting were released and show the RBA considered a rate cut but decided to hold off and wait for more data. They are looking to see if the previous rate cut will have the desired effect on the economy. The RBA went on to add, "We're of the view that a case to ease policy further might emerge", which suggests they are at the ready to cut again.

On the currency side of things the RBA said: “Although the Australian dollar had depreciated, particularly against the US dollar, it remained above most estimates of its fundamental value, particularly given the significant declines in key commodity prices”. The market is likely to take an overall bearish view of this comment and indeed the statement as a whole.

Looking ahead, the outlook for the Australian dollar is rather negative, especially with a central bank sitting with its finger on the rate cut trigger. This week will be relatively quiet from Australia with only a speech by RBA Governor Stevens at the end of the week. From the US side is a different story with the FOMC likely to pile on the volatility later tomorrow.

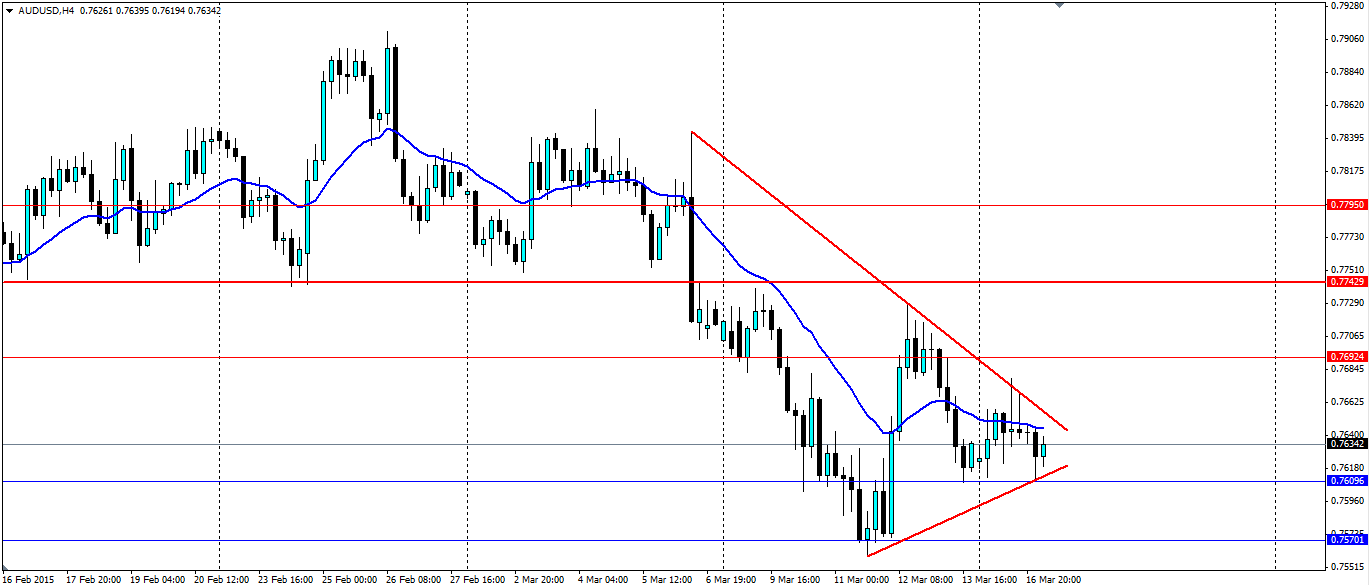

Leading up to the statement the Australian dollar had been forming higher lows and lower highs as it consolidated under a two week old bearish trend line. The consolidation is likely to lead to a breakout lower and a continuation of the trend.

If we do see a breakout lower, look for the support at 0.7609 to fail, confirming the breakout. The next level of support will be found at the recent 5 year low at 0.7570 with 0.7501 further on. If the Australian dollar finds some strength (or the US dollar weakens thanks to FOMC), an upside breakout will find resistance 0.7692, 0.7742 and 0.7795.