The Australian dollar dropped sharply as the RBA unexpectedly cut rates by another 25 bps to 2.75% today. Markets generally expected the central bank to stand pat. In the accompanying statement, the RBA noted that the inflation outlook afforded scope for further easing to support demand, and the board "decided to use some of that scope" to encourage "sustainable growth in the economy, consistent with achieving the inflation target". It should be noted that the statement somewhat implied that there is still some more "scope" for further easing should the economic outlook worsen. Other data from Australia saw a wider than expected trade balance at AUD 0.31b in March. The house price index rose much less than forecast, at 0.1% qoq in Q1.

Technically, the AUD/USD dropped through 1.0220 support to resume last week's fall from 1.0581. Such a decline should now extend to 1.0115 support in the near term. The EUR/AUD is limited below 1.2887 so far, in spite of today's rally. The near term outlook stays bullish for another high above 1.2887 to extend the rebound from 1.2218. The GBP/AUD broke last week's high to the recent rebound from 1.4380. The AUD/JPY, which is the relatively weak yen cross, is heading back to 100.

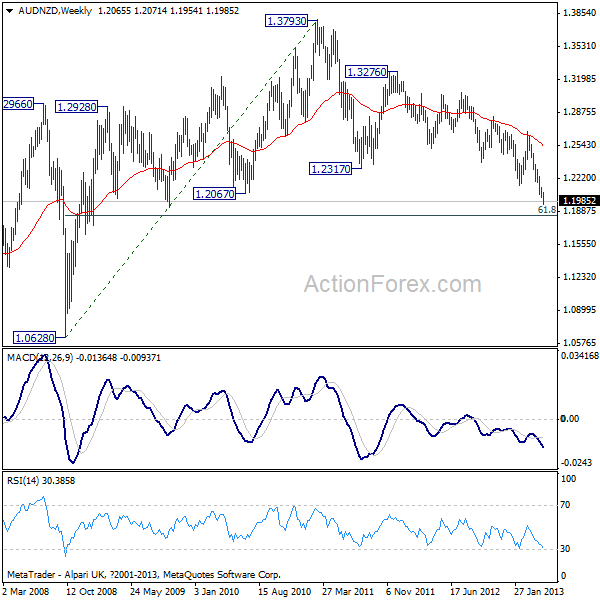

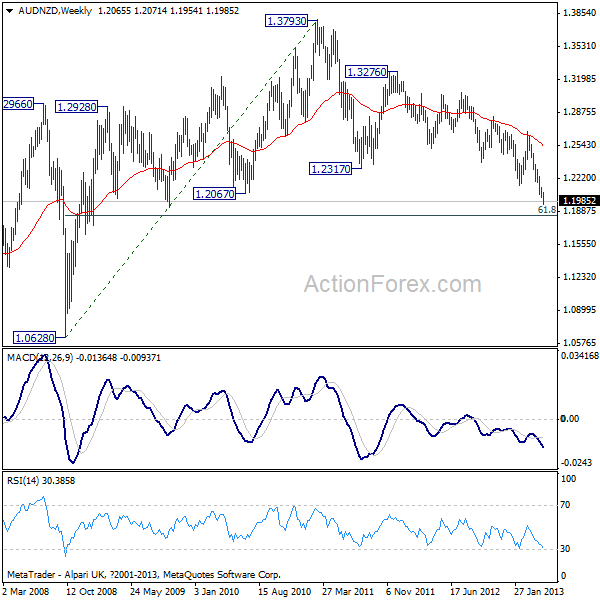

The AUD/NZD continues it's long term downtrend this week, and broke the 1.12 handle. Note that the RBA rate is at 2.75% after today's cut, which is close to RBNZ's rate of 2.50%. Another cut this year from the RBA would put them on par. The AUD/NZD's downtrend from 1.3793 is expected to extend lower to 61.8% retracement of 1.0628, to 1.3793 at 1.1837.

ECB president Draghi yesterday said that the central bank is "ready to act again" if necessary, and will "look at all the data on the eurozone economy in the coming weeks". He noted that "there are many complications and consequences to take into account that need to be studied carefully and the council has decided to study them, to analyze these consequences in order to be able to act if necessary." The ECB lowered the main interest rate to a 0.50% historical low last week. The euro struggled in range as Draghi opened the door for negative deposit rates.

Looking ahead, Swiss data will be a main focus in the European session with unemployment rate, SECO consumer confidence and foreign currency reserves featured. Germany will release factory orders.

Technically, the AUD/USD dropped through 1.0220 support to resume last week's fall from 1.0581. Such a decline should now extend to 1.0115 support in the near term. The EUR/AUD is limited below 1.2887 so far, in spite of today's rally. The near term outlook stays bullish for another high above 1.2887 to extend the rebound from 1.2218. The GBP/AUD broke last week's high to the recent rebound from 1.4380. The AUD/JPY, which is the relatively weak yen cross, is heading back to 100.

The AUD/NZD continues it's long term downtrend this week, and broke the 1.12 handle. Note that the RBA rate is at 2.75% after today's cut, which is close to RBNZ's rate of 2.50%. Another cut this year from the RBA would put them on par. The AUD/NZD's downtrend from 1.3793 is expected to extend lower to 61.8% retracement of 1.0628, to 1.3793 at 1.1837.

ECB president Draghi yesterday said that the central bank is "ready to act again" if necessary, and will "look at all the data on the eurozone economy in the coming weeks". He noted that "there are many complications and consequences to take into account that need to be studied carefully and the council has decided to study them, to analyze these consequences in order to be able to act if necessary." The ECB lowered the main interest rate to a 0.50% historical low last week. The euro struggled in range as Draghi opened the door for negative deposit rates.

Looking ahead, Swiss data will be a main focus in the European session with unemployment rate, SECO consumer confidence and foreign currency reserves featured. Germany will release factory orders.