The Aussie dipped sharply in the Asian session, as data indicated that the unemployment rate jumped 0.2% to 5.6% in March, hitting the highest level since 2009. That was much worse than the expectation of steady rate of 5.4%. The number of unemployed was 9.7% yoy higher. Employment dropped -36k versus expectation of -7.2k. The pull back was expected after the unsustainable 74k job growth in February, but its depth caught the markets by surprise. While the RBA is still leaning towards a loosening bias, a month's data shouldn't be enough to trigger action from the central bank yet. Other data released from Australia showed consumer inflation expectations slowed slightly to 2.2% in April. The AUD/USD And AUD/JPY pairs are still holding on to the near term bullish outlook despite today's retreat. The Aussie is showing further weakness against the kiwi in cross.

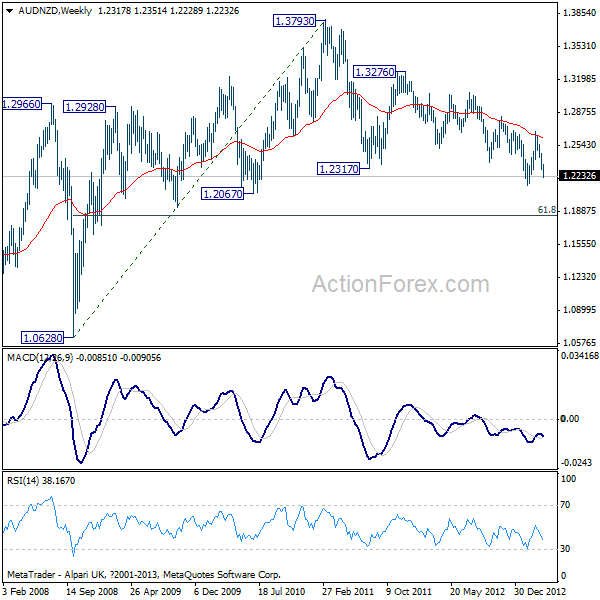

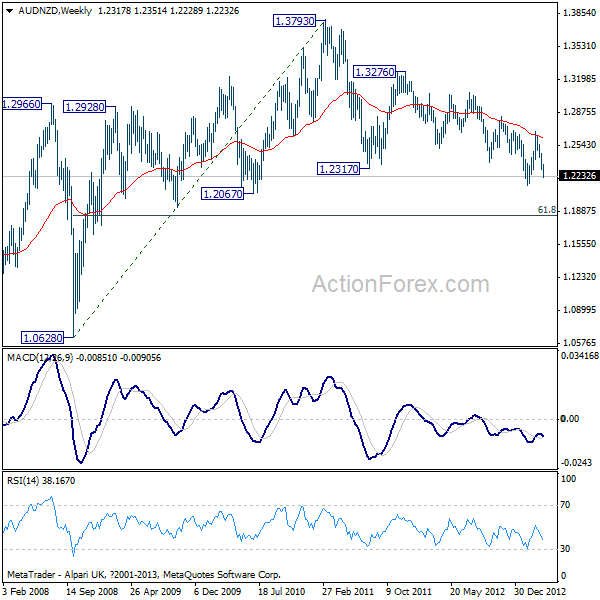

The AUD/NZD is still maintaining a series of lower lows lower highs since hitting 1.3276 back in 2011. The rebound earlier this year was limited cleanly by the falling 55 weeks EMA, maintaining the bearish trend. This week's decline indicates that the fall is possibly accelerating and we'd expect a test on 1.2142 support in near term. The whole decline from 1.3793 should extend to 61.8% retracement of 1.0628 to 1.3793 at 1.1837 and below.

AUD/NZD Weekly" title="AUD/NZD Weekly" width="600" height="600" />

AUD/NZD Weekly" title="AUD/NZD Weekly" width="600" height="600" />

The Japanese yen remains soft today, but downside momentum is unconvincing fornoe. Expect the yen to bottom in near term and have a recovery soon. BoJ governor Kuroda has made it clear that the central bank has take all necessary and possible measures for the moment . He'd probably wait and see the reactions from the G20 meeting in Washington next week. Data from Japan saw M2 + CD rose 3.0% yoy in March, domestic CGPI dropped -0.5% yoy in March; machine orders rose 7.5% mom in February.

In the U.S., strong risk appetite pushed the DOW to a new record high of 14802.24 overnight, while S&P 500 also jumped to new record high of 1587.73. The dollar was slightly higher against European majors but there is no clear sign of bottoming yet. Minutes of March 19/20 FOMC showed meeting some policymakers thought the "labor market conditions improved as anticipated". A few members noted the "risks and costs of purchases" and argued that "it would probably be appropriate to slow purchases later in the year and to stop them by year-end." Again, we'd like to emphasize that the data since that meeting, including ISM indices and NFP, were rather weak and consequently market reaction to the minutes was rather muted.

Data due: German CPI, US import price index, jobless claims and the Canada new housing price index.

The AUD/NZD is still maintaining a series of lower lows lower highs since hitting 1.3276 back in 2011. The rebound earlier this year was limited cleanly by the falling 55 weeks EMA, maintaining the bearish trend. This week's decline indicates that the fall is possibly accelerating and we'd expect a test on 1.2142 support in near term. The whole decline from 1.3793 should extend to 61.8% retracement of 1.0628 to 1.3793 at 1.1837 and below.

AUD/NZD Weekly" title="AUD/NZD Weekly" width="600" height="600" />

AUD/NZD Weekly" title="AUD/NZD Weekly" width="600" height="600" />The Japanese yen remains soft today, but downside momentum is unconvincing fornoe. Expect the yen to bottom in near term and have a recovery soon. BoJ governor Kuroda has made it clear that the central bank has take all necessary and possible measures for the moment . He'd probably wait and see the reactions from the G20 meeting in Washington next week. Data from Japan saw M2 + CD rose 3.0% yoy in March, domestic CGPI dropped -0.5% yoy in March; machine orders rose 7.5% mom in February.

In the U.S., strong risk appetite pushed the DOW to a new record high of 14802.24 overnight, while S&P 500 also jumped to new record high of 1587.73. The dollar was slightly higher against European majors but there is no clear sign of bottoming yet. Minutes of March 19/20 FOMC showed meeting some policymakers thought the "labor market conditions improved as anticipated". A few members noted the "risks and costs of purchases" and argued that "it would probably be appropriate to slow purchases later in the year and to stop them by year-end." Again, we'd like to emphasize that the data since that meeting, including ISM indices and NFP, were rather weak and consequently market reaction to the minutes was rather muted.

Data due: German CPI, US import price index, jobless claims and the Canada new housing price index.