For the 24 hours to 23:00 GMT, the AUD strengthened 0.16% against the USD to close at 0.9353.

In a speech to bankers in the US, RBA Governor, Glenn Stevens, highlighted the need for swift sorting of regulations and banking reform to dodge another financial crisis while urging bankers to aggressively build capital buffers ahead of time to prevent any stocks in the future.

LME Copper prices edged up 0.1% or $7.0/MT to $6667.5/MT. Aluminum prices jumped 2.9% or $53.5/MT to $1870.5/MT.

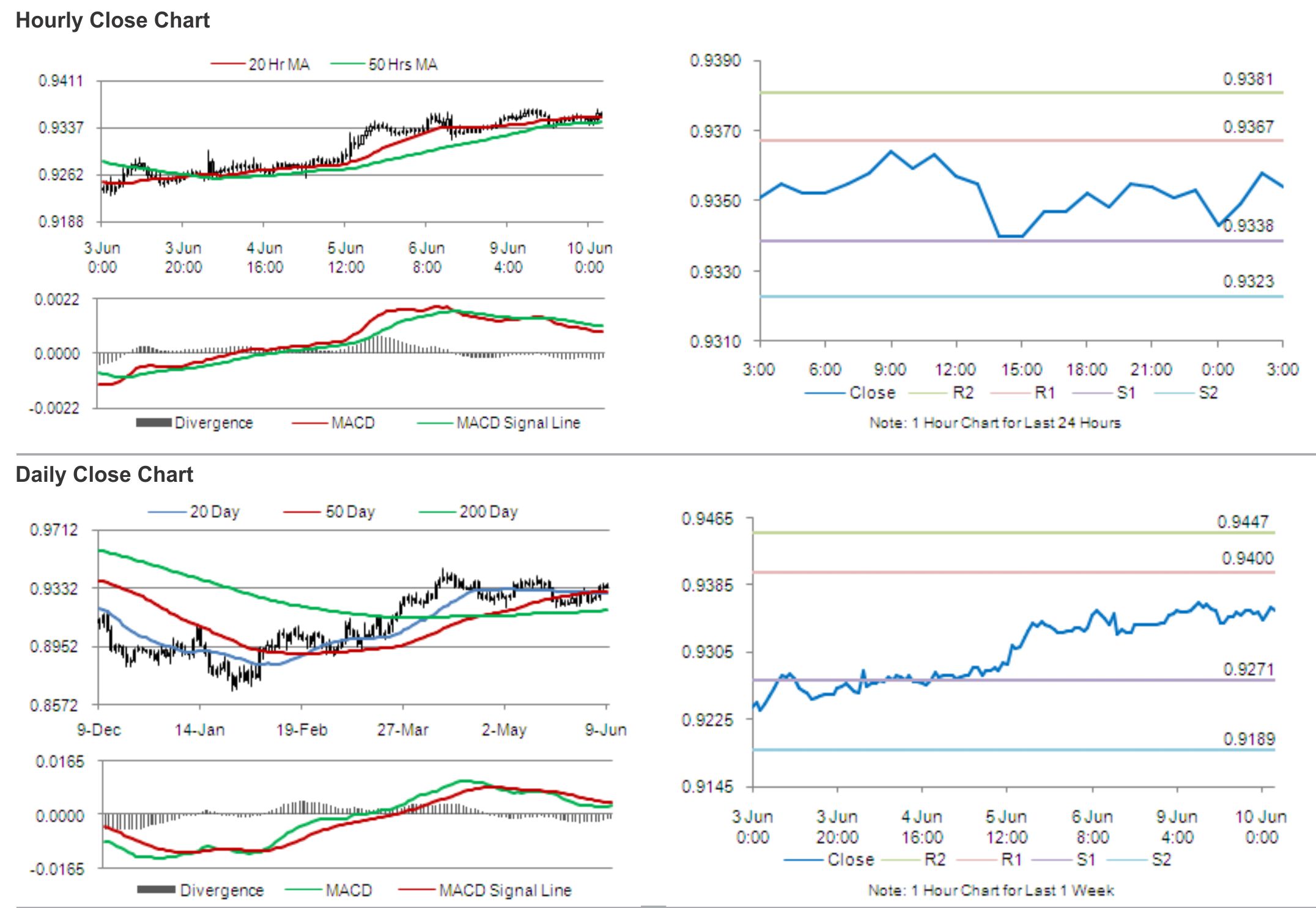

In the Asian session, at GMT0300, the pair is trading at 0.9354, with the AUD trading a tad higher from yesterday’s close.

In economic news, data from Australia showed that demand for home loans in the nation was flat in April while the National Australia Bank (ASX:NAB) Index measuring business confidence, remained unchanged in May even as its index on Australia’s business conditions dipped into negative territory last month. Separately, data from China, Australia’s largest trading partner, showed that the consumer inflation rate rose to a four-month high of 2.5% in May.

The pair is expected to find support at 0.9338, and a fall through that level could take it to the next support level of 0.9323. The pair is expected to find its first resistance at 0.9367, and a rise through could take it to the next resistance level of 0.9381.

The currency pair is showing convergence with its 20 Hr moving average and is trading just above its 50 Hr moving average.