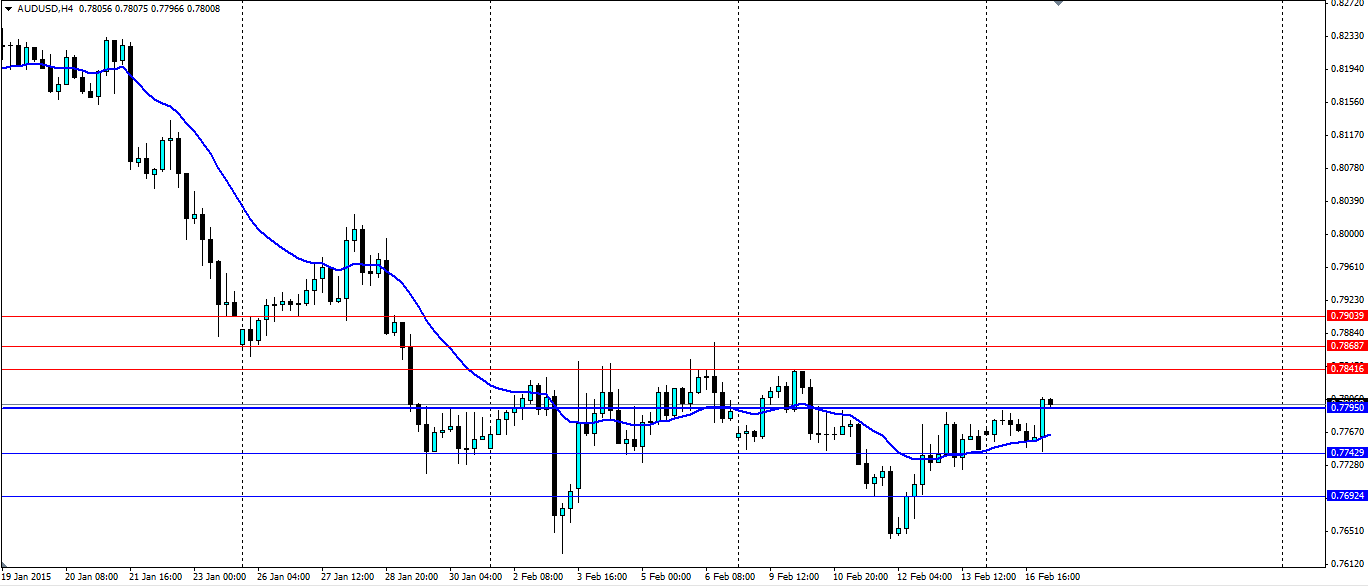

The Aussie has had a few cracks at the resistance just below the 78c mark against the US dollar without much success. That changed today and could lead to a cheeky push higher before the next RBA announcement.

The latest minutes from the Reserve Bank of Australia’s latest meeting show the rate cut was in response to a less than rosy economic outlook. But interestingly the RBA is becoming more concerned about the strength in the Australian housing market. A rate cut will only add fuel to the fire, meaning that we may not see further rate cuts until the housing market cools off. This has pushed the Aussie dollar through the resistance at 0.7795 and over the 78 cent mark.

We have already seen a pull back to the resistance which has held firm meaning we could see a solid push up from here. The Aussie will target the first level of resistance at 0.7841, if this fails we will see 0.7868 and 0.7904 come under pressure. Certainly a short term buy is a play that could net punters a few cheeky pips.

The long term outlook for the Aussie dollar is decidedly bearish and US dollar strength is nothing to be taken lightly. So this trade is a short term play and anyone looking to long the Aussie should manage their risk with a stop loss. If we do see a reversal back under the support, look for 0.7742 and 0.7692 as the next levels of support.