The Australian dollar entered a fifth day of solid gains against the US dollar on Monday, reaching its highest levels in over a month. The Aussie fell to a 10 year low against the US dollar on August 7th, amid rising US/China trade tensions and a dovish outlook from the Reserve Bank of Australia (RBA).

Home Loans Surge

The Australian dollar was lifted by data released on Sunday from the Australian Bureau of Statistics indicating that buyers are flocking back to the housing market. Australia’s mortgage approvals beat expectations in July, with home loans marking their largest monthly gain in almost four years.

October Trade Talks

Renewed optimism emerged last Thursday, after the US and China agreed to proceed with high-level trade talks in early October. Hopes for improving trade relations between the world’s two largest economies boosted ‘risk on’ assets including the Australian dollar.

China Reserve Requirements

China’s economic growth fell to its lowest level in 27 years in the second quarter, reflecting the damaging effect of the ongoing trade war. On Friday the People’s Bank of China (PBOC) announced plans to cut the reserve requirement ratio for most financial institutions by 50 basis points, in a move intended to boost the economy. China is Australia’s largest trading partner and the Australian dollar was supported by the news.

Powell Comments

Speaking at the University of Zurich on Friday, Fed Chair Jerome Powell reiterated that the US central bank will act “as appropriate” to sustain the economic expansion. Powell stated: “Our obligation is to use our tools to support the economy, and that’s what we’ll continue to do.” The comments boosted risk sentiment, lifting assets including the Australian dollar and US stocks.

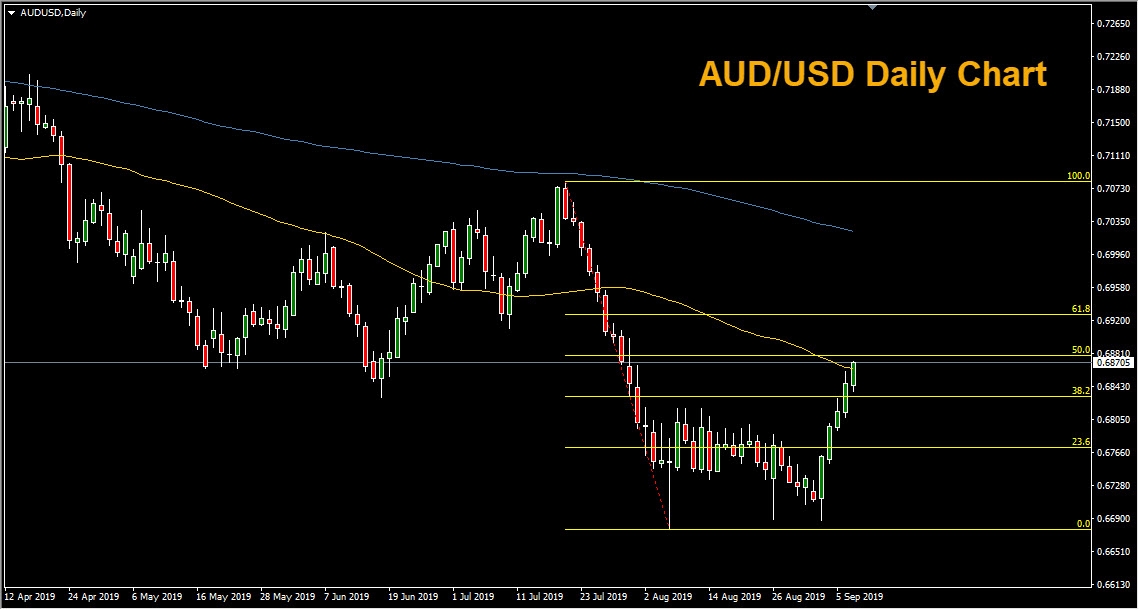

Technical Outlook

Looking at the daily chart we can see that AUD/USD has reached above the 50-day SMA resistance level. Additional resistance lies above at the 50% retracement level of 0.6878.

The Bottom Line

The recent bullish surge has traders wondering whether the Australian dollar has bottomed. The market now looks to the all-important FOMC monetary policy meeting taking place on September 17-18.