Aurizon’s (ARZ) second quarter results demonstrated an encouraging recovery from Q112, with production increasing 11.9% compared to the previous quarter as a result of a 7.2% increase in tonnes milled and a 4.0% increase in the head grade to 7.27g/t. As a result, the company reported a 3.0% quarter-on-quarter increase in earnings per share, despite a 5.9% decrease in the realised gold price to US$1,592/oz.

Shotcrete and backfill provide future mining flexibility

While less so than in Q1, ground conditions remained challenging and some high grade ore was temporarily isolated. As a result, operations continued to be affected by a shortfall in shotcreting capacity, which resulted in unit operating costs that, at C$142/t, were higher than plan (although still 6.6% below Q1). To address this, additional shotcreting equipment has now been installed and a paste backfill plant will be commissioned in early 2013, which will improve flexibility in difficult ground conditions by reducing the mining cycle time and preventing the permanent loss of ore in failed stopes. As a result, grades are expected to rise to 7.5-7.6g/t in H2, while unit working costs are forecast to fall an additional 1.8% to C$139.45/t milled.

Encouraging exploration drilling

Aurizon’s exploration budget in FY12 is approximately C$30m. Based on results released in July, we estimate that the return on this investment may be c 140koz in Zone 123 at Casa Berardi (worth c US$10.7m at ARZ’s current rating of US$75.94 per resource ounce), 245koz at the Hosco West Extension (worth c US$18.6m), 403-894koz at Heva East (c US$30.6-67.9m) and 453koz at Heva West (c US$34.4m).

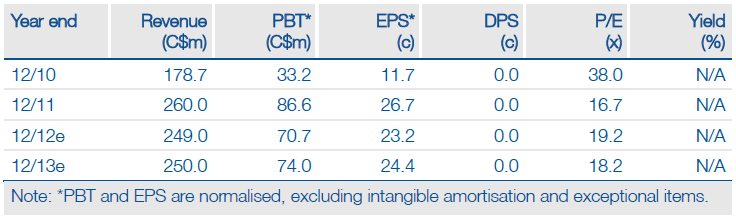

Valuation: 19.8% EV/EBITDA discount to HUI

ARZ’s historic P/E multiple to December 2011 is at a premium to the equivalent measure for the Arca Gold BUGS index (at its currently prevailing level of 428.87). However, if its balance sheet position (and in particular cash pile worth C$1.26/share as at end-June 2012) is taken into account, its EV/EBITDA ratio of 4.55x to December 2012 is at a 16.7% discount to that of the HUI of 5.46x and its ratio of 4.25x to December 2013 is at a 19.8% discount to the HUI on 5.30x.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Aurizon Mines Q2 Results

Published 08/14/2012, 07:32 AM

Updated 07/09/2023, 06:31 AM

Aurizon Mines Q2 Results

A tale of two halves

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.