Street Calls of the Week

Auris Medical Holding announced in July that the 50-subject AM-201 Phase Ib trial for olanzapine-induced weight gain and somnolence completed enrolment, with top-line data in five dose levels expected in the coming weeks. Due to the positive safety profile seen in the trial so far (efficacy is unknown as the company is blinded), the company is seeking to extend the trial by adding two higher dose cohorts, with data from these expected around Q120. The company has also initiated the 138-patient AM-125 Phase II trial in acute vertigo, with data expected around Q419/Q120.

AM-201 trial fully enrolled, data by the end of Q319

Auris is developing AM-201, an intranasal betahistine formulation, for co-administration with olanzapine to counteract adverse effects such as weight gain and sleepiness. In July, the company announced it completed enrollment of 50 healthy volunteers in its Phase Ib dose escalation trial, which is testing five different dose levels, with data expected in Q319. Due to the positive safety profile seen in the trial so far, the company is seeking to extend the trial and add two higher dose cohorts, with data from these additional dose levels expected around Q120.

TRAVERS trial interim data in Q419/Q120

Auris is developing AM-125, also an intranasal formulation of betahistine, for the treatment of acute vertigo. The Phase II trial, TRAVERS, will include 138 patients with surgically induced acute vertigo following vestibular schwannoma excision. The trial has started enrolling with interim data expected in Q419/Q120.

Tinnitus program to return?

The company announced it has completed the design of a new Phase II/III trial of Keyzilen/AM-101 for acute inner ear tinnitus. Auris is currently seeking feedback from both the FDA and EMA and is exploring non-dilutive funding options.

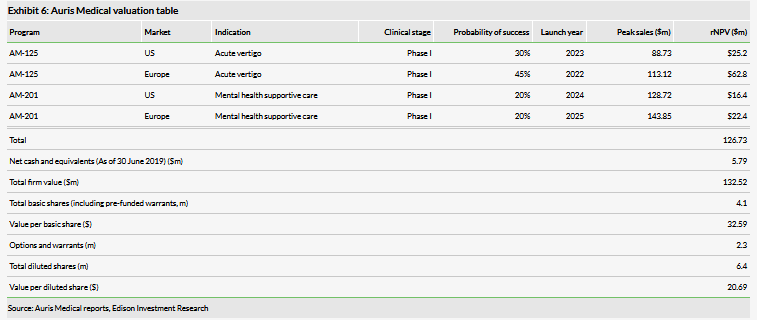

Valuation: $132.5m or $32.59 per basic share

We have adjusted our valuation to $132.5m or $32.59 per basic share ($20.69 per diluted share), from $131.0m or $32.23 per basic share ($29.49 per diluted share). The total and basic share valuation increased as we rolled forward our NPV and was mitigated in part by lower net cash. The diluted value per share decreased due to the warrants associated with the May 2019 financing. In our forecasts, we model a total of CHF65m (previously CHF57.4m) in financing needs through 2023, which we record as illustrative debt.

Business description

Auris Medical is a Swiss biopharmaceutical company developing neurotology and central nervous system targeting therapeutics. It is developing intranasal betahistine in a Phase I trial for mental disorder supportive care and it is entering Phase II for vertigo; both are designed to demonstrate proof-of-concept.

Key datapoints coming soon

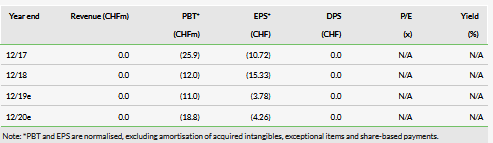

In March, Auris initiated the AM-201 Phase Ib pharmacokinetics/pharmacodynamics (PK/PD) trial testing intranasal betahistine for the prevention of olanzapine-induced weight gain and somnolence. Fifty healthy volunteers have been enrolled at one site in Europe with data from these 50 subjects expected in the coming weeks. In the data release, we expect information on the primary and secondary endpoints of weight gain and daytime sleepiness, respectively, as well as safety.

In its H119 update, the company announced that due to the positive safety profile seen in the trial so far (efficacy is unknown as the company is blinded), the company is seeking to extend the trial by adding two higher dose cohorts (30mg and 40mg), with data from these (if the trial is extended) expected around Q120.

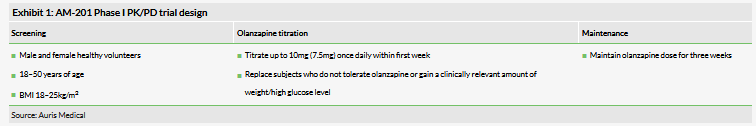

As a reminder, Olanzapine is approved for the treatment of schizophrenia and bipolar disorder for adolescents and adults in the US and EU. Schizophrenia is a mental disorder characterised by a breakdown in the relation between thought, emotion, and behaviour that leads to a false sense of perception, inappropriate actions and feelings, and withdrawal from reality into delusion. The efficacy of olanzapine, which is just one of nine second-generation antipsychotic drugs approved by the FDA for the first-line treatment of schizophrenia and bipolar disorders, is mediated via a combination of dopamine and serotonin type 2 (5HT2) antagonism. Interestingly, olanzapine (and other atypical antipsychotics) is also a histamine-H1 receptor antagonist, which regulates central functions including food intake, body temperature control and circadian rhythm,1 and consequently common side effects of the drug include significant weight gain (see Exhibit 2), drowsiness and somnolence. Because betahistine acts as a partial postsynaptic H1 receptor agonist, the co-administration of oral betahistine with olanzapine may offset some of the undesirable side effects.

AM-125 TRAVERS trial enrollment has begun

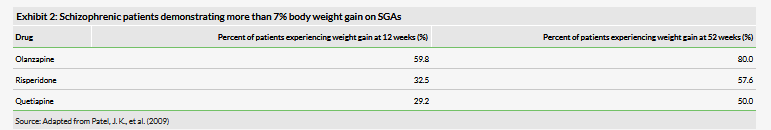

Auris also provided an update on its AM-125 clinical program for the treatment of acute vertigo. The TRAVERS trial is a randomized, controlled, double-blind Phase II trial divided into two parts (Exhibit 3) and will include 138 patients in total with surgically induced acute vertigo following the removal of vestibular schwannoma (which is a noncancerous tumor on the main nerve leading from the inner ear to the brain, also known as acoustic neuroma). Vestibular schwannoma surgery leads to loss of peripheral vestibular input, which triggers acute vertigo.

In Part A of the trial, which has just been initiated, a total of 50 patients will be administered AM-125 or placebo in five dose cohorts three times daily and 16 patients will receive 48mg oral betahistine three times daily (open-label, for reference purposes). Dosing will begin roughly three to four days after surgery. The company plans to report interim data in Q419/Q120 and expects to determine a dose-response curve and select a low dose and a high dose of AM-125 for the second part of the trial, which will be measured against placebo. Then in Part B of the trial, the company plans to enroll 72 patients.

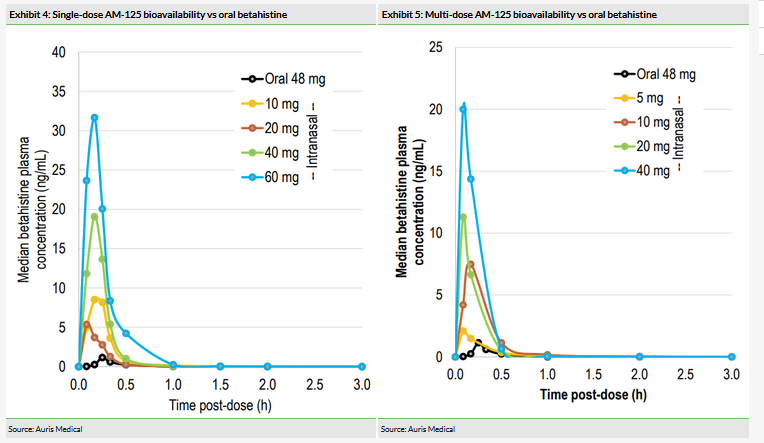

Auris previously demonstrated the superior bioavailability of AM-125, intranasal betahistine, compared to oral betahistine (48mg) in both single and multiple doses (Exhibits 4 and 5) in its Phase I trial. Adverse events (AEs) were mild to moderate, described as transient and included sneezing and nasal congestion, which corresponded to dose. One patient withdrew from the trial due to an AE, but no serious AEs were reported. According to Auris, the maximum tolerated repeated dose based on local tolerability in the nose was identified and set at 40mg; the maximum tolerated single dose was not reached at 60mg.

Resuscitating Keyzilen (AM-101)?

Auris also recently announced that it has completed the design of a new Phase II/III trial developing Keyzilen, an otic gel formulation of esketamine hydrochloride, for the treatment of acute inner ear tinnitus. Esketamine (an enantiomer of ketamine) is a small-molecule N-Methyl-D-aspartate (NMDA) receptor antagonist. Cochlear NMDA receptors are activated by the excessive release of neurotransmitters from inner hair cell post-synapses, which become excitotoxic to the primary auditory neuron.2 These excitotoxic events may emanate from acoustic trauma, salicylate toxicity (salicylate is the active component of NSAIDS such as aspirin) or other events associated with sudden deafness. They can also cause activity imbalance between NMDA and non-NMDA receptors, which can lead to hyperactivity of the auditory nerve and thus the initiation of tinnitus activity. Auris Medical has previously conducted two Phase II and two Phase III trials in both the US and Europe investigating the safety and efficacy of Keyzilen for acute inner ear tinnitus. Unfortunately, both Phase III trials missed their primary endpoints. The company believes that changes to the collection of patient reported outcomes, to certain elements of study conduct and the use of a novel method to measure and diagnose tinnitus may help demonstrate Keyzilen’s efficacy in another trial. It is currently seeking feedback from the FDA and EMA on the design of the trial. Also, the company is exploring non-dilutive funding options for the program including partnering, special purpose vehicle financing, grants or a combination of the three. Note that we currently include no value in our model for this potentially late-stage program, but that may change if a viable path forward is determined.

Valuation

We have adjusted our valuation to $132.5m or $32.59 per basic share ($20.69 per diluted share), from $131.0m or $32.23 per basic share ($29.49 per diluted share). The total and basic share valuation increased as we rolled forward our NPV and was mitigated in part by lower net cash. The diluted value per share decreased due to the warrants associated with the May 2019 financing. As a reminder, in May the company raised approximately $7.6m in net proceeds through the issuance of 440,000 shares of common stock and 1,721,280 in pre-funded warrants. While not all the pre-funded warrants have been exercised, as they are pre-funded we count them as shares in our basic share calculation (the basic share count excluding the non-exercised warrants was 3.3m shares as of June 30). Additionally, there were 2,161,280 warrants associated with the offering, which we have now included in our diluted valuation.

Financials

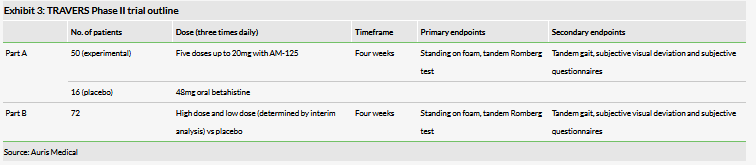

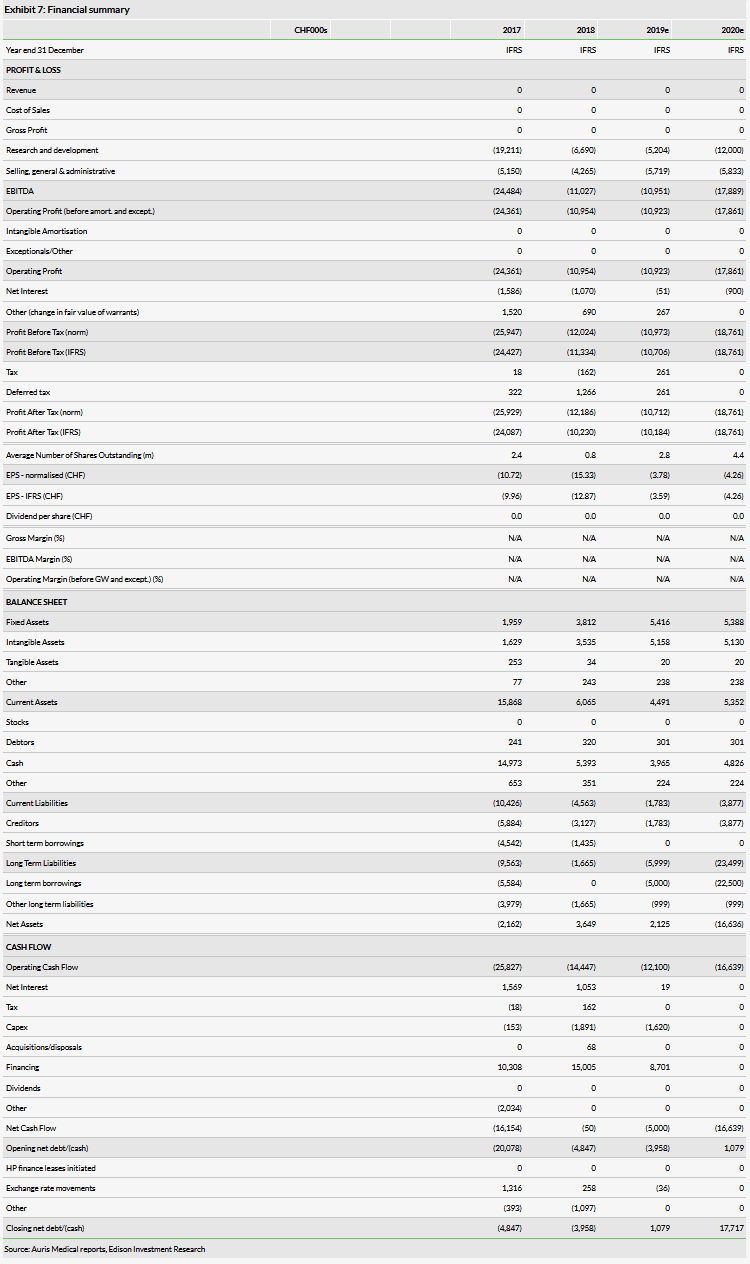

Auris recently reported its H119 results (it recently migrated from quarterly to semi-annual reporting). The company reported R&D spend of CHF1.3m for H119 compared to CHF5.0m for H118. CHF1.6m of this decrease reflects the capitalization of direct costs associated with the AM-125 program (R&D expenses would have been CHF2.9m without this capitalization), with the rest of the decrease due to the completion of the late-stage programs. G&A expenditure for the half-year was CHF2.8m, which is up from CHF2.5m in the same period one year ago. Adjusting for the capitalised portion of R&D, our estimates for R&D are roughly the same as they have been previously. Our G&A estimates have increased by CHF1.4m for both 2019 and 2020 due to a higher run rate. Note that the company has reiterated its prior guidance for operating expenditure in the range of CHF10m to CHF13m for FY19.

As of 30 June 2019, Auris had CHF5.8m in cash and equivalents and no debt following the repayment of its CHF1.4m in debt. In our forecasts, we model a total of CHF65m (previously CHF57.4m) in financing needs through 2023, which we record as illustrative debt, to bring the two intranasal betahistine programs to commercialization. This includes an estimate for CHF5m in additional financing this year.