Pre-Open market analysis

The Emini is at the top of a 9 day tight trading range. Most days continue to have reversals and lots of trading range trading. That means that today will probably have more of the same. While the bulls can get a strong breakout to a new all-time high, the odds are against a protracted leg up. This is because the weekly chart has such an extreme buy climax.

The bears have a nested head and shoulders top over the past 2 weeks. They need a strong breakout below the 9 day range to trigger an attempt at a measured move down.

Today is the 1st day of the month. The past 4 months have been strong bull bars. The monthly chart has a 9 bar bull micro channel. Since that is extreme, it increases the chance of a bear bar this month or next month. In addition, the weekly buy climax is exceptionally extreme. Yet, even if the bears get a trend down in August, the odds are that any selloff will be a pullback on the monthly chart. Hence, any reversal will probably not last more than a few bars on the monthly chart, which is a few months.

Overnight Emini Globex trading

The Emini is up 6 points in the Globex market. The bulls are trying to get a rally above Thursday’s sell climax high and then a measured move up. The bears want a break below Thursday’s low, which would trigger a nested head and shoulders top pattern over the past 2 weeks. Since most days over the past 2 months have had at least one swing up and one swing down, that is what is likely again today. This is especially true since the Emini has been in a tight range for 9 days.

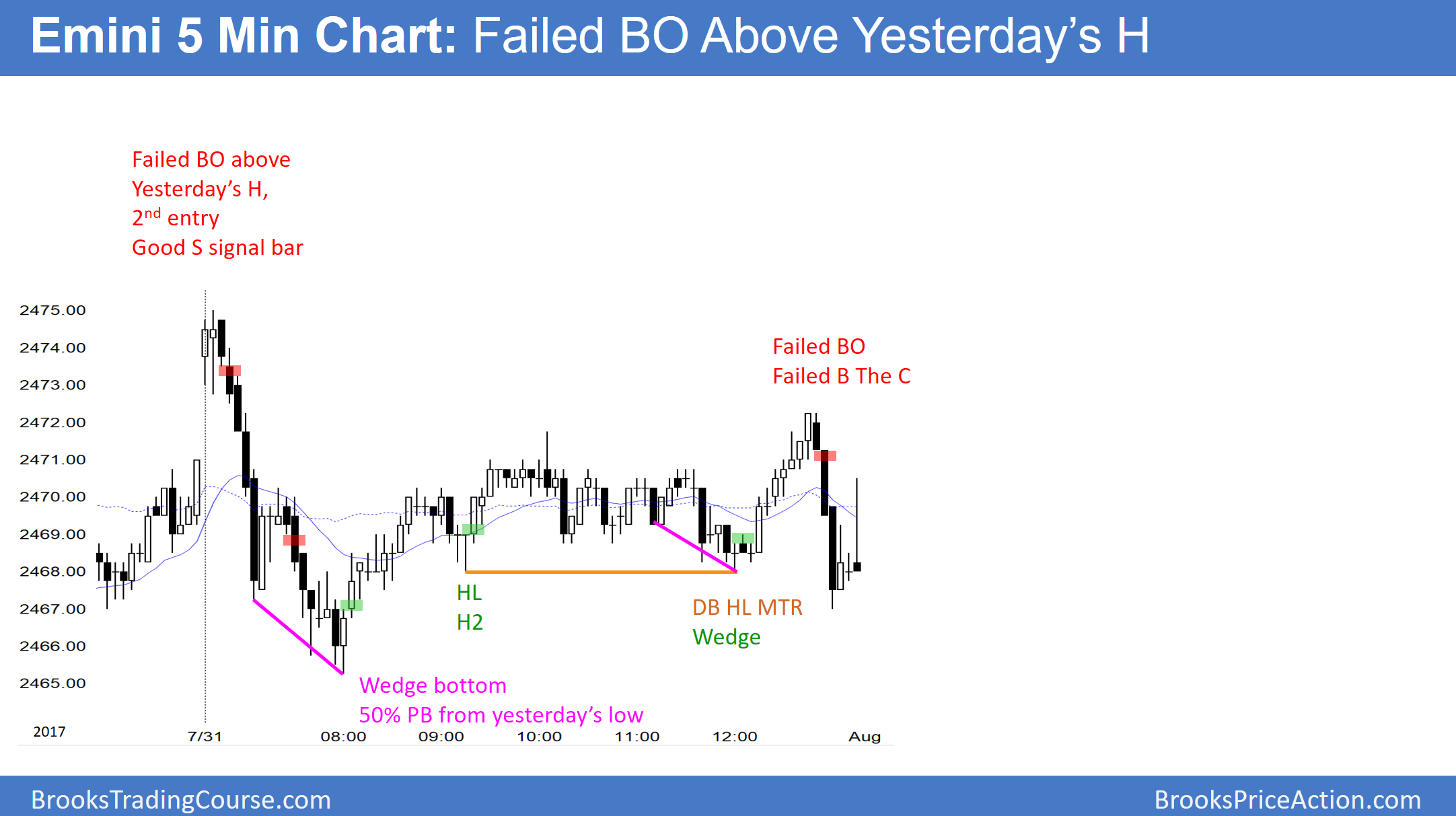

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.