This August seems hot. Not only temperature but also currency market volatility is rising. The period of active vacations, which is accompanied by a decrease in volumes, this time result in increased volatility. So far we have seen this in the EM currencies that have been subjected to sanctions or tariffs from the United States. However, the British Pound is also in the camp of suffered currencies.

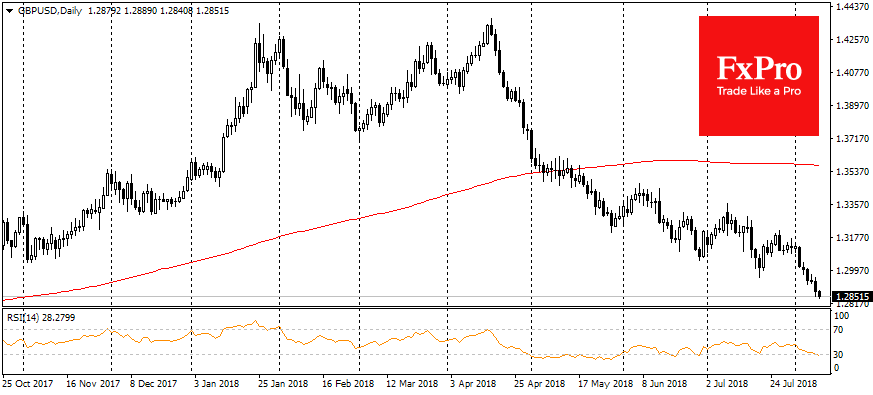

More “hard” Brexit than it was expected earlier causes the weakening of sterling. Since the beginning of August, the British currency has lost more than 2%, dropping below the important level of 1.30 dollar. By the euro, the pound had sunk yesterday to the lowest values since September last year.

On Wednesday, the Russian rubble lost more than 3% on fears of new sanctions from the U.S. and as a result of sharp drop of oil. The dollar rose to the highest rates in 21 months above 65.5 and completed the summer consolidation period.

Earlier the week, the Turkish lira lost more than 6.5% in a day, rewriting the historical highs to 5.42. Some rollback of the lira was short-lived, and today in the morning it has lost 2.4% and has returned to 5.40.

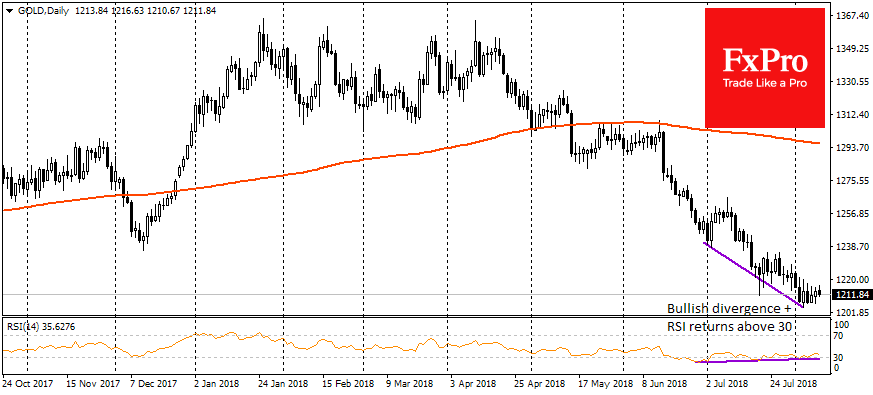

The commodities market also cannot boast of summer lull. Gold at the end of last week dropped to $1204 per ounce, and now stabilized near 1215. The main support factors in this case are the demand for protective assets against the Sterling backdrop and EM currencies drop and the extreme oversold of gold in the previous months. The recent report of the World Gold Council has shown a record volume of net short positions on this metal. Often, the excess oversold is a good signal for bulls to start buying. This is also evidenced by the RSI dynamics.

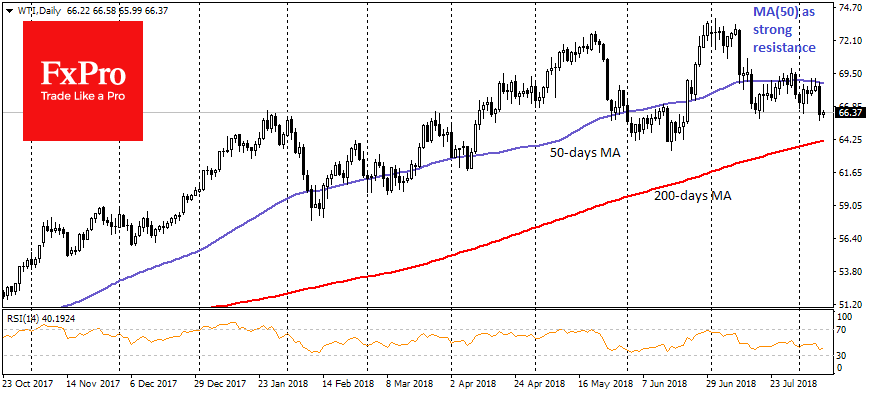

Oil abruptly lost on Wednesday amid the report EIA on the return of shale companies to net positive cash flow, which promises the growth in production, despite the rise in interest rates in the United States. As a result, Brent Crude oil lost more than 3%, fell below $72 at some point. WTI rewrote 2-month lows near $65.80.

It is noteworthy that the weakening of the pound has not caused any pressure on the euro. However, the euro is potentially vulnerable to this topic as investors switch their interest to the regions that are farther from the epicenter of the problems.

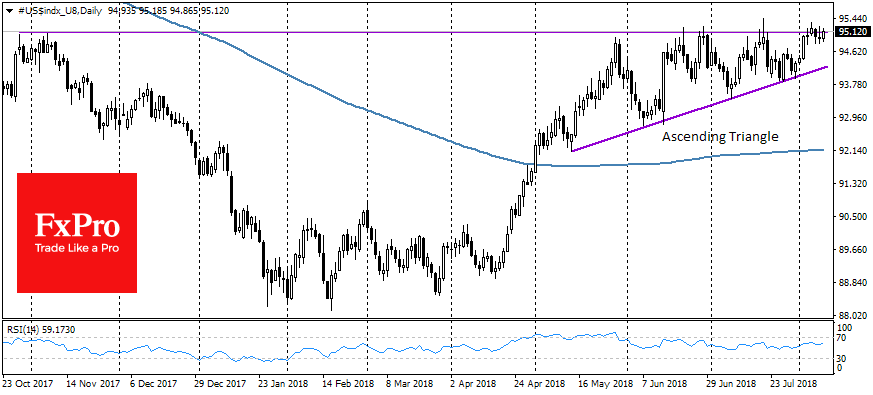

The positive dynamics of the euro and the strengthening of the Japanese yen constrain the dollar index from the growth, despite the pound weakness. As a result, DXY Remains near the upper limit of the trading range of the last months, adding 0.1% on Thursday. However, the increased demand for security is likely to allow U.S. currency to demonstrate its strength soon. It is also worth paying attention to the U.S.PPI figures, the acceleration here could give support to the American currency.

Alexander Kuptsikevich, the FxPro analyst