Throughout the bulk of 2013, investors became accustomed to seeing U.S. stock market benchmarks close near their intra-day highs. In August, however, we may be witnessing the birth of a disconcerting pattern whereby institutional investors sell broad-based equities into strength.

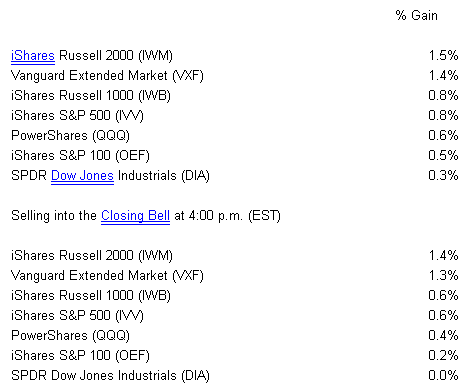

Consider the trading activity on seven of the most popular ETFs on Tuesday, 8/20:

On Tuesday, 8/20/2013, at 3:30 p.m. (EST)

Tuesday’s gains did snap a 4-day losing streak for the S&P 500. Yet the Dow Industrials logged a 5th consecutive loss, and that came after trading in positive territory for the majority of the session. Moreover, money flow data at WSJ.com show that adviser-based investors dumped roughly $150 million of iShares S&P 500 ( IVV) on heavier than normal 3-month volume; similarly, Vanguard loyalists bid farewell to $78 million of Vanguard Extended Market (VXF) on 7x the typical volume over the last 3 months.

Granted, it is way too much of a stretch to suggest that a near-term downtrends is inevitable. On the other hand, what are the compelling reasons to be a “net buyer” of U.S. stock assets at this moment? Stocks are fairly valued or extremely overvalued, depending upon the analysis. Treasury yields are rising faster than the Fed can contain them. And, in spite of the noise, there’s little evidence of a “great rotation” from bonds into stocks.

You may believe (as I do) that the 10-year Treasury yield and corresponding lending rates will come back down to the 2.25%-2.5% range. Nevertheless, many have already succumbed to a notion that rates will keep climbing. Consumers and businesses simply will not spend as freely if they expect rates to continue on an upward trajectory; down go corporate profits; down go sales and expectations for better times ahead.

It follows that the uncertainty in August (and perhaps September) may be too much to bear. Profit-taking and capital preservation instincts may kick in, though stock sellers may not choose to rotate back into bonds. Call it, the “Great Cash Pile-Up.”

The guidance that I am providing here is to make sure that you have a bit of cash on the sidelines as well. In my estimation, there is a likelihood that the Fed may not even get the cover it needs in a “strong” employment report, and that any slowing of bond purchases by the Fed will be miniscule. In essence, an August-September swoon should provide ample opportunity to buy defensive stock ETFs with less sensitivity to interest rate movement.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

August ETF Selling Into Strength

Published 08/21/2013, 03:17 AM

Updated 03/09/2019, 08:30 AM

August ETF Selling Into Strength

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.