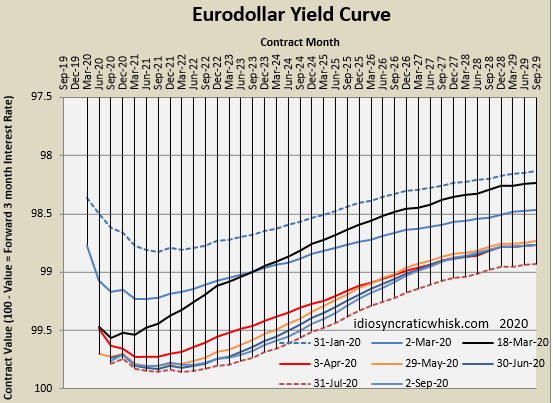

Inflation breakevens continue to rise, slowly. After really flattening out last month, the yield curve perked up in August, somewhat, especially helped by recent Fed discussion about allowing for more catch-up inflation and a more of a symmetrical 2% inflation target.

The move up is a good sign, but higher would be better. (Sorry, the graphs a bit of a mess. Sept. 2 is the light blue line in the group of curves toward the bottom.)

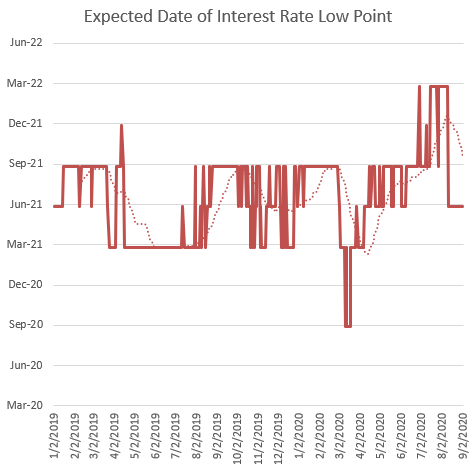

The date of the first expected rate hike is displaying a good trend. Last month, the expectation had moved all the way toward 2022. Now, it's moved back to June 2021. It looks like it might have some staying power. Of course, the Fed communicates loose policy intentions by saying they are committed to keeping rates low for longer. It is staggering to think such a useless communication policy is the norm, but it is what it is. The better (more accommodating) they are the faster they will get to the first hike.