US Census reported that construction spending declined slightly month-over-month in August 2012 – Econintersect sees a major decline. Unfortunately, government construction spending continues to contract, and remains a drag on the relatively robustly expanding private sector.

Econintersect analysis:

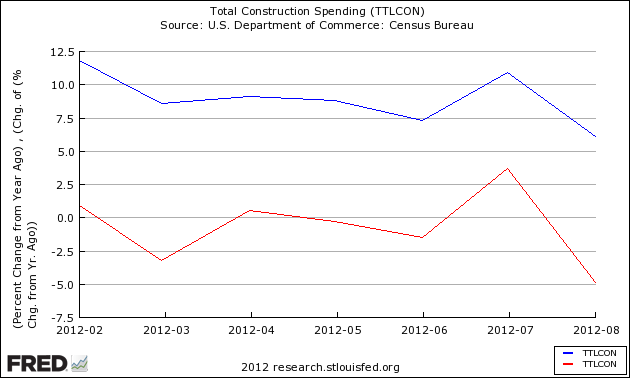

- Down 4.9% month-over-month and Up 6.1% year-over-year

- Inflation adjusted construction spending down 6.4% month-over-month – and up 4.8% year-over-year.

- Down 0.6% month-over-month and Up 9.0% year-to-date

- Market expected Up 0.1% to 0.4% month-over-month (versus the -0.6% reported)

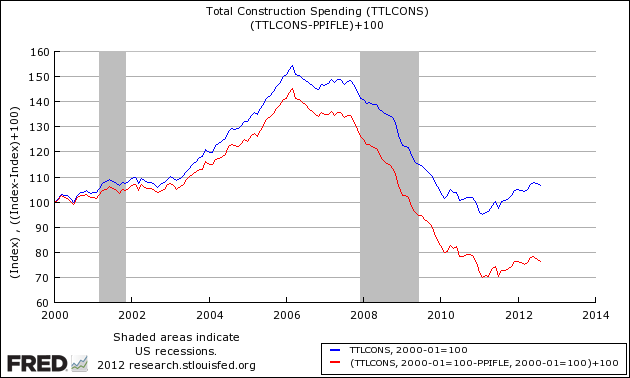

Indexed and Seasonally Adjusted Total Construction Spending (blue line) and Inflation Adjusted (red line)

This month’s headline statement from US Census:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during August 2012 was estimated at a seasonally adjusted annual rate of $837.1 billion, 0.6 percent (±2.1%)* below the revised July estimate of $842.0 billion. The August figure is 6.5 percent (±2.1%) above the August 2011 estimate of $786.3 billion. During the first 8 months of this year, construction spending amounted to $545.2 billion, 9.0 percent (±1.5%) above the $500.1 billion for the same period in 2011.

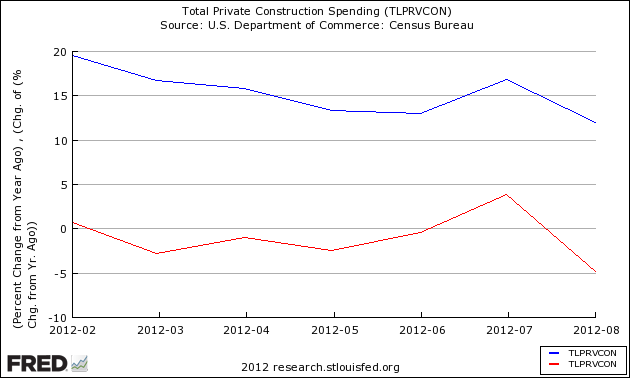

PRIVATE CONSTRUCTION Spending on private construction was at a seasonally adjusted annual rate of $562.2 billion, 0.5 percent (±1.2%)* below the revised July estimate of $564.8 billion. Residential construction was at a seasonally adjusted annual rate of $273.5 billion in August, 0.9 percent (±1.3%)* above the revised July estimate of $271.1 billion. Nonresidential construction was at a seasonally adjusted annual rate of $288.7 billion in August, 1.7 percent (±1.2%) below the revised July estimate of $293.7 billion.

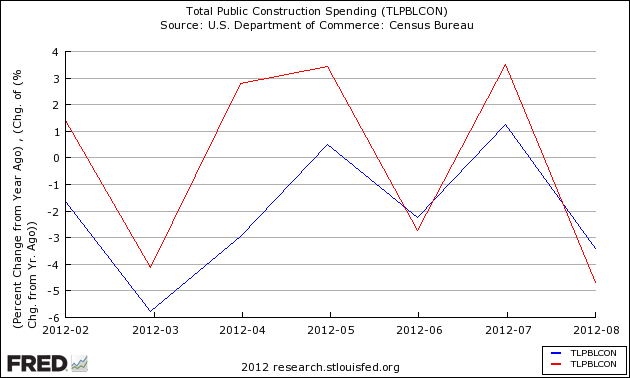

PUBLIC CONSTRUCTION In August, the estimated seasonally adjusted annual rate of public construction spending was $274.9 billion, 0.8 percent (±3.3%)* below the revised July estimate of $277.2 billion. Educational construction was at a seasonally adjusted annual rate of $67.0 billion, 3.4 percent (±6.3%)* below the revised July estimate of $69.4 billion. Highway construction was at a seasonally adjusted annual rate of $80.8 billion, 0.6 percent (±6.9%)* below the revised July estimate of $81.3 billion.

Unadjusted Total Construction Spending Year-Over-Year (blue line) and Month-over-Month (red line) Change

Unadjusted Private Construction Spending Year-Over-Year (blue line) and Month-over-Month (red line) Change

Unadjusted Public Construction Spending Year-Over-Year (blue line) and Month-over-Month (red line) Change

It is obvious from the above graphics that all recent growth in construction spending has been in the private sector.

Public construction is down 3.5% year-over-year (down 2.1% year-to-date) – all numbers are unadjusted. Private construction is up 12.1% year-over-year (up 15.5% year-to-date) – all numbers are unadjusted. Construction spending would have to increase by more than 45% to equal the average for 2006, 2007 and 2008. The sector is in a deep depression.

Caveats on the Use of Construction Spending Data

Although the data in this series is revised for several months after issuing, the revision is generally minor. This series is produced by sampling – and the methodology varies by sector being sampled.

The headline data is seasonally adjusted. Econintersect uses the raw unadjusted data. Econintersect determines the month-over-month change by subtracting the current month’s year-over-year change from the previous month’s year-over-year change. This is the best of the bad options available to determine month-over-month trends – as the preferred methodology would be to use multi-year data (but the New Normal effects and the Great Recession distort historical data).

The data set for construction spending is not inflation adjusted. Econintersect adjusts using the BLS Producers Price Index – subindex New Construction (PCUBNEW–BNEW). However in the inflation adjusted graph in this post, FRED does not have this series – and Econintersect has used Producer Price Index: Finished Goods Less Energy (PPIFLE), Monthly, Seasonally Adjusted which has similar characteristics.

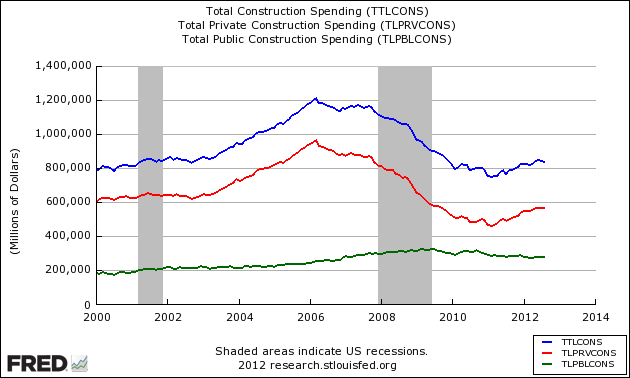

Construction (which historically is an major economic driver) is a literal shadow of its former self. Its contribution to GDP is down $400 billion from its peak level in 2006. The main driver of construction spending is the private sector. Here is the historical breakdown. The graph below uses US Census seasonally adjusted data.

Obvious from the above graph that public spending on construction is falling off, while private spending is slightly trending up. The overall effect is that construction spending is near the same place it was in early 2010.