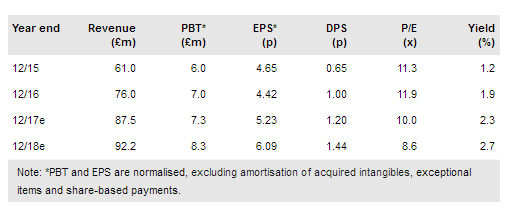

Augean's (LON:AUG) half-year trading update has highlighted a challenging contract issue, which is reducing group profitability and weighing on the company’s outlook. The problem, in the recently acquired Colt business, has resulted in a cut to our PBT forecasts for FY17 and FY18 of 10% and 13% respectively.

Furthermore, we reduce our fair value per share to 67p from 80p. Management is taking decisive steps to offset the problem by instigating a £2m cost reduction programme. Despite our profit forecast reduction and the risk of further negative newsflow as contract negotiations near completion in September, we take some comfort from the fact that, despite Augean’s challenges, both our forecasts and management guidance still imply a y-o-y increase in profit before tax.

Legacy contract issue in Colt depresses outlook

A “major legacy contract” within Colt, which was acquired in 2016 and now sits in the Industry & Infrastructure (I&I) division, has been loss-making in the first half.

At the time of acquisition, Colt was expected to contribute more than £1m of operating profit in FY17. We now forecast that the whole I&I unit will be loss-making in FY17 and reach break-even in FY18. Management is renegotiating the contract with the customer, expects this process to complete in September and anticipates a positive impact on I&I in the second half of 2017.

To read the entire report Please click on the pdf File Below: