Redhill Biopharma's (NASDAQ:RDHL) Q117 business update described steady progress on both fronts: the R&D pipeline and planned commercialisation of the two products for gastrointestinal (GI) diseases via co-promotion or in-licensing deals. The initiation of promotional activities is expected in Q217 and data readouts from two mid- to late-stage clinical trials in Q2/Q317 will provide inflection points this year. Our valuation is slightly higher at NIS1.40bn ($378m).

Financials: Steady R&D progress

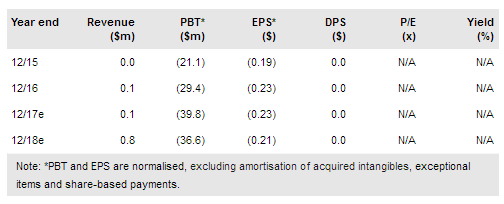

RedHill reported $8.1m in R&D costs, a significant 74% jump y-o-y and 9% q-o-q, while G&A expenses were $1.3m, up 44% y-o-y and 12% q-o-q. As expected, increased cash burn was due to increasing clinical trial activities. The company reiterated its guidance that quarterly cash burn in 2017 will stabilise at c $10m; we therefore make no changes to our FY17 estimates. Following a successful $38m fund-raising in December 2016, RedHill ended Q117 with cash reserves of $61m. This implies cash reach well into 2018 and past several mid- to late-stage trial data readouts in Q2/Q317. Two new commercial GI products, Donnatal and EnteraGam, could provide a near-term revenue source.

To read the entire report Please click on the pdf File Below