Trade Of The Day: AUD/USD To Test Pivotal Resistance

Trade Of The Day: AUD/USD edged up nearly half a cent to 0.6927, underpinned by some bargain hunting after it touched a seven-year low. A minor recovery in iron ore, Australia’s top export earner, to above $40 a tonne supported the Aussie. The mineral has shed 40 percent in the past 12 months and dropped to $37 in December 2015, the lowest recorded by The Steel Index (TSI) which began in 2008.

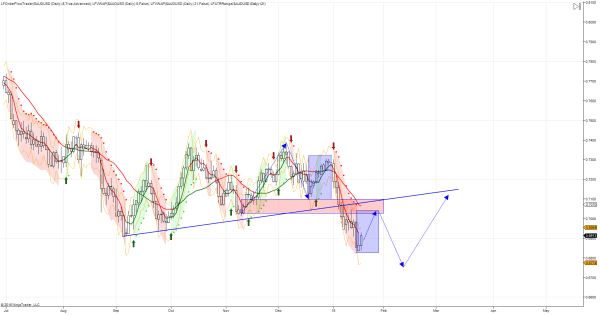

Technical: While .6950 caps intraday upside, expect a grind lower to retest .6830’s lows. Only a breach of .7050 eases immediate downside pressure.

Trade Idea: Aussie is experiencing some near term profit taking after breaching the 2015 lows last week, I am anticipating this profit taking to develop into a short squeeze as players piled into shorts on the break of prior lows are forced to cover poorly positioned entries. This short squeeze should facilitate a premium short set up as price maps an equidistant swing with the prior corrective move as highlighted by the blue shaded boxes in the chart below. If price action tracks the thesis set out above, I will monitoring intraday reversal patterns between .7050/.7100 leaning against .7200 for a retest and break of 2016 lows en-route to an initial objective of .6700 as mapped in the chart below.