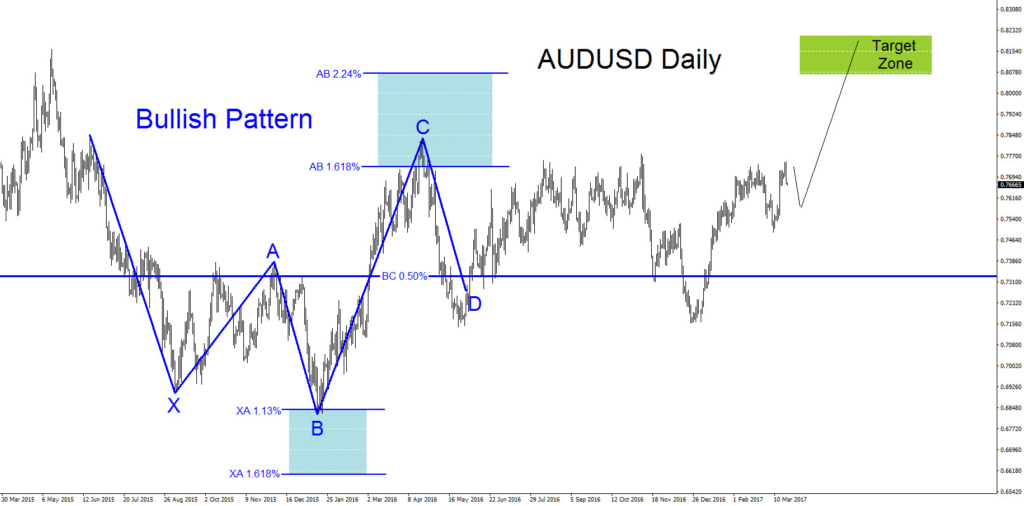

AUD/USD found a possible bottom in December 2015 and has bounced higher. The pair has tried to test the December 2015 low but has been rejected twice, once in May 2016 and the second time in December 2016, both at the point D (Blue pattern) BC 0.50%-0.618% Fib. retracement levels. We at Elliottwave-Forecast still feel the pair can continue pushing higher in the coming days and weeks. Only time will tell what the pair will do. Below are scenarios of why we feel the pair remains bullish.

AUD/USD Daily Chart: Bullish pattern (Blue) still needs to push above point C high to complete the pattern. If AUD/USD continues higher we can expect the pair to push towards the green target zone box (0.8070 – 0.8200 area) which is also the Fib. 1.0% – 1.236% extension.

AUD/USD 1 Hour Chart: On the 1 hour chart we can see another bullish pattern (Blue) that triggers a BUY at the BC 0.50% Fib. retracement level where point D of the bullish pattern can terminate. Expect bulls to be waiting at the green box (Buy Zone) to push the pair higher. The buy zone is also at a support/resistance level where price can bounce off .

If looking to buy AUD/USD traders should be patient and wait for the 1 hour blue point D pullback to the BC 0.50% Fib. level buy zone (green box). Waiting for the blue point D pullback/retrace to the possible buy zone area will offer a better risk/reward trade setup. Stop loss should be placed at the blue point B 0.7490 low.

Of course, like any strategy/technique, there will be times when the strategy/technique fails so proper money/risk management should always be used on every trade.

DISCLAIMER: Always use proper risk/money management according to your account size