Key Points:

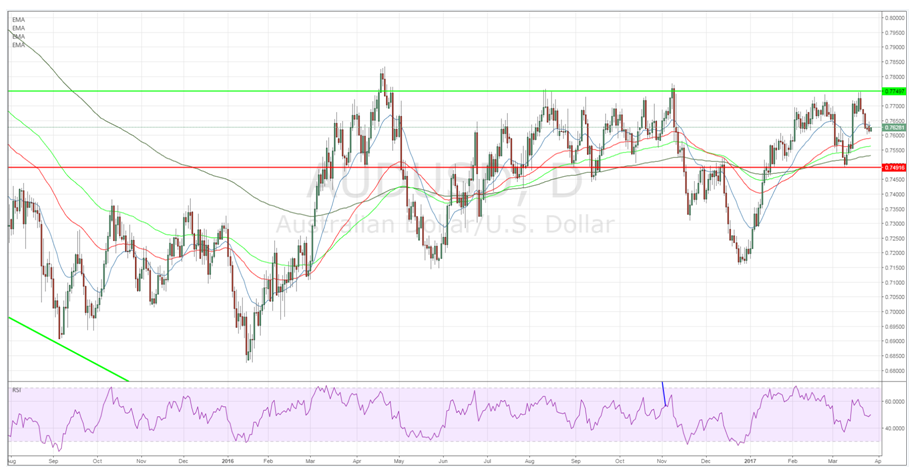

- Price action trading sideways within a consolidative pattern.

- RSI Oscillator trending lower.

- Watch for a break down in the days ahead.

The past few days has seen the AUD/USD continue to trend in largely a sideways manner within a relatively tight 50 pip range. Subsequently, there has been little in the way of a defined trend and the pair remains meandering around 50% of the March move at 0.7619. However, there is likely to be a breakout in the coming week given that there are some key economic events pending that may, finally, fuel a move for the Aussie.

In particular, the AU HIA New Home Sales figures are likely to be watched closely given the current precariousness of the Australian property market. There have been some indications of a slowdown over the past few months and the large lending institutions are certainly skittish about their exposure. Subsequently, we may see the impact of restricted credit flowing through the new home sales figures. A significant miss could see the pair under pressure as the market takes a negative short term view of the Aussie.

Also, there is plenty of scope for volatility on the greenback side of the fence in the days ahead. The U.S. Final FDP and Unemployment Claims figures are due out Thursday and are likely to fuel a revaluation for the USD. In particular, a jobless claims result below the forecasted 245k could be just the thing the greenback needs to rally against most of the cross pairs. This is a fairly realistic scenario and could additionally bring about a needed breakdown for the Aussie.

From the technical perspective, price action is now trending lower, within its consolidative range, towards a key support zone at 0.7605. This is a major downside hurdle for the pair, representing the low from February, and will need to be breached to signal the commencement of a pullback. In addition, the RSI Oscillator is also trending lower, within neutral territory, indicating that there is still plenty of room to move on the downside.

Ultimately, it remains to be seen which direction the pair will break in the near term but the reality is that break it must. The consolidative pattern has lasted for a significant period of time at the 50% of March level and a breakout is now all but inevitable. However, the evidence is suggesting that we are likely to see a downside move, especially given the presently high valuation for the Aussie. Subsequently, keep a keen watch on the pair over the next few days as a move through support at 0.7605 could signal the start of a sharp depreciatory phase.